[ad_1]

Sixth IPO of the month: Why you should subscribe UTI AMC, brokerages answer

UTI Asset Management Company (AMC), the sixth IPO to launch this month, opens for subscription today and will close on October 1. The company will be the third AMC to get listed on the stock exchanges after Nippon Life India Asset Management (NAM) and HDFC AMC and has fixed a price band of Rs 552-554 per share for its IPO. At the upper end of the price band, the IPO would fetch Rs 2,160 crore. UTI AMC is the second-largest AMC in India in terms of total AUM, seventh-largest AMC in India in terms of mutual fund Quarterly Average Assets Under Management with Rs 1.5 lakh crore. It also has the largest share of monthly average AUM amongst the top ten Indian AMC coming. Most brokerages have a ‘subscribe’ rating on the issue given its decent returns and profit margins in the past few years. It is well-positioned to capitalise on favourable industry dynamics, including the under-penetration of mutual fund products, brokerages said. They added that a long-term track record of product innovation, consistent investment performance and AUM growth are the key positives. More here

Don’t think SBI as a franchise is at risk. If one removes value of subsidiaries, SBI’s banking biz is available free . Bharti Airtel underperforming as it was a consensus buy, says Prashant Jain of HDFC AMC (@hdfcmf) pic.twitter.com/o7y9yzJzHf

— CNBC-TV18 (@CNBCTV18Live) September 29, 2020

Technical View | We are at a critical juncture – the resistance level range of 11,300-11,350 is not very far from the current price level. This could be a turning point for the Nifty; we could reverse from here to resume the downtrend we saw last week or we could break out of this level to see higher price points. On the upside, the markets can rally to 11,700-11,800. On the downside, we could go to 10,700-10,800, says Manish Hathiramani, Proprietary Index Trader and Technical Analyst, Deen Dayal Investments.

Market Watch: Shubham Agarwal, CEO & Head Of Research, Quantsapp Advisory

“Buy Bata India. The stock has been consolidating for a very long time but the recent data development is indicating that there is a good possibility of a breakout and we did see some longs also getting added in the last couple of days. So 1,400 strike Call option can be bought for a target of Rs 45 with a stop loss at Rs 22.

The second buy call is on Reliance Industries Ltd (RIL) where we have seen that RIL has been one of the stocks, which has been participating in this entire rally and now we have seen a rebound happening from the lower bound of Rs 2,200, which is also very important support for RIL and this rebound should again lead to a mean reversion and a higher high. So 2,300 strike Call option can be bought for a target of Rs 75 with a stop loss at Rs 50.”

What the grey market premium is suggesting for upcoming IPOs

The market is going to be busy with UTI AMC, Mazagaon Dock Shipbuilders, and Likhitha Infrastructure IPOs launching on September 29. On the other hand, the grey market, is not only busy, but cautious as well. The unofficial grey market price of an IPO is the best indicator of how market perceives an IPO. It is the rate of premium an IPO commands in the informal market. UTI AMC, the second-largest Asset Management Company — due to close on October 1 — has priced its offer between Rs 552 and Rs 554 per share. This issue comprises of 3,89,87,081 equity shares with a face value of Rs 10 per share. The company manages domestic MFs of UTI Mutual Fund, provides portfolio management services (PMS) to institutional clients and high net worth individuals (HNIs) and manages retirement funds, offshore funds and alternative investment funds. More here

Opening Bell: Sensex, Nifty open higher led by gains in global peers

Indian indices opened higher on Tuesday tracking rise in Asian peers helped a recovery in US markets after last week’s selloff. Gains in the domestic indices were led by buying in all key sectors led by metal, auto and IT indices. At 9:18 am, the Sensex was trading 162 points higher at 38,143 while the Nifty rose 61 points to 11,288. Broader markets also rose with Nifty Midacp and Nifty Smallcap indices up 0.6 percent and 1 percent, respectively. Hindalco, Asian Paints, Tata Steel, Hero Moto, and UltraTech Cement were the top gainers on the Nifty50 idnex while ICICI Bank, Power Grid, Bharti Airtel, HCL Tech and Dr Reddy’s led the losses.

Market Watch: Gautam Duggad, Head of Research for Institutional Equities at Motilal Oswal Financial Services

On AMCs

This is the space, which is going to be around for a long time and this is just the third AMC, which is getting listed. Over the next two years, you will see many AMCs, which will get listed. From a longer-term point of view, AMCs are going to have a very strong future in my view given the level where we stand as far as the financialisation of savings is concerned.

On OMCs

Within the oil marketing companies (OMCs) if you force me to choose one stock then my analyst has a positive view on Indian Oil Corporation (IOC) purely because of low valuations and dividend yields. I will ideally avoid this space because there are far too many moving parts in OMCs – I would avoid this space whether it is Bharat Petroleum Corporation Ltd (BPCL) or Hindustan Petroleum Corporation Ltd (HPCL) or IOC but if you force me to choose one amongst the three then we have a slightly positive bias towards IOC given the valuation.

