[ad_1]

Here are the key highlights from today’s trading session:

– Market sees a sharp recovery in the 2nd half to close near day’s high

– Sensex gains nearly 350 points & Nifty more than 100 points from lows

– Midcap gains the most amongst frontline indices, closes 1.5% higher

– Sensex closes 185 points higher at 39,086 & Nifty 65 points higher at 11,535

– Nifty Bank gains 63 points to 23,875 & Midcap index 250 points to 17,070

– Except PSU bank, all sectoral indices close higher; media & metal top gainers

– Metal stocks continue gaining momentum on hope of demand improvement

– Strong gain in sales MoM lead autos higher; M&M up 6%, Tata Motors over 4%

– Announcement of Zee Plex launch, leads a gain of more than 8% for Zee Entertainment

– Bharti Infratel closes 4% higher after brokerages sound positive on the stock

– Vodafone Idea regains yesterday’s losses, ends with a gain of 13%

– Adani Group stocks continue to gain, stocks up 1-10%

– Jubilant Foodworks closes at record high after reporting in-line Q1 earnings

– OMCs close the session higher despite MoM drop in petrol & diesel sales

– Market Breadth favours advances; advance-decline ratio at 2:1

Closing Bell: Market ends higher for 2nd consecutive trading session; banks lead, Zee Entertainment top gainer

Indian benchmark indices, Sensex and Nifty ended higher for the second consecutive trading session on Wednesday led by the banking stocks.

At close, the Sensex ended 185 points higher to 39,086 while the Nifty50 index ended at 11,535, up 65 points. Broader markets outperformed the frontline indices, with Nifty Midcap 100 and Nifty Smallcap 100 indexes closing over 1.5 percent each.

Media index remained best-performing sector of the day followed by Nifty Metal (+1.87 percent) and Nifty Auto (+1.41 percent).

Zee Entertainment and M&M remained the Nifty50 top gainers while Bajaj Auto and Hero MotoCorp were the top losers of the index.

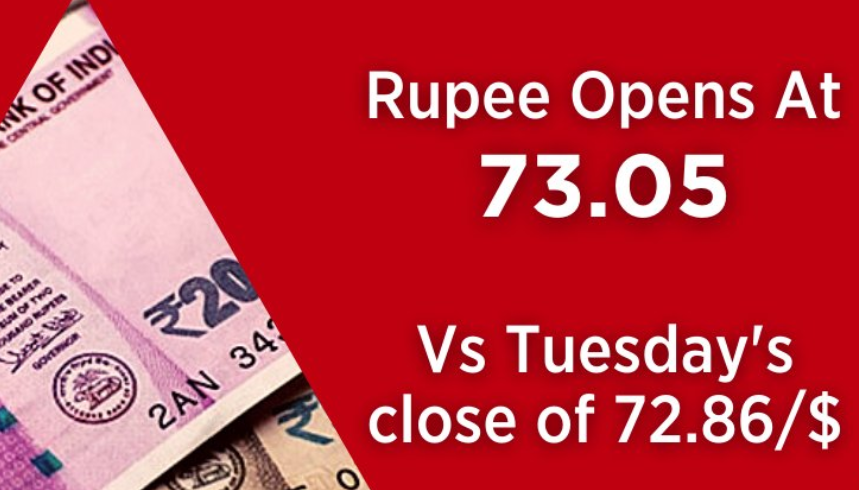

Rupee Update: The Indian currency ended slightly lower on Wednesday, at 73.03 against the US dollar as compared to Tuesday’s close of 72.87. Yield on the 10-year government bond ended at 5.919 percent as compared to Tuesday’s close of 5.942 percent.

