[ad_1]

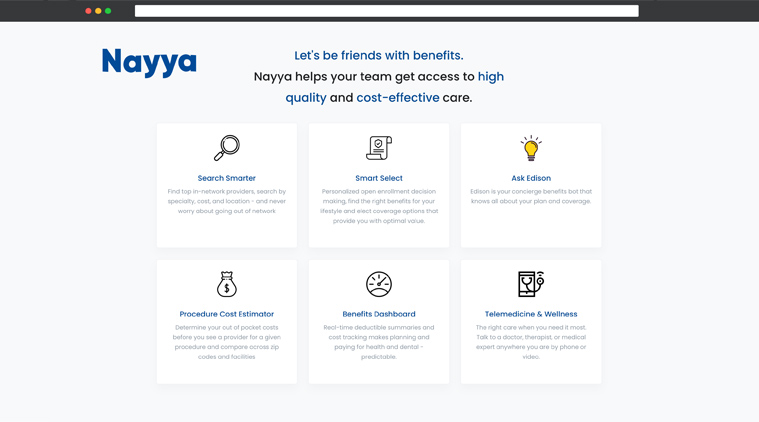

Magoon says his company is trying to simplify how employers choose health care plans for their employees in the US, where the healthcare system is broken at a macroeconomic as well as a micro level. (Image credit: Nayya)

Magoon says his company is trying to simplify how employers choose health care plans for their employees in the US, where the healthcare system is broken at a macroeconomic as well as a micro level. (Image credit: Nayya)

The US healthcare system is “broken” so much so that over half of Americans borrow money to pay an unexpected medical bill over $500. In fact, an estimated 530,000 families turn bankrupt each year because of rising health-care costs, according to the American Journal of Public Health.

But Indian-American engineer Akash Magoon along Sina Chehrazi, who together founded New York-based start-up Nayya, think they can help businesses choose and manage health care and employee benefit insurance plans through data transparency and machine learning.

“With over half the people in the US getting health insurance through their employer, there’s a lot of opacity around what is the best health plan for me and my business and my employees, given the strength of the doctor networks, the location of those networks, and also the specialisation of who are these providers and practicing physicians that are available,” Magoon told indianexpress.com over a call from New York. “There’s a huge gap between all these large insurance companies and what they offer and that’s really the problem that we’re shooting to solve.”

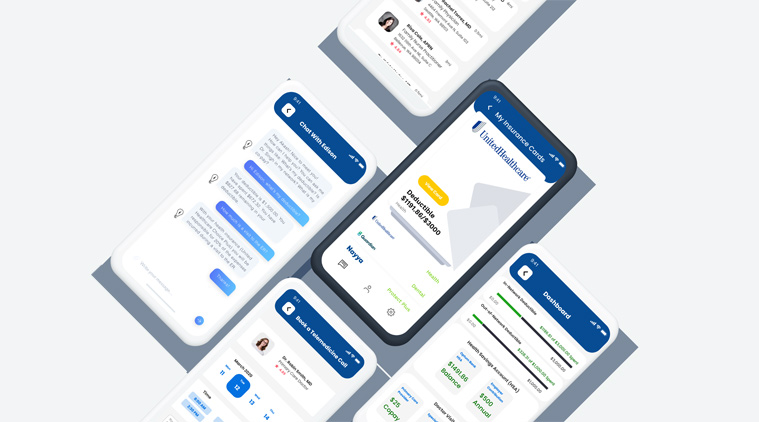

Nayya’s Companion acts as a matchmaking tool that fetches the right data and based on that it looks into various insurance plans selected by the employer. (Image credit: Nayya)

Nayya’s Companion acts as a matchmaking tool that fetches the right data and based on that it looks into various insurance plans selected by the employer. (Image credit: Nayya)

In the US, the process of choosing employee benefits and health insurance plans is not only complicated but also less transparent, thanks to the deep involvement of hospitals, life insurance companies, and doctors. That’s where Nayya, an AI-based platform that is deeply integrated with existing insurance companies, comes in. The software gathers all plan details, data, and insights in real-time. This helps the team to understand how employees are actually using their plans.

A smart ring tries to figure out if it can read Covid-19 before the symptoms

At the fundamental level, it is the HR head of the company that decides employee benefits and health insurance plans for employees. Magoon and his team work closely with the HR head throughout the enrollment process. When the two-week enrolment process starts, which happens once a year, employers provide their employees a link to Nayya’s Companion, a real-time software visualisation platform that can be accessed on the web or through smartphones.

Akash Magoon co-founded Nayya along with Sina Chehrazi in 2019. (Image credit: Nayya)

Akash Magoon co-founded Nayya along with Sina Chehrazi in 2019. (Image credit: Nayya)

Companion helps employees find and select a plan. The software asks a number of questions about their families, drugs they take, predisposing conditions, what kind of work they do, where they live, and so on. For example, Companion even asks questions like whether a person rides a bicycle to work, as opposed to taking public transportation. Such factors need to be taken care of because those employees are 20 times more likely to get into an accident and need emergency service. Therefore, employees who ride bicycles to work would want an insurance plan that covers accidents and the types of specialised doctors in their network.

