[ad_1]

Here are the key highlights from today’s trading session:

1. Market closes lower for 4th straight session; Sensex & Nifty at 7-week lows

2. Market recovers from opening hour lows but fails to turn positive

3. Sensex slips 300 points to 37,734 after a trading range of 679 points

4. Nifty falls 97 points to 11,154 and Nifty Bank 228 points to 21,139

5. Nifty Bank fails to hold the 100-day moving average of 21,358

6. Midcap Index closes 257 points lower at 16,508 after 612-point trading range

7. Market Breadth favours declines; advance-decline ratio at 2:7

8. RIL, HDFC twins, L&T, Axis Bank drag Nifty while IT majors TCS & HCL lift

9. Except IT & Pharma, all sectoral indices close in the red

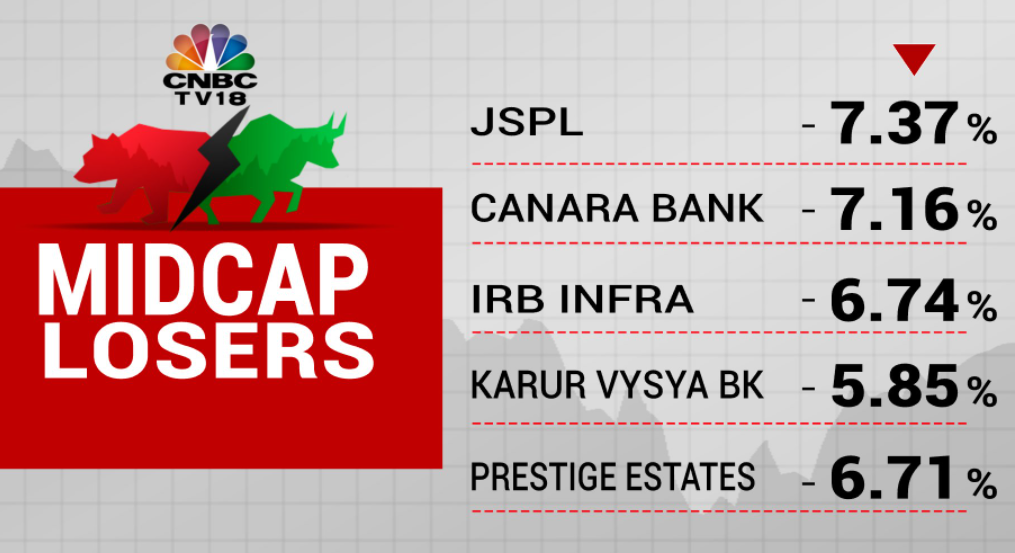

10. Canara Bank, M&M Finance, Manappuram Finance, GMR Infra top Midcap losers

Closing Bell: Sensex ends 300 points lower, Nifty holds 11,150; Zee, Bharti Infratel top losers

Indian indices ended lower on Tuesday following weakness in global peers. Asian shares were weaker on concerns about new pandemic lockdowns in Europe and after reports about financial institutions allegedly moving illicit funds hurt global banking stocks. The decline in most key sectors including bank, auto, metal, and FMCG indices dragged the benchmarks further.

The Sensex ended 300 points lower at 37,734 while the Nifty lost 97 points to settle at 11,154. Broader markets also ended with deep cuts with the Nifty Midcap and Nifty Smallcap indices down nearly 1.5 percent each.

HCL Tech, TCS, Sun Pharma, Tech Mahindra, and Grasim were the top gainers on the Nifty50 index while Zee, GAIL, Bharti Infratel, Adani Ports and Maruti led the losses.

All sectoral indices, except Nifty IT and Nifty Pharma, ended the day in the red. Nifty Media lost the most, down 2.7 percent followed by Nifty Realty and Nifty Auto, down 1.7 percent. Nifty Bank and Nifty Metal also shed around 1 percent for the day. Meanwhile, Nifty Pharma rose over 1 percent and Nifty IT added 0.9 percent.

SEBI mulls setting up backstop facility for corporate bonds

The capital market regulator Securities & Exchange Board of India (SEBI) is considering setting up a ‘backstop’ facility for corporate bonds in case of illiquidity and crisis in the markets.

Speaking at the 25th AGM of industry body AMFI, Sebi Chairman Ajay Tyagi emphasized on the need to increase liquidity in the corporate bond market to ensure smooth functioning of the debt mutual funds.

“Apart from mandating mutual funds to do a minimum percentage of their secondary market trades in corporate bonds on the RFQ platform of stock exchanges, SEBI is pursuing a multitude of measures to not only increase liquidity in secondary markets but also to enable greater issuances of paper rated below AAA,” Tyagi said.

One such measure the regulator is examining is the setting up of a backstop facility. To read more, click here

Just In | Lupin launches Divalproex sodium extended-release tablets.