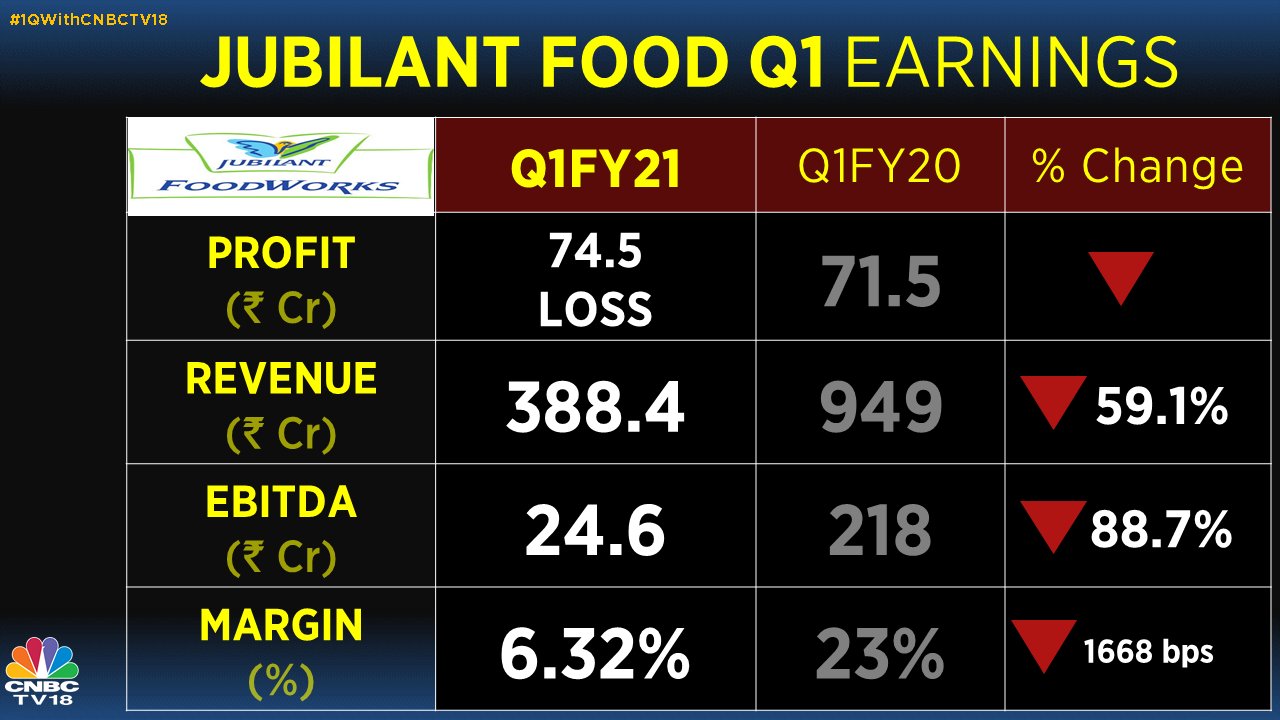

Stock Update: Jubilant Foodworks’ shares trade at an all-time high of Rs 2,238.45 per share on the NSE despite reporting weak Q1FY21 earnings. The company said that there has been a strong system sales recovery in July and August at 69.8 percent and 84.6 percent respectively. Delivery channel saw a growth of about 110 percent like-for-like while takeaway saw 161 percent growth. At 2:57 pm, the shares traded 3.75 percent higher to Rs 2,229.40.

Market Update | Sensex is up 157.55 points or 0.41 percent at 39,058.35, and the Nifty added 73.15 points or 0.64 percent to trade at 11,543.40. M&M, IndusInd Bank, PowerGrid Corporation and Reliance Industries are the top gainers in Sensex.

Retail loans bounce back in July but industrial credit growth remains muted

As the Indian economy struggled during the pandemic-induced lockdown, the commercial banks remained risk-averse amid uncertainty which resulted in a weak credit pick-up. Despite ample liquidity with the banks, the credit growth during the month of July remained weak while the deposit growth continued to run higher.

The gross bank credit as of July 31, 2020, stood at Rs 91.5 lakh crore. The credit growth in July was 6.9 percent as compared to 11.5 percent in the same month last year. Around 31 percent of the Non-food credit at Rs 90.7 lakh crore as of July 2020 is towards the priority sector. Within the priority sector, Agriculture accounted for the highest share of 41 percent in outstanding credit followed by Micro & Small Enterprises with 39 percent share and weaker sections, according to a report by CARE Ratings. Read more here.