Here are a few global cues ahead of trade

JUST IN | Sources say AMFI submits proposal that SEBI should be sole authority for investigating, punishing MFs. The proposal comes after an FIR was filed against Franklin Templeton officials last week

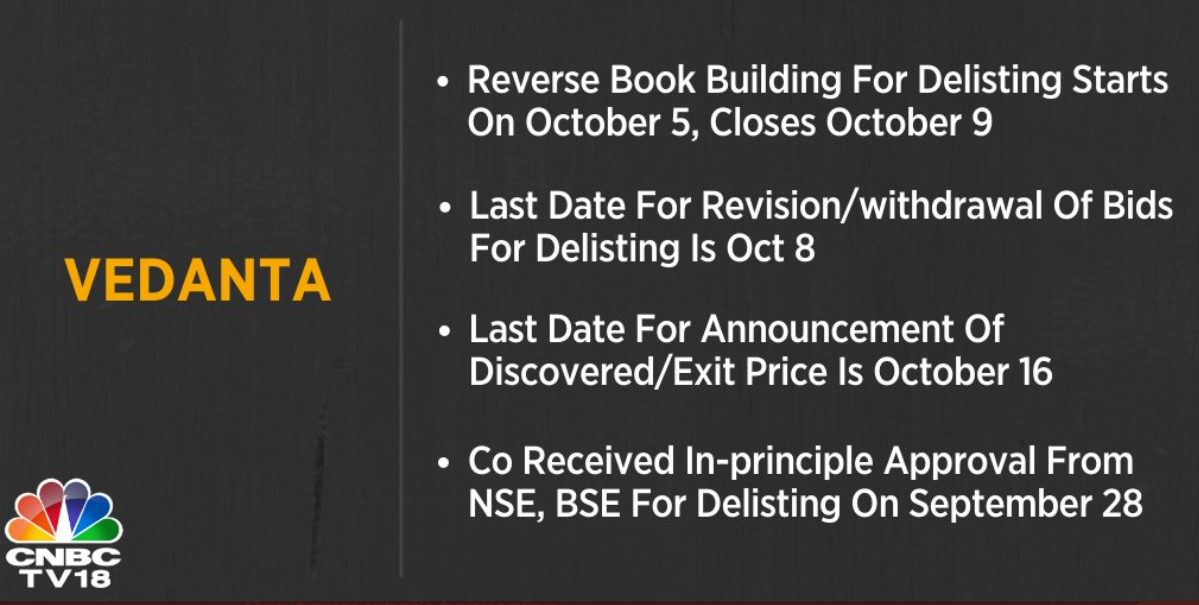

CNBC-TV18 Newsbreak Confirmed | Vedanta schedule for delisting is out; bid opens on October 5

Asian markets push higher after US bounce

Asian markets largely opened higher on Tuesday, building on newfound momentum after bargain hunters helped a recovery in US markets in the wake of last week’s selloff. Hong Kong’s Hang Seng index was up 0.2 percent while Chi83nese shares opened higher with the blue-chip CSI 300 index up 0.41 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan advanced 0.39 percent to 555.01. Japan’s benchmark Nikkei average, however, dropped 0.61 percent as telecom stocks fell after Nippon Telegraph and Telephone Corp announced a USD 38 billion take-private of its wireless carrier business, paving the way for price cuts in the sector. Australia’s S&P/ASX 200 index rose 0.22 percent, while New Zealand’s S&P/NZX 50 index edged down 0.27 percent after rising in early trade. More here

Trump vs Biden: How US election outcome could impact global markets

The US presidential election for 2020 pitting President Donald Trump against former Vice-President Joe Biden is less than two months away and its outcome is more uncertain than ever. Markets across the globe have reacted sharply to US election results in the past and reports suggest that 10 days after a presidential election, a Democratic victory tended to be less positive for the S&P 500 and S&P MidCap 400. One hundred days after the election, a Republican victory tended to be less positive for the equity market than a Democratic win, but Barack Obama’s first election win is an exclusion, which happened amid the 2008 financial crisis.

According to Societe Generale, a global financial services firm, a second term for Trump would be marginally more positive for the US equity market than a Biden presidency. “The US election process is likely to trigger a bumpy road ahead – beware of the risk of a delayed/contested election outcome – but won’t cause a disruption to the uptrend we still expect for US equities overall as the early stage of the economic cycle gets priced-in. Better to leverage the outcome through individual sectors and single stocks,” Societe Generale said in a report. More here

First up, here is quick catchup of what happened in the markets on Monday

Indian shares ended over 1.5 percent higher on Monday mainly led by gains in bank stocks, while gains in Asian markets further uplifted the sentiment. State-owned banking stocks rose with the Nifty PSU Bank index up over 3 percent on hopes that the government may infuse some capital into the sector. The Sensex ended 593 points higher at 38,981 while the Nifty rose 177 points to settle at 11,227. Broader markets outperformed benchmarks with the Nifty Midcap index up 3 percent and Nifty Smallcap index adding 3.7 percent for the day.

Welcome to CNBC-TV18’s Market Live Blog

Good morning, readers! I am Pranati Deva the market’s desk of CNBC-TV18. Welcome to our market blog, where we provide rolling live news coverage of the latest events in the stock market, business and economy. We will also get you instant reactions and guests from our stellar lineup of TV guests and in-house editors, researchers, and reporters. If you are an investor, here is wishing you a great trading day. Good luck!

[ad_2]

Source link