COVID-19 Impact: Govt unlikely to give full projections under MTEF

The government’s first statement in FY21 on expenditure and fiscal projections – the Medium-Term Expenditure Framework – is unlikely to be a full-fledged document, sources told CNBC-TV18. The uncertainty and churn caused by COVID in the growth and fiscal estimates is likely to impede the government from presenting clear projections for FY22, FY23.

“Visibility on future projections is unlikely. It will not be a full-fledged statement. But some statements will be made for compliance under FRBM law,” the sources, who did not want to be named, said.

Section 3 of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003, requires the government to lay the Medium-Term Expenditure Framework (MTEF) Statement in both Houses of Parliament. The statement has to be laid in the session immediately following the session of the Parliament in which the budget has been presented. Read more here.

GE Power India says its parent GE to pursue exit from new build coal power market

GE announced today that it intends to exit the new build coal power market, subject to applicable consultation requirements. GE’s Steam Power business will work with customers on existing obligations as it pursues this exit, which may include divestitures, site closings, job impacts and appropriate considerations for publicly held subsidiaries.

GE will continue to focus on and invest in its core renewable energy and power generation businesses, working to make electricity more affordable, reliable, accessible, and sustainable. GE Steam Power will continue to deliver turbine islands for the nuclear market and service existing nuclear and coal power plants.

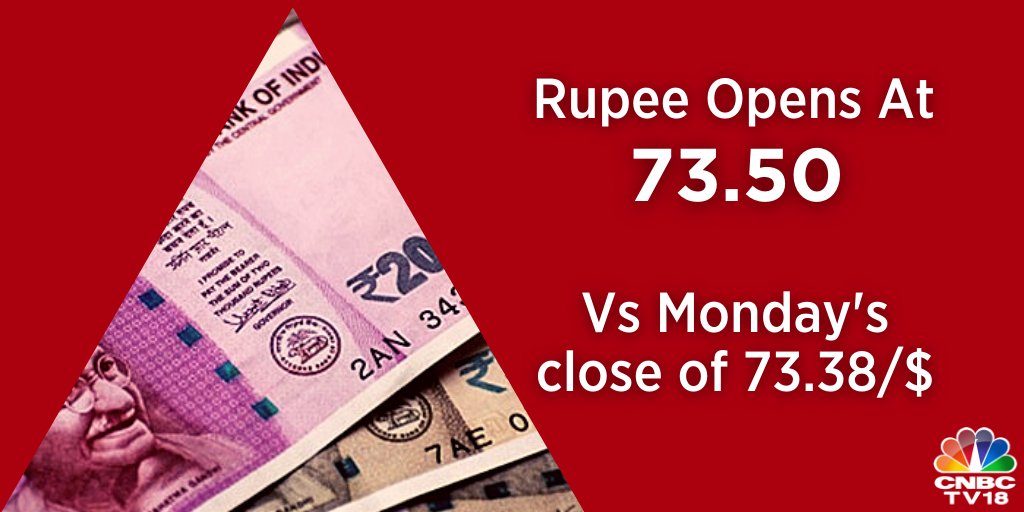

Rupee Update: The Indian currency snaps the gaining streak and posts single biggest fall on Tuesday. The rupee ended at 73.58 as against the US dollar as compared to Monday’s close of 73.38.

CAMS IPO fully subscribed on Day 2; retail quota sees 1.7 times subscription

The initial public offer (IPO) of Computer Age Management Services (CAMS) got fully subscribed on the second day of the bidding process.

The Rs 2,244-crore public issue received bids for 1.38 crore equity shares against the offer size of 1.28 crore equity shares.

The portion reserved for retail investors has been subscribed 1.7 times, while the reserved category of non-institutional investors segment received 32.3 percent subscription. The qualified institutional investors’ portion has been subscribed 24.76 percent while that reserved for its employees has been subscribed 25.72 percent, as per the data available on the exchanges.

The IPO is available for subscription till September 23. The price band has been fixed price band of Rs 1,229-1,230 per share. For more info, click here

Angel Broking IPO Day 1: Issue subscribed 26%; retail quota booked 41%

The Rs 600-crore initial public offering (IPO) of Angel Broking has been subscribed 26 percent so far on the first day of the bidding process Tuesday.

The issue has received bids for 36.48 lakh equity shares against the offer size of 1.37 crore equity shares (excluding anchor book), according to the data available on exchanges.

The retail quota was subscribed by 41 percent but qualified institutional buyers and non-institutional investors have not started bidding yet.

The IPO of the fourth largest broking house in terms of active clients comprises a fresh issue of Rs 300 crore and an offer for sale aggregating to Rs 300 crore by promoters and investors.

