[ad_1]

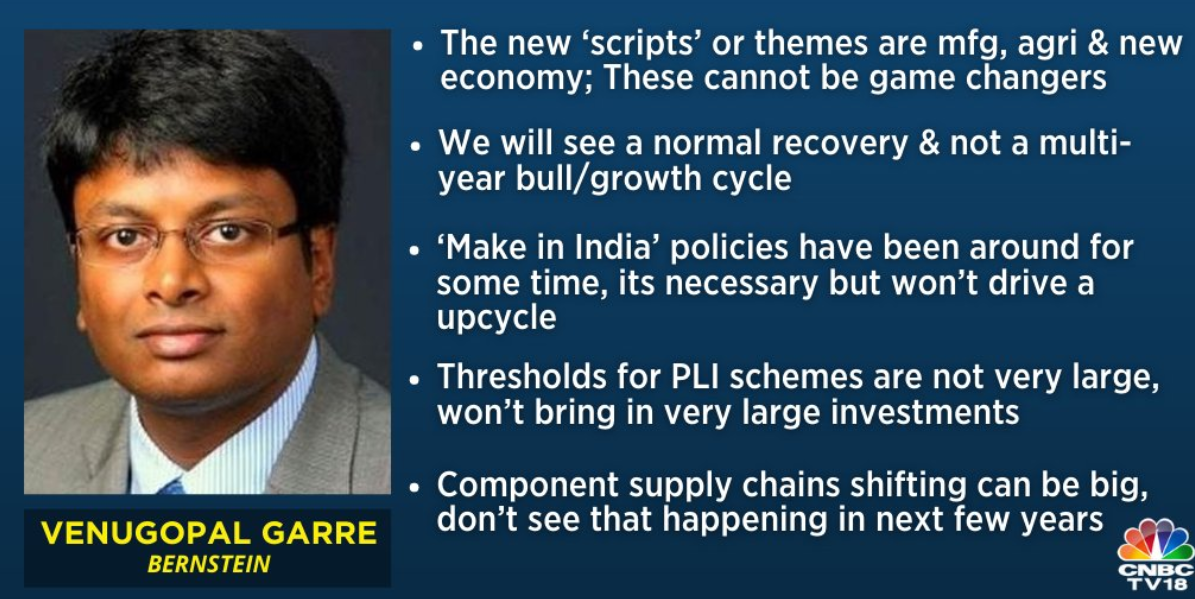

One needs to be more discerning from here in terms of stock picking, Venugopal Garre of Bernstein tells us.

Gold rate today: Yellow metal trades flat with positive bias; support seen at Rs 51,800 per 10 grams

Gold prices in India traded flat with a positive bias while silver prices surged over 2 percent on the Multi Commodity Exchange (MCX) Monday. At 11:20 am, gold futures for October delivery rose 0.12 percent to Rs 52,290 per 10 grams as against the previous close of Rs 52,227 and opening price of Rs 52,151 on the MCX. Silver futures traded 2.18 percent or by Rs 1,467 higher at Rs 68,638 per kg. The prices opened at Rs 67,106 as compared to the previous close of Rs 67,171 per kg. “Gold prices recovered from the lows of last week and seem to consolidate. The volatility may prevail and investors will look for minutes from the Federal Reserve’s last policy meeting and further developments on the vaccine. However, the bias remains positive,” said Amit Sajeja, AVP Research – Commodities & Currencies at Motilal Oswal. More here

Market Watch: Nooresh Merani of www.nooreshtech.co.in

“TCS has seen multiple attempts at the Rs 2,300-2,350 mark over the last 12-18 months as well as in the last few weeks. We expect it to break over the next few weeks going forward and at current price it is a risk reward buy with a stop loss at Rs 2,220 with a first target at Rs 2,350 and then higher.

Second one is a buy on Coal India, which is contrarion buy wherein the stock has made a good base around Rs 125-130 and saw a good price volume action on Friday. So we expect a move towards Rs 142 and a stop loss to be placed at Rs 130.”