Just In | NCC bags 6 orders worth Rs 1,548 crore in August from state governments.

Jubilant Foodworks Q1FY21 | The company reports a net loss of Rs 74.5 crore as against CNBC-TV18 poll of Rs 100 crore loss. Revenue was at Rs 388.4 crore versus poll of Rs 400 crore.

Jyoti Roy, DVP- Equity Strategist, Angel Broking Ltd

NMDC reported strong growth in production and sales for the month of August 2020 driven by increased demand from steel companies as domestic steel production continues to improve. Production was up 14.9% YoY to 1.62mn tonne while sales was up by 20.1% YoY to 1.79mn tonnes. We believe that this will be sentimentally positive for NMDC in the short term though international iron ore prices are key monitorable as they rallied above $100 /tonne due to increased demand from Chinese millers along with reduced supply from Brazil due outbreak of Covid-19. Any fall in Iron ore prices could be negative for NMDC.

Aditya Agarwala of Yes Securities: Torrent Pharma has been back in action. After the recent correction, the stock is up and running on good volumes. It has broken from a downward slopping channel. One can buy it with a target of Rs 3,000 on the upside, keeping a stop loss of Rs 2,610 on the downside. Also, SBI Life Insurance is showing resilience in the past few trading sessions. Today, the stock is up on good volumes. So one can go ahead and buy it for a target of Rs 920 on the upside, keeping a stop loss at Rs 820 on the downside.

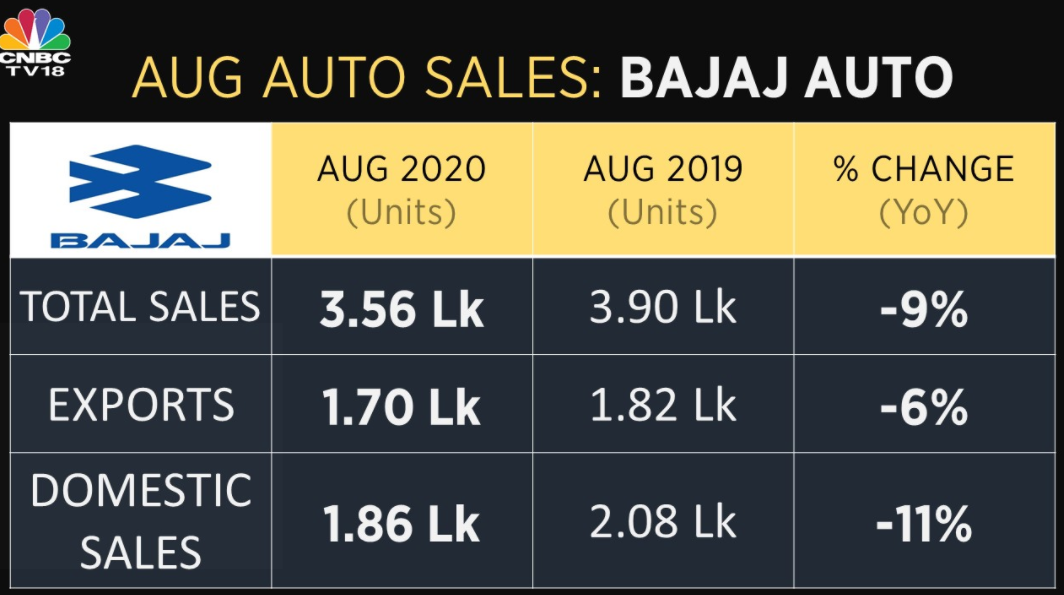

Bajaj Auto August sales drop 9% YoY; prepares for normal demand during festive season

Two and three-wheeler manufacturer Bajaj Auto’s total sales in the month of August 2020 fell 9 percent to 3.56 lakh units as against 3.90 lakh units in the same month last year.

