[ad_1]

It hasn’t been the best quarter for ESE Entertainment Inc. (CVE:ESE) shareholders, since the share price has fallen 15% in that time. But over the last year the share price has taken off like one of Elon Musk’s rockets. In that time, shareholders have had the pleasure of a 549% boost to the share price. So it is not that surprising to see the stock retrace a little. The real question is whether the fundamental business performance can justify the strong increase over the long term. We love happy stories like this one. The company should be really proud of that performance!

Since it’s been a strong week for ESE Entertainment shareholders, let’s have a look at trend of the longer term fundamentals.

View our latest analysis for ESE Entertainment

Because ESE Entertainment made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year ESE Entertainment saw its revenue grow by 1,728%. That’s stonking growth even when compared to other loss-making stocks. But the share price seems headed to the moon, up 549% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. So this looks like a great watchlist candidate for investors who look for high growth inflexion points.

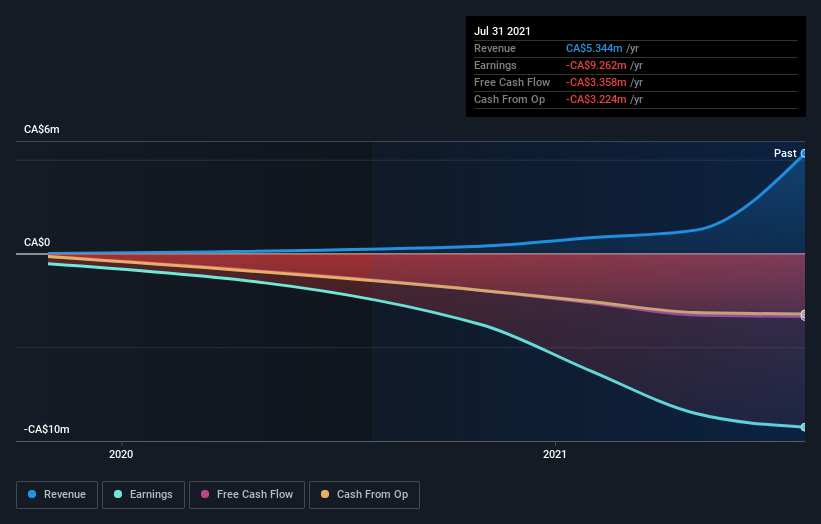

The company’s revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on ESE Entertainment’s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It’s nice to see that ESE Entertainment shareholders have gained 549% over the last year. We regret to report that the share price is down 15% over ninety days. Shorter term share price moves often don’t signify much about the business itself. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example – ESE Entertainment has 5 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you would prefer to check out another company — one with potentially superior financials — then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

If you’re looking to trade ESE Entertainment, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

[ad_2]

Source link