[ad_1]

Broader markets rally after new Sebi rules; Nifty Midcap up 3%, Nifty Smallcap jumps 5%

Broader markets surged on Monday after market regulator Sebi announced new rules for the multi-cap funds. As per the new guidelines, multi-cap mutual funds will have to make a minimum investment of 25 percent each in equity and related instruments of large-cap, midcap and smallcap companies.

The fund managers have been given flexibility for the balance of 25 percent of the fund.

The Nifty Midcap 100 index surged over 3 percent post the announcement while the Nifty Smallcap index rallied over 5 percent as industry experts estimate the move will see Rs 30,000-40,000 crore moving out of large-cap to midcap and smallcap companies.

The regulator on Sunday clarified that mutual funds have multiple options to comply with the changes in the framework for multi-cap mutual funds. Further, it said that the changes are targeted at ensuring that funds are true to their ‘label’. Here’s more on this

Gold rate today: Yellow metal trades higher; likely to face resistance at Rs 51,900 per 10 grams

Gold prices in India traded higher on the Multi Commodity Exchange (MCX) Monday tracking gains in the international spot prices as investors await US Federal Reserve’s monetary policy decision later this week, analysts said.

At 11:10 am, gold futures for October delivery rose 0.20 percent to Rs 51,421 per 10 grams as against the previous close of Rs 51,319 and opening price of Rs 51,599 on the MCX. Silver futures traded 0.24 percent higher at Rs 68,088 per kg. The prices opened at Rs 68,485 as compared to the previous close of Rs 67,928 per kg.

“Gold prices look to trade in range while sentiments remain weak as investors maintained a cautious approach ahead of US Federal Reserve’s monetary policy decision this week and as optimism around a potential COVID-19 vaccine lifted appetite for riskier assets,” said Ajay Kedia, director, Kedia Commodity Comtrade.

International gold prices rose on Monday, supported by a weaker dollar and expectations that the US Federal Reserve will adopt a dovish stance at its two-day monetary policy meeting later this week, Reuters reported. Read more

A timeline of Indian market’s 4 big bull runs: 38,000% returns in last four decades

The recovery in the Indian equity market this year is a reset button for the next bull run, believe many analysts. Goldman Sachs also recently indicated that we are already in the first phase of a new investment cycle.

However, data shows we are moving ahead but the pace this time is slow.

Since 1979, there have been 4 big bull runs that have pushed the Indian equity market to deliver 380x (or 38,000 percent) returns to date. The biggest bull run was last witnessed during 1988-92, where the market had rallied about 10x in 4 years. What we are witnessing now is the slowest run since the 1980s.

In the last 10 years, the Indian benchmarks have risen only over 300 percent. This year, however, the global equity markets have continued to rally despite the COVID-19 pandemic. In fact, factors like declining GDP, rising number of coronavirus cases and high unemployment rate have remained ineffective to push the market in a downward spiral. Continue reading!

Stock Update: Sun Pharma’s shares declined 1.14 percent to Rs 499.80 per share on the NSE, at 12:20 pm after the company received a patent infringement action in the U.S. District Court of New Jersey from Orexo. The lawsuit was filed in response to an Abbreviated New Drug Application (ANDA) filed by Sun Pharma with the U.S. FDA, in which Sun Pharma sought to market and sell generic versions of Orexo’s Zubsolv products, sublingual tablets in the U.S.

Just In: Wholesale prices in India rose 0.16 percent year-on-year for the month of August, according to the Press Information Bureau. Primary article prices rose 1.6 percent as compared to last year while fuel, power and lighting prices declined 9.7 percent year-on-year. Wholesale food prices rose 4.07 percent while Manufactured product prices saw an increase of 1.27 percent as compared to the previous year.

These stocks are trading at 52-week highs. MCX is now up more than 15% in the session

RIL and its partly-paid up stocks hit new highs; overall m-cap tops Rs 16.5 lakh crore

Shares of Reliance Industries (RIL) and Reliance Industries Partly Paid (PP) climbed about 2 percent and 3 percent, respectively, on Monday to hit new highs of Rs 2,360 and Rs 1,461.60, respectively. The market-capitalisation (m-cap) of RIL now stands above Rs 15.8 lakh crore while that of RIL PP stock is above Rs 61,000 crore. The cumulative m-cap of RIL and RIL PP now stands at about Rs 16.5 lakh crore. RIL became the first Indian company to surpass the market capitalisation of $200 billion on September 10. The oil-to-telecom conglomerate now ranks 44th in terms of valuations globally.