During the month, the company’s total domestic sales declined 11 percent to 1.86 lakh units from 2.08 lakh units while exports fell 6 percent to 1.70 lakh units from 1.82 lakh units, YoY.

The company sold 3.21 lakh two-wheelers as against 3.25 lakh sold in the year-ago period. However, domestic two-wheeler sales rose by 3 percent YoY to 1.78 lakh units.

Speaking to CNBC-TV18, Rakesh Sharma, Executive Director, Bajaj Auto said that the company saw retail growth due to Ganesh Chaturthi in Maharashtra while Onam led to better sales in Kerala. Read more here

5 key ratios to consider before investing in mutual funds

Mutual Fund (MF), as an investment opportunity, is an important part of an investor’s portfolio. In MFs, the money is managed by a professional fund manager, who is backed by a team of researchers.

There are many ways to analyze mutual funds before investing in them.

While understanding the risk tolerance, investment horizon and financial goals are essential before choosing mutual funds to invest in, there are certain financial ratios that can help investors in picking the best funds, based on their profile.

Here are the key ratios to consider before investing in mutual funds:

Gautam Adani says ‘Mumbai Intl Airport is absolutely world-class. I compliment GVK Group for having built such an outstanding airport.’

Bharti Infratel’s shares surge nearly 5% post positive brokerage calls on Indus Towers merger

Bharti Infratel’s shares surged nearly 5 percent on Wednesday after the company approved the long-pending merger with Indus Towers. Brokerages feel that this merger will add value in the future, and have maintained positive call on the stock. The shares rose as much as 5 percent to Rs 197.50 per share on the NSE.

In a statement, Bharti Airtel said that Vodafone Idea will be able to divest 11.15 percent stake in Indus Towers for Rs 4,000 crore. The transaction is subject to approval of the National Company Law Tribunal (NCLT).

Post merger announcement, brokerages feel there’s value in the Bharti Infratel. UBS maintains ‘neutral’ call on Bharti Infratel with target price at Rs 188 per share as it believes the risk-reward is balanced here.

On Vodafone Idea’s front, the brokerage said that the outlook remains uncertain. “We give a target of Rs 110/share if Vodafone exits the market, Rs 190/share if it stays partially in the market and Rs 220/share assuming it continues to remain in the market.”

Deutsche Bank kept its target price on the stock at Rs 250/share, with a ‘buy’ call due to the current risk adjusted value.

According to the brokerage, the merger will prove a strong source of value-addition in the long term. “Estimate a 10.6 percent EPS gain from merging. The national footprint and broader shareholder base improves scale and independence,” the report said.

Bharti Airtel’s shareholding drops from 54 percent to around 37 percent, while the rest is split fairly evenly between minorities and Vodafone PLC/PEP. We believe building a bigger tent to attract tenants is the most important element of this merger, as we estimate the synergies are not particularly large, explained the brokerage.

Gold rate today: Yellow metal falls; Strong support seen at Rs 50,800 per 10 grams

Gold prices in India traded lower on the Multi Commodity Exchange (MCX) Wednesday tracking weakness in international spot prices amid a strong dollar. Silver prices also declined more than 1 percent, slipping below Rs 70,000 levels.

At 11:15 am, gold futures for October delivery fell 0.54 percent to Rs 51,225 per 10 grams as against the previous close of Rs 51,502 and opening price of Rs 51,449 on the MCX. Silver futures traded 1.67 percent or Rs 1,183 lower at Rs 69,707 per kg. The prices opened at Rs 70,600 as compared to the previous close of Rs 70,890 per kg.