The issue will close on September 24 while the price band has been fixed at Rs 305-Rs 306 per equity share. Read more

European markets slightly higher, attempting to rebound from coronavirus concerns

European stocks were cautiously higher Tuesday, attempting to bounce back from Monday’s losses on coronavirus concerns and bank allegations.

The pan-European Stoxx 600 gained 0.5 percent in early trade, with tech shares jumping 1.4 percent to lead gains while the insurance sector slid 0.8 percent.

European shares are seeking a from Monday’s losses; the pan-European Stoxx 600 closed down by over 3.2 percent provisionally, with banks plunging 5.7 percent and travel stocks tumbling 5.2 percent to lead losses as all sectors and major bourses slid into negative territory, reported CNBC International.

Gold rate today: Yellow metal trades flat; Support seen at Rs 50,300 per 10 grams level

Gold prices in India traded flat on the Multi Commodity Exchange (MCX) Tuesday tracking gains in international spot prices on short-covering after the prices plunged over 2 percent in the previous session.

At 10:55 am, gold futures for October delivery inched higher by 0.03 percent to Rs 50,484 per 10 grams as against the previous close of Rs 50,471 and opening price of Rs 50,560 on the MCX. Silver futures traded 0.11 percent lower at Rs 61,251 per kg. The prices opened at Rs 61,869 as compared to the previous close of Rs 61,316 per kg.

Bullion prices fell 2.36 percent to settle at $1911.60 per ounce and silver plunged 9.53 percent to close at $24.39 per ounce on Monday after the US dollar soared to an almost six-week high due to growing safe-haven bids, amid sharp losses in the stock markets pushing investors away from precious metals. Continue reading

‘There are no talks of stake sale to PE players’

Akhil Gupta of Bharti Infratel speaks to CNBC-TV18 in an #exclusive conversation, says small cells for 5G & optic fibres are the next capex opportunities for the co pic.twitter.com/dtzK930pKX

— CNBC-TV18 (@CNBCTV18Live) September 22, 2020

Stock Update: TCS’ shares traded 1.16 percent higher to Rs 2,494 per share on the NSE after the IT giant signed a five-year contract with Morrisons- a leading supermarket chain in the UK. TCS will use AI and machine learning to augment human teams and boost productivity. “We are using our deep contextual knowledge of Morrisons’ business and our expertise in AI and automation to reimagine their IT operating model to enable superior customer experience, greater agility, and growth,” said Shekar Krishnan, Head of retail in the U.K. at TCS in the exchange filing.

Trader’s Diary: Looking at history for trends and patterns not a wise thing to do now

The most difficult thing to do is to work without preconceived notions. Yet, it’s a worthwhile pursuit because then and only then will you become data-dependent. The problem is that the source of the data has become tainted with preconceptions and hence tends to point us in a particular direction.

These preconceptions today, are most often born out of political leanings, but they could have links to employment, society or even religion. In our market, almost everything put out these days has an agenda attached to it and almost every writer writes a piece in his head first, before the first data point has been collected. The cart is already before the horse and from that point on, a selection process begins to get the data to fit the predetermined outcome. Read more

HSIL hits 52-week high after board approves buyback plan

Shares of HSIL hit a fresh 52-week high of Rs 78, up 9 percent on Tuesday after its board approved buyback of shares at Rs 105 per share for an aggregate amount of Rs 70 crore via open market. “At the maximum buyback price and for maximum buyback offer size, the indicative maximum number of equity shares to be bought back would be 6.67 million equity shares which are 9.22 per cent of the total number of equity shares of the Company,” HSIL said in exchange filing.

Debt funds were allowed to invest more in G-Secs, as a temporary measure, says Sebi Chaiman

Market Watch: Rahul Mohindar of viratechindia.com

“The biggest contributor could potentially be Reliance. If you look at the period between September 10 and September 20, we clearly saw the stock holding a level of Rs 2,300 quite successfully. In fact, when I looked at the volume patterns, bulk of the trading volume has been between Rs 2,300 and Rs 2,350; that is the range that has broken. So, we will definitely see a meaningful correction here which is why I would sell Reliance; keep a stop loss of Rs 2,260 if you are looking at a very short term move, immediate target would be about Rs 2,150 on Reliance Industries.”

“Vedanta looks weak to me. It could be shorted with a Rs 131 stop loss and a Rs 120 target. These are not intraday calls, it could take a couple of days for things to materialize.”

“On the buy side, ITC, the last 5 days has a very clear declining trend in volume. So, each day has had lower and lower volumes while ITC corrected. Rs 170-175 is a belt of support. So, keep a stop loss below Rs 170 and a target of Rs 181. It is a bit of a counter trend call, but I think it is worth risk to reward.”