Embattled SoftBank renews talks on taking the group private: Source

SoftBank Group Corp executives have held early-stage talks about taking the Japanese technology group private as the company seeks a new strategy after disposing of several large assets, according to a person familiar with the matter. The discussions are driven by frustrations over the persistent discount in SoftBank’s equity valuation compared with the value of its individual holdings, which continues even after an asset sale programme tried to close that gap, the source said, requesting anonymity as the discussions are private. The deliberations are at a very preliminary stage and SoftBank management is divided about whether or not move ahead with the deal, the source cautioned, adding it is not the first time SoftBank executives have held such discussions.

Market Watch: Manas Jaiswal of manasjaiswal.com

“First recommendation is a buy call on Voltas because we have seen lot of buying interest in Voltas for last 2-3 months’ time and the stock has been making higher tops and higher bottoms from the levels of around Rs 550 and after some pause you can see a clear breakout today on Voltas. We have seen significant higher volumes. So Voltas has potential to test Rs 730 take a long position here, stop loss should be around Rs 669.”

“Second is from IT space that is HCL Technologies, you can see a clear flag breakout case on HCL Tech, we have seen some consolidation, but now the stock has broken the key resistances area of Rs 742-750. So take a long position here, stop loss should be around Rs 744 and target would be around Rs 805.”

Raamdeo Agarwal of Motilal Oswal Fin says the best option is to go for a new category called Flexicap to accommodate existing funds

Market Watch: Prakash Diwan, Market Expert On IT

“IT is definitely the pocket to watch out for because with the kind of valuation that we have seen getting stretched on other sectors specially chemicals, pharma, a lot on telecom, there will be this flight to safety kind of a move. Some of the top rung stocks like Tata Consultancy Services (TCS), Infosys, Wipro have actually run up quite a bit. The next round is going to see a huge absorption of a huge demand coming into the Tech Mahindra and HCL Technologies of the world. But if you have to create a basket of IT stocks from all these various segments, I think Tech Mahindra plus a Tata Elxsi – because these are names that are doing very unique businesses and maybe something smaller like a Persistent, that is the way to go about it. It is more segmental, more driven by pockets and bunches of excellence. I believe there will be a lot of money that comes into IT but it will probably be more broad based and not necessarily on the Infy and TCS moves that we have seen – in fact I wouldn’t be surprised if there will be some profit booking that comes on the largecap IT names and these mid-tier IT names will actually get accumulated more by institutional managements.”

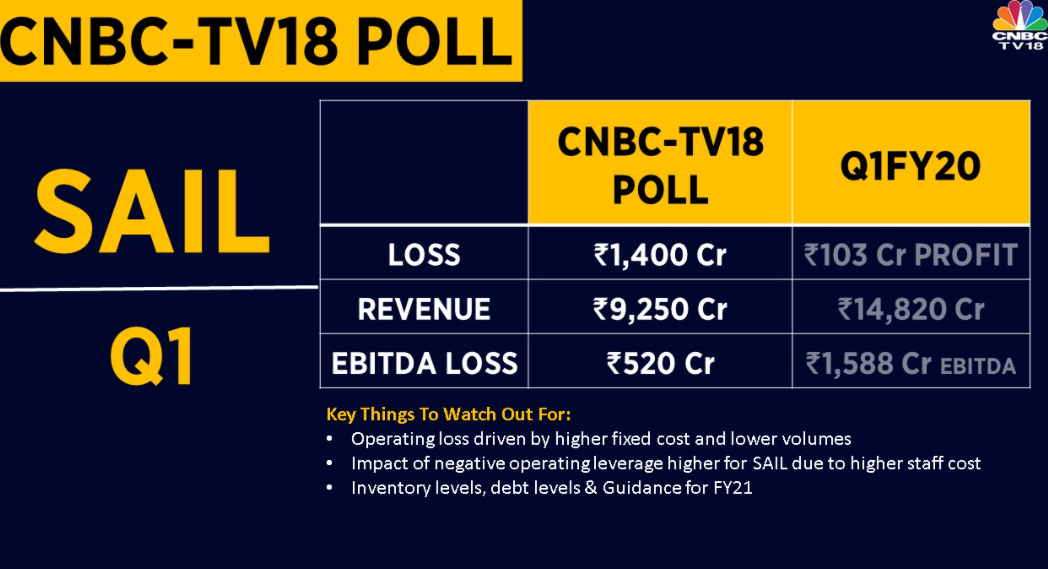

SAIL is due to report its Q1 earnings today, street estimates a loss of Rs 1,400 cr for the co.