“Gold prices fell after robust manufacturing activity in the US boosted investors’ risk appetite. Expectations of strong US GDP data which is to be released later today also supported dollar leading weakness in the yellow metal,” said Ajay Kedia, director, Kedia Commodity Comtrade. Continue reading

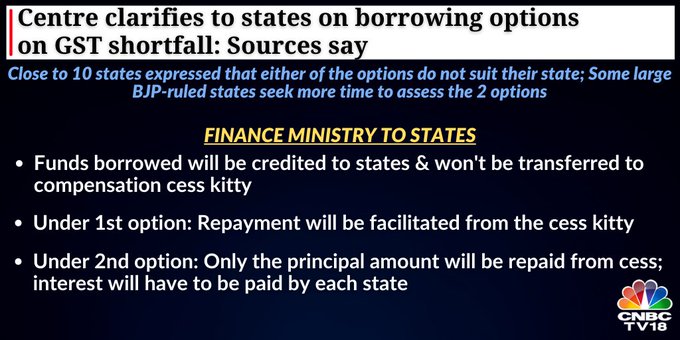

Sources say the Centre has clarified to states on borrowing options on #GST shortfall. The clarifications were made during meeting of Finance Secretary with the State Officials.

Vodafone Idea shares zoom 13% as board to consider fundraising

Shares of Vodafone Idea jumped over 13 percent on Wednesday after the announced that its board will meet on Friday to consider fund-raising plans. “We wish to inform you that a meeting of the Board of Directors of the Company is scheduled to be held on September 4, 2020, inter-alia, to consider and evaluate any and all proposals for raising ofvfunds in one or more tranches by way of a public issue, preferential allotment, private placement, including a qualified institutions placement or through any other permissible mode and/or combination thereof as may be considered appropriate,” the company said in a BSE filing.

Life insurers may soon launch index-based insurance products

Insurance Regulatory and Development Authority of India (IRDAI) has constituted a 6-member committee to examine various aspects around index-linked products in the life insurance segment. IRDAI’s current regulations do not specifically permit insurers to sell index-based products. IRDAI had received requests from various life insurance companies to allow them to offer index-linked products. Currently, life insurance companies can offer products under two categories: participating products and non-participating products. More here

Adani Green ranked largest solar power generation owner in the world; shares surge 10%

Shares of Adani Green Energy jumped 10 percent on Wednesday after the company was ranked as the largest solar power generation ownerin the world by Mercom Capital. The stock rose as much as 10 percent to its 52-week high of Rs 546 per share. In a BSE filing, the company said, “the latest ranking of global solar companies by Mercom Capital ranks the Adani Group as the #1 global solar power generation asset owner in terms of operating, under construction and awarded solar projects. It added that Adani’s renewable energy portfolio exceeds the total capacity installed by the entire United States solar industry in 2019 and will displace over 1.4 billion tons of carbon dioxide over the life of its assets.