Majority of flows in US are driven by non-fundamental drivers, says JPMorgan’s Mixo Das

The majority of the flows in US markets are driven by non-fundamental drivers, said Mixo Das of JPMorgan. Das, speaking from the sidelines of JPMorgan India Investor Summit, said that some volatility is expected over the next few months and more event risks in the next 3 months. Watch the video for more details

Aurobindo Pharma 5% off lows; Investec in its report today, raised target price for the stock to Rs 1,000 from Rs 755/share

Market Watch: Shubham Agarwal, CEO & Head of Research at Quantsapp Advisory

“Sell Hindustan Unilever (HUL). If you look at HUL, since a long time the stock was consolidating and recently we saw that there is a breakdown on the chart. The derivative data is also suggesting that there are minor shorts that are getting built which can be carry forwarded to the next series. So, a bear Put spread can be initiated where the trade will be to buy a 2000 strike Put option and sell a 1940 strike Put option and this is for the October series. The spread cost right is at Rs 20.50, we are looking for a spread target of Rs 32 with a stop loss at Rs 14.”

“Sell ONGC. ONGC on the long term chart has been one of the underperformers. Recently we saw that some continuation patterns were formed from where we had seen a breakdown and especially on the derivative data, since the entire September series started, the stock has been witnessing massive shorts on the derivative data. So, looks like that this weakness will continue. So, a 70 strike Put option for the October series can be bought for a target of Rs 5.50 with a stop loss of Rs 2.”

Buzzing | Shares of GMM Pfaudler were locked at lower circuit of 10 percent on Tuesday after the company announced an offer for sale by its promoters at a steep discount. The promoters of the company are selling up to 28 percent stake via offer for sale (OFS) at a floor price of Rs 3,500. The window for retail investors will open on Wednesday while non-retail investors can subscribe to the issue today. Read more here.

Rupee Opens | The Indian rupee opened lower against the US dollar as compared to the previous close amid selling in equity markets.

Technical View | The breaking of 11,300-11,350 yesterday has resulted in this sharp fall between yesterday and today. The volumes are high and impulsive. We could crack all the way down to 10,950-11,000 levels. The upside resistance is at 11,500-11,550. Until then the markets look weak, says Manish Hathiramani, Proprietary Index Trader and Technical Analyst, Deen Dayal Investments.

Adani group stocks trading with deep cuts

Angel Broking IPO opens today: Key things to know

The initial public offer (IPO) of India’s one of the largest retail broking houses Angel Broking opens for subscription today. The firm allocated 58,82,352 equity shares at an upper price band of Rs 306 per equity share to the anchor investors. It would be the eighth IPO of 2020 to hit Dalal Street. The investors can bid for a minimum of 49 equity shares and in multiples of 49 shares thereafter. The equity shares are proposed to be listed on both National Stock Exchange and BSE Limited. The Rs 600 crore-IPO comprises a fresh issue of Rs 300 crore and an offer for sale aggregating to Rs 300 crore by promoters and investors. More here

Midcap Index takes a sharp knock; Neuland Lab, Canara Bank, Bharat Dynamics, JSPL top losers

Opening Bell: Sensex opens flat, Nifty below 11,300; IT stocks gain, banks drag

Indian indices opened flat on Tuesday following weakness in global peers. Asian shares were weaker on concerns about new pandemic lockdowns in Europe and after reports about financial institutions allegedly moving illicit funds hurt global banking stocks. At 9:18 am, the Sensex was up 31 points at 38,056 while the Nifty fell below 11,300. Gains in IT, pharma stocks were capped by losses in banking and financial stocks. Broader markets underperformed with Nifty Midcap and Nifty Smallcap down over 1 percent each. Most key indices, except Nifty Pharma and Nifty IT, also fell at opening. Nifty Metal shed 1.4 percent while Nifty Auto and Nifty FMCG lost half a percent each. Nifty Bank was also in the red at opening.

Asian stocks fall on concerns about fresh lockdowns, banking sector

Asian shares opened weaker on Tuesday on concerns about new pandemic lockdowns in Europe and after reports about financial institutions allegedly moving illicit funds hurt global banking stocks. JPMorgan Chase & Co and Bank of New York Mellon Corp on Monday fell 3.1 percent and 4.0 percent, respectively, while HSBC Holdings Plc and Standard Chartered Plc hit 25-year-lows on reports that they and others moved funds despite red flags about the origins of the money.

Emerging market stocks lost 1.64 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan closed 1.26 percent lower. In Asia, Australia’s S&P/ASX 200 declined 0.5 percent while South Korea’s Kospi fell 0.9 percent. Japan is closed for a public holiday. Hong Kong’s Hang Seng index futures were down 0.36 percent. E-mini futures for the S&P 500 rose 0.10 percent. The dollar index rose 0.639 percent as the euro dipped 0.03 percent to USD1.1766. More here

[ad_2]

Source link