Japan’s economy shrinks at record pace as pandemic wipes out ‘Abenomics’ gains

Japan was hit by its biggest economic contraction on record in the second quarter as the coronavirus pandemic crushed consumption and exports, keeping policymakers under pressure for bolder action to prevent a deeper recession. The third straight quarter of declines knocked the size of real gross domestic product (GDP) to decade-low levels, wiping out the benefits brought by Prime Minister Shinzo Abe’s “Abenomics” stimulus policies deployed in late 2012. While the economy is emerging from the doldrums after lockdowns were lifted in late May, many analysts expect any rebound in the current quarter to be modest as a renewed rise in infections keep consumers’ purse-strings tight. More here

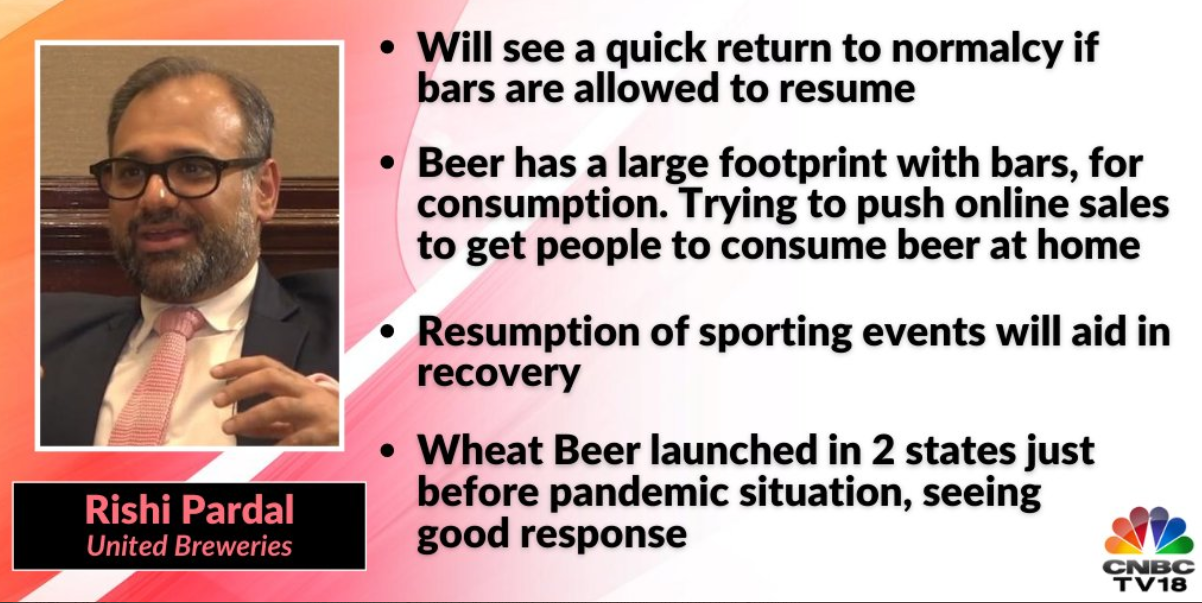

Will see a quick return to normalcy if bars are allowed to resume, Rishi Pardal of United Breweries says.

HDFC Bank faces potential lawsuit from a US-based law firm

New-York based Rosen Law Firm has announced an investigation of potential securities claims on behalf of HDFC Bank shareholders based on allegations of sharing “materially misleading business information” with investors. The law firm said it was preparing a securities lawsuit on behalf of HDFC Bank shareholders in a press release put on its website, and asked HDFC Bank shareholders to join the “securities action”. HDFC Bank’s ADRs are listed on the NYSE. The law firm quoted media reports about allegations of improper practices and conflict of interest in its vehicle financing operations, which involved its former unit head. “On this news, HDFC Bank’s American depositary receipt price fell $1.37 per share, or 2.83%, to close at $47.02 per share on July 13, 2020,” the firm said.

Rupee Update: The Indian currency opened mildly stronger on Monday after rangebound session last week. The rupee opened at 74.88 per dollar as compared to the previous close of 74.90.