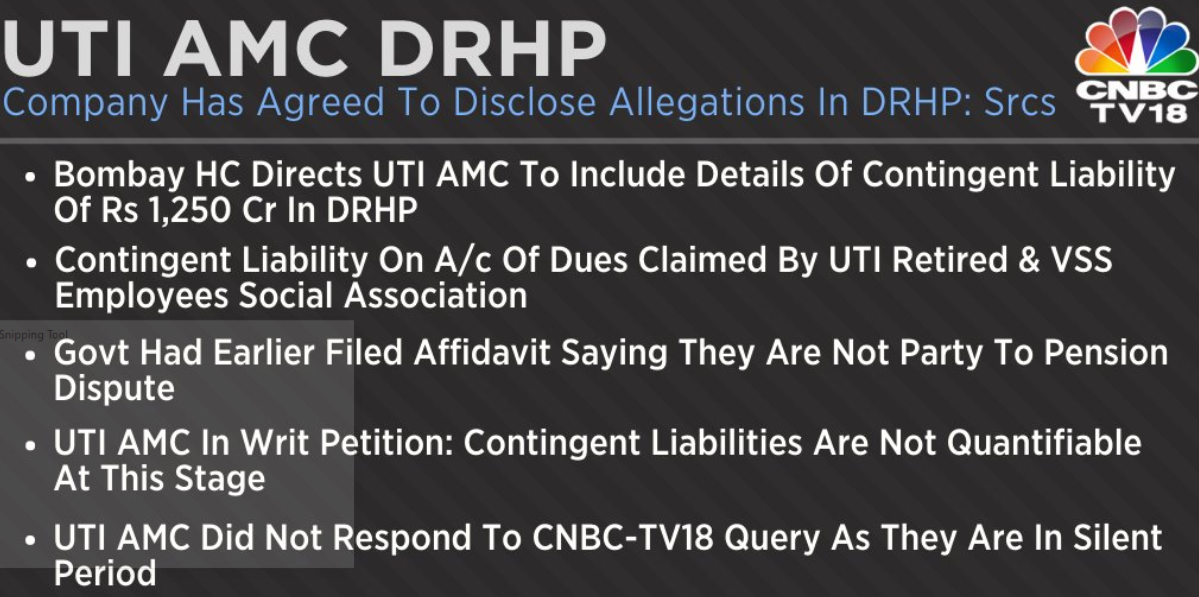

Sources Say UTI AMC has agreed to disclose allegations w.r.t contingent liability of Rs 1,250 Cr in DRHP

JUST IN: Japan ruling party sets September 14 vote on PM Abe successor: AFP

Sameet Chavan, Chief Analyst-Technical and Derivatives, Angel Broking

“Monday’s sharp fall might have shaken so many market participants and it has certainly applied brakes on the recent euphoria. Fortunately for us, there was no follow through selling seen yesterday and the Nifty successfully managed to defend the crucial support of 11325. Since, Monday’s correction is the profit booking move of a strong bull run, markets have still not distorted their structure. So, as long as 11325 is defended, the momentum traders would still have some hopes of a recovery. If any weakness has to trigger, it will happen only after breaking this crucial point.

However on the higher side, we do not expect Nifty surpassing Monday’s high soon. Meanwhile, it would be a daunting task for the Nifty to surpass the sturdy wall of 11550-11650. Going ahead, we continue to advocate some caution and one should avoid aggressive bets, considering the rise in volatility, Till the time we are stuck in a range of 11325 – 11650, we are likely to get trades on both sides and hence, swings traders can capitalise on such higher volatile moves.”

Reliance-Future Retail Deal: What’s in store for DMart, other FMCG firms now?

The takeover of Future Group’s retail business by Reliance has changed the dynamics of the organised grocery retail space. FMCG companies especially grocery retailer DMart will now look to step up to this big change in the industry given the intensifying competition and pressure, Credit Suisse said in a report.

According to the brokerage, the acquisition of Future Group’s retail businesses by Reliance marks a major consolidation in the Indian organised retail sector, with two of the top three players merging.

Reliance’s revenue and retail space will receive a big jump from this transaction. Read more

System is not ready to adapt to the new pledge system, says Asit C Mehta Investment

New rules kick in with respect to how clients pledge/re-pledge securities for margin purposes and the system now moves to a pledge/re-pledge mark versus title transfer earlier. “The customers are expected to give margins if they want to buy or sell any security be it in derivatives market or in cash market. In cash market earlier they did not have initial margins, post the trade was executed there were margins and the customers didn’t have to pay margins on sell transactions. Now SEBI has mandated that purchase as well as sell transaction will have margins. More here

Rupee back above 73 against the US dollar

Need 8.5% annual GDP growth for 90 million jobs by 2030, says McKinsey Report

India will need a reform agenda over the next 12-18 months to speed up GDP growth and aim for the creation of at least 90 million non-farm jobs by 2030. To meet that target the economy needs to grow between 8 and 8.5 percent annually over the next decade, according to a report by According to a McKinsey. The report warns that lower growth of between 5.5 to 6 percent would help the economy absorb only about six million new workers, marking a decade of lost opportunity. The coronavirus pandemic and the resulting lockdown combined with an already slowing pre-COVID economy, has dealt a brutal blow to the economy resulting in a 24 percent contraction in GDP in the April to June quarter, the sharpest fall ever recorded. More here

Bajaj Auto reports total sales of 3.56 lakh units

[ad_2]

Source link