As Magoon explained, Companion acts as a matchmaking tool that fetches the right data and based on that it looks into various insurance plans selected by the employer. But the role of Companion doesn’t end there. Once employees find the plan that is right for them, they can use the Companion app to help understand the financial component of healthcare and make the most cost-effective decisions for themselves for a year.

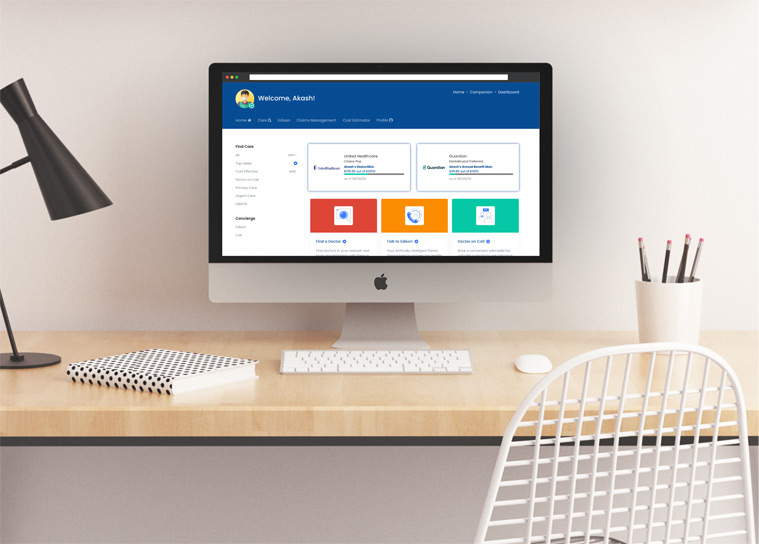

As a business model, the company charges a SAS-type monthly fee, depending on the size of the company. (Image credit: Nayya)

As a business model, the company charges a SAS-type monthly fee, depending on the size of the company. (Image credit: Nayya)

“The value proposition to the employer and to the employee are two-fold. For the employer, it’s all about saving them costs. So we’re able to help employers save around 10 to 12 per cent on health insurance each year per employee, which is a huge lift for them. And then secondly, and more importantly, we make sure that employees are happy and we increase engagement of that health insurance plan,” Magoon explained.

Magoon says his company is trying to simplify how employers choose health care plans for their employees in the US, where the healthcare system is broken at a macroeconomic as well as a micro level which is preventing people from accessing care that has been covered by their insurance plans.

“Over the last five to 10 years, healthcare costs in the US have gone up anywhere from 5 to 10 per cent a year, which is huge,” he added. ”It’s not the insurance companies or doctors that have been impacted. What happens is, as costs continue to rise, and the budgets for employees, and also the budget for HR departments have gone down. That means that individuals that are going to have to spend more out of pocket than they were before.”

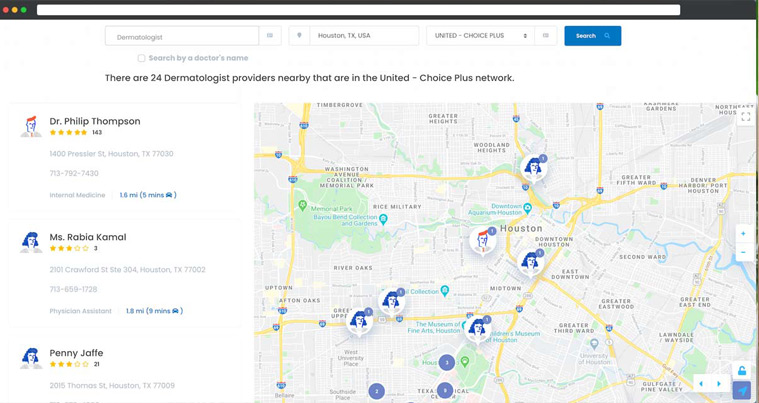

The company recently raised $2.7 million in seed funding led by Social Leverage. (Image credit: Nayya)

The company recently raised $2.7 million in seed funding led by Social Leverage. (Image credit: Nayya)

For Magoon, Nayya is not only helping employers choose and manage the health care and employee benefit insurance plans but also in creating an ecosystem where employers, employees and life insurance companies work together. “We want to help the rank and file employees that need some good health care,” he said.

As a business model, the company charges a SAS-type monthly fee, depending on the size of the company. It could vary between $5 to $10 per employee, though Magoon refused to give exact numbers. The bigger the company in size, the better deal per employee is given.

Magoon, who likes to describe his company as a mix of healthcare insurance and data science, says the Covid-19 pandemic has made the US companies “super interested” in knowing how they can decrease costs while increasing coverage of their health care.

The company recently raised $2.7 million in seed funding led by Social Leverage. Other investors included Soma Capital, Guardian Strategic Ventures, and Cameron Ventures. Magoon plans to hire more people in his team, which currently stands at six. The plan is also to partner with large insurance companies in the near future.

Since opening up a beta earlier this year, Magoon’s Nayya AI platform has been used by a number customers, including the real estate board of New York which has over 14,000 employees. Magoon is currently not looking at the Indian market, as he says there are many medical insurance-related problems in the US that need to be addressed first.

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Technology News, download Indian Express App.

© IE Online Media Services Pvt Ltd

[ad_2]

Source link