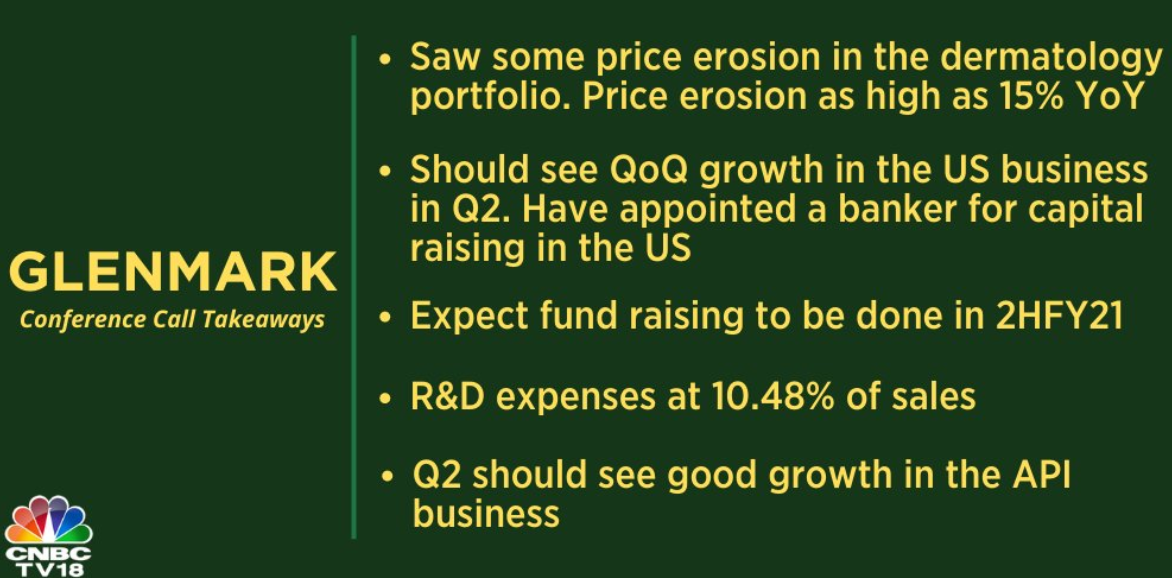

Glenmark Pharma’s shares surge nearly 7% over robust Q1FY21 earnings

Glenmark Pharmaceuticals’ share price surged as much as 7 percent on Monday after the company reported over two-fold increase in its consolidated net profit to Rs 254.04 crore for the quarter ended June 30, 2020. The pharmaceutical giant in the same period last year reported a net profit of Rs 109.28 crore.

The shares gained as much as 7 percent to Rs 509 per share on the NSE. At 9:51 am, the stock gave up some gains to trade 2.51 percent higher to Rs 487.65.

Consolidated revenue rose nearly a percent higher to Rs 2,345 crore as compared to Rs 2,323 crore last year.

The company’s formulations sales in the domestic market rallied to Rs 780 crore as compared to Rs 731 crore in the year-ago period. Europe’s business revenue surged about 13 percent to Rs 274 crore while the US business revenue rose 1.6 percent to Rs 743 crore.

“Despite the difficult operating environment, we managed to record sales growth for the organisation. We focussed on controlling costs on all fronts and will continue with these efforts for the remaining part of the financial year,” said Chairman and MD Glenn Saldanha.

On the COVID-19 drug development, he said, “Our fight against COVID-19 will continue and we will continue to innovate in this space to explore other promising treatment options.”

Here are the key takeaways from Glenmark’s conference call today

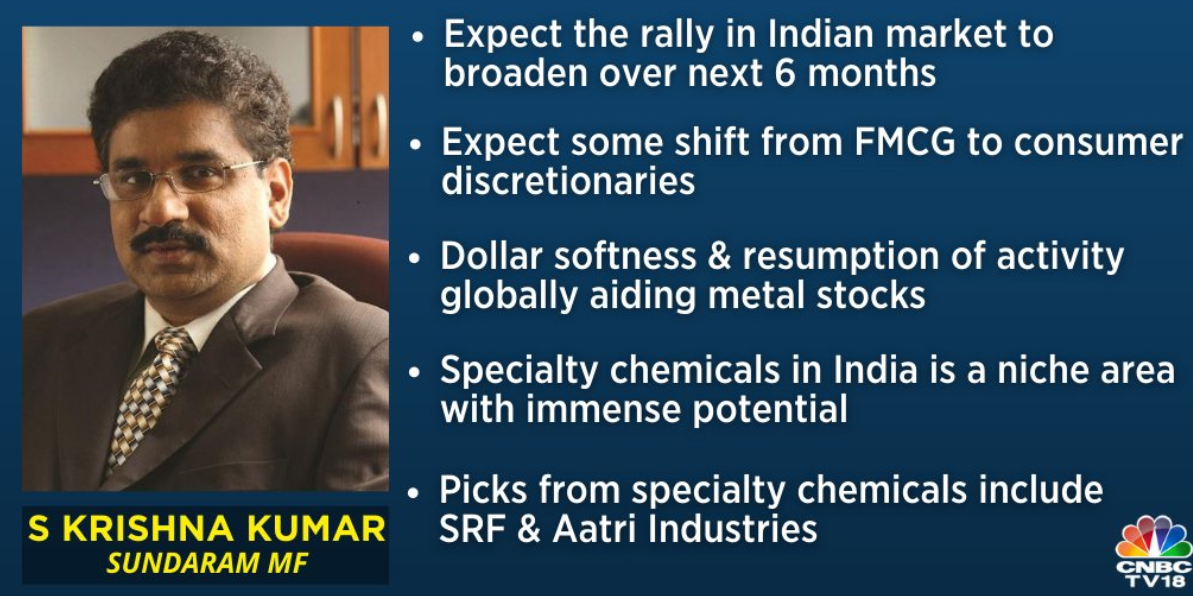

‘May see a return of interest in travel & hospitality going ahead,’ S Krishna Kumar of Sundaram MF says.

GVK group auditors seek to resign; cite non-cooperation from company

Price Waterhouse Chartered Accountants LLP, statutory auditors of GVK Power and Infrastructure Ltd, have submitted their proposed resignation letter as the beleaguered group is not providing them with the necessary information for audit of the financial statements for FY20, a filing from GVK to stock exchanges said on Friday. The auditors alleged that despite several communications to GVK, the group did not provide them with necessary information. “In view of various matters described in our communications, including the recent events in relation to companys subsidiary Mumbai international airport Ltd (MIAL), we have assessed the appropriateness of our continuance as the statutory auditor of the company in terms of Standard on Quality Control..” the auditors said. More here

Opening Bell: Sensex, Nifty open higher; financials gain

Indian markets opened higher on Monday tracking gains in Asian peers. The domestic indices were led by financials, pharma and IT space. Both the bank and fin services indices rose over 0.8 percent while FMCG and IT sectors were up over 0.7 percent each. At 9:18 am, the Sensex was trading 179 points higher at 38,056 while the Nifty rose 57 points to 11,236.NTPC, L&T, Zee, Tech Mahindra, and M&M were the top gainers on the Nifty50 index while Hindalco, M&M, Bharti Infratel, Tech Mahindra, and Hero Moto led the losses.

Govt not considering modifications in ITR form: Sources

Taxpayers will not have to mention their high-value transactions in their income tax return (ITR) and the government is not considering any modification in the form, according to sources. Any expansion in reporting under the statement of financial transactions (SFT) will mean that such reporting of high-value transactions to the income tax department will be done by financial institutions, the sources said.

“There is no such proposal to modify income tax returns forms,” the sources said. “The taxpayer would not need to mention his/her high value transactions in his/her return.” They said collecting reports of high-value transactions was the most non-intrusive way to identify those who spend big money on various items and yet they do not file income tax returns by claiming that their income was less than Rs 2.5 lakh per annum. More here

Here’s a look at CNBC-TV18’s top stocks to watch out for on August 17

ICICI Bank: Second largest private sector lender ICICI Bank on Saturday said it has raised Rs 15,000 crore equity capital by issuing shares to qualified investors, including Monetary Authority of Singapore, Morgan Stanley Investment Management Inc and Societe Generale. ICICI Bank said it has issued 418,994,413 equity shares at an issue price of Rs 358 per equity share.

Infosys: Infosys on Friday said there had been an “inadvertent trade” by the portfolio management services of Bela Parikh, spouse of the company’s independent director Bobby Parikh. Following this, a penalty of Rs 2 lakh has been imposed on Bobby Parikh, Infosys said in a regulatory filing.

PNB Housing Finance: The company’s board meeting on August 19 could consider fund raising.

Top stock tips by Ashwani Gujral for today

– Buy NTPC with a stop loss of Rs 86, target at Rs 94

– Buy Coal India with a stop loss of Rs 127, target at Rs 141

– Buy Sun Pharma with a stop loss of Rs 525, target at Rs 545

– Sell Axis Bank with a stop loss of Rs 441, target at Rs 425

– Sell Bajaj Finance with a stop loss of Rs 3,350, target at Rs 3,275

Click here for buy/sell calls by Sudarshan Sukhani, Mitessh Thakkar

Six of top-10 most valued companies lose Rs 78,275 crore in m-cap

Six of the 10 most valued domestic companies witnessed a combined erosion of around Rs 78,275 crore in market valuation last week, pulled down largely by heavyweights Reliance Industries Limited (RIL) and Tata Consultancy Services (TCS). During the last week, the Sensex declined 163.23 points or 0.42 percent. RIL, TCS, HDFC Bank, Hindustan Unilever Limited (HUL), Bharti Airtel and Kotak Mahindra Bank were among the losers. The market capitalisation of Infosys, HDFC, ITC and ICICI Bank, however, rose last week. RIL’s valuation plunged by Rs 20,666.46 crore to Rs 13,40,213.50 crore, taking the biggest drop among the 10 most valued firms. More here

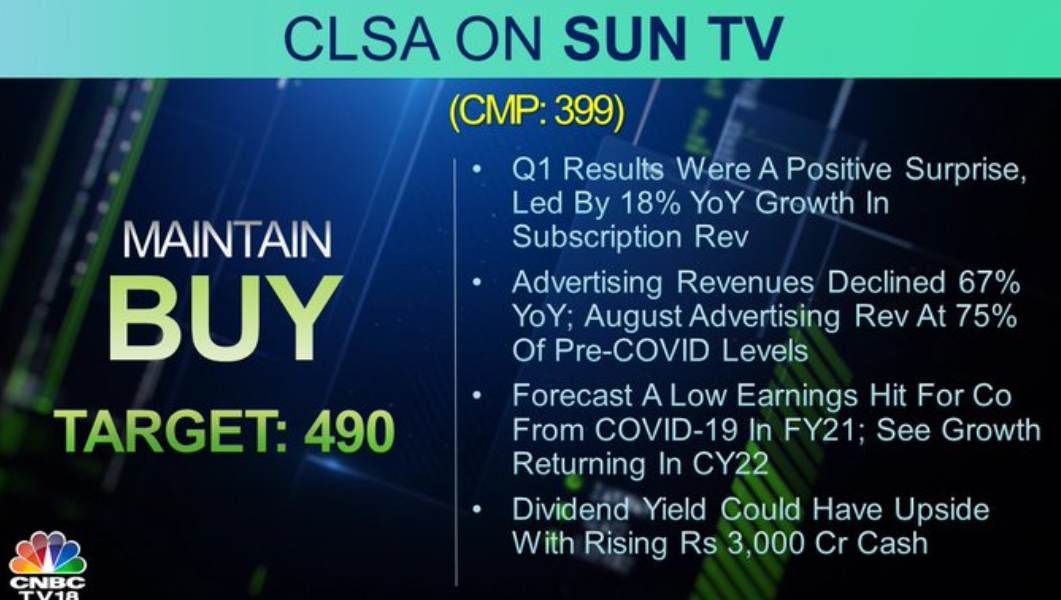

CLSA maintains its BUY call on Sun TV, says co’s Q1 results were a positive surprise

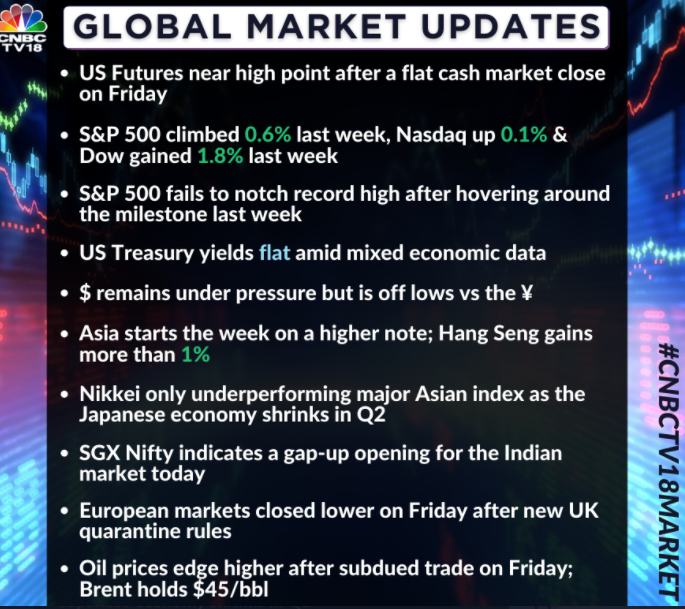

SGX Nifty indicates a gap-up opening for Indian market today.

Bank credit grows 5.51%, deposits 11.11%, shows RBI data

Bank credit and deposits grew 5.51 percent and 11.11 per cent to Rs 102.65 lakh crore and Rs 141.61 lakh crore, respectively, in the fortnight ended July 31, according to the latest data from the RBI. In the fortnight ended August 2, 2019, bank credit and deposits were at Rs 97.29 lakh crore and Rs 127.44 lakh crore, respectively. On a year-on-year (y-o-y) basis, non-food bank credit growth was at 6.7 percent in June 2020, nearly the same as in May 2020 but lower than the growth of 11.1 percent in June 2019. Credit growth to agriculture and allied activities rose 2.4 percent in June, compared with a higher growth of 8.7 percent in the corresponding month of 2019.

Global Update: Asia shares pause near highs, eyes on U.S. yields

Asian shares dozed near recent highs in quiet trade on Monday as investors waited to see if the recent sell-off in longer-dated U.S. Treasuries would extend, and maybe take some pressure off the beleaguered dollar. MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.02 percent lower at 562, but still eyeing the January top of 574.52. Japan’s Nikkei dipped 0.4 percent after touching a six-month peak on Friday, as the country suffered its biggest economic contraction on record in the second quarter.

First up, here is quick catchup of what happened in the markets on Friday

Indian shares pared all opening gains to end lower on Friday dragged by selling in auto stocks, primarily Eicher Motors and Tata Motors. Banks also contributed to the losses including Axis Bank, SBI and ICICI Bank, which fell over 3 percent. At close, the Sensex closed 433 points or 1.13 percent lower to 37,877 while the Nifty50 index ended at 11,178, down 122 points. Broader indices remained in-line with the benchmarks, ending over a percent lower. Barring metal and pharma indices, all sectors ended in deep red. Nifty Auto remained the worst-performing sector of the day, down 2.71 percent.

Welcome to CNBC-TV18’s Market Live Blog

Good morning, readers! I am Pranati Deva the market’s desk of CNBC-TV18. Welcome to our market blog, where we provide rolling live news coverage of the latest events in the stock market, business and economy. We will also get you instant reactions and guests from our stellar lineup of TV guests and in-house editors, researchers, and reporters. If you are an investor, here is wishing you a great trading day. Good luck!

[ad_2]

Source link