Market Update: With the onset of new SEBI rule on multicap schemes, there is a huge buying sentiment seen in midcaps and smallcaps. At 10:15 am, the Nifty Midcap 100 and Nifty Smallcap 100 indexes rallied 2.49 percent and 5.14 percent respectively. To read more on the SEBI regulation, click here.

Stock Update: Tata Motors’ shares surged as much as 2.42 percent to Rs 147.80 per share on the NSE after CLSA maintained ‘buy’ rating on the stock with target price at Rs 220 per share. It said, “JLR is gearing for a stronger Q2. July and August retail numbers of JLR indicate a QoQ uptick of 57 percent.” The brokerage feels that the cash flow recovery and cost cuts should lead to strong free cash flow generation and deleveraging.

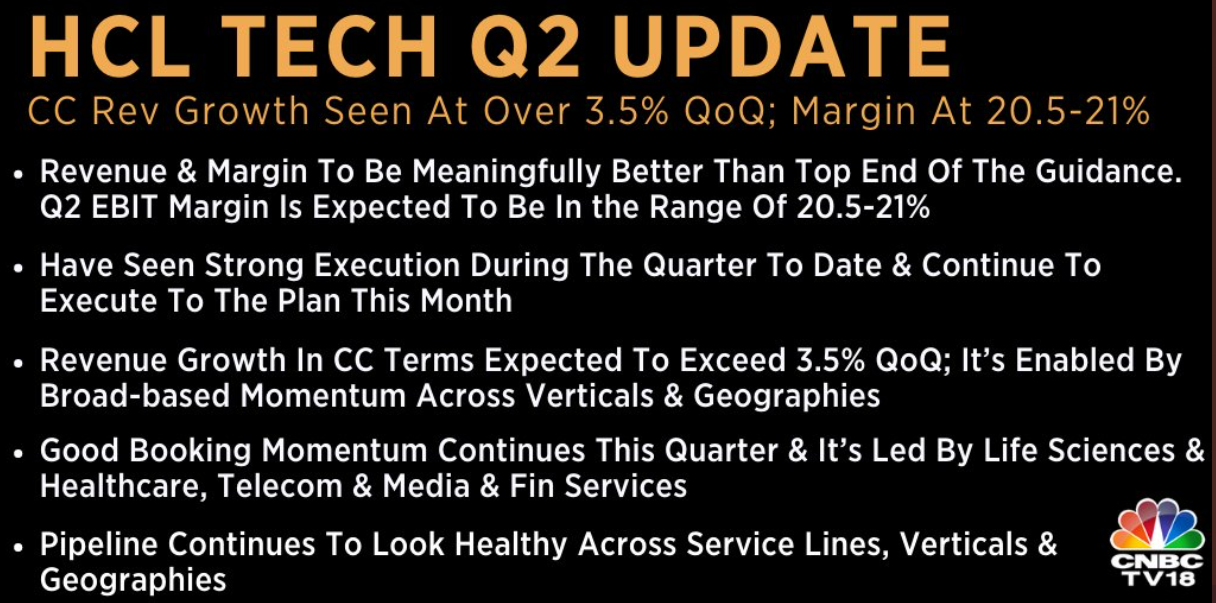

HCL Tech shares hit 52-week high, up 6.6% on strong September quarter update

Shares of HCL Tech jumped over 6.5 percent on Monday to hit a fresh 52-week high after a strong September quarter update by the company. The IT firm said that it sees Q2 constant currency revenue up over 3.5 percent on a QoQ basis and margin in the range of 20.5-21 percent. It is enabled by broad-based momentum across all service lines, verticals and geographies, the firm added. In the June quarter, the company said that it expects topline to increase by an average of 1.5-2.5 percent QoQ in constant currency for the next three quarters while operating margin is likely to grow between 19.5-20.5 percent for FY21.

Reliance Industries hits record high, crosses 2,350

IT stocks gain after a strong Q2 update by HCL Tech

Opening Bell: Sensex opens 300 points higher, Nifty above 11,500

Indian indices opened higher on Monday following Asian peers as hopes of a coronavirus vaccine were rekindled after AstraZeneca resumed its phase-3 trial. The late-stage trials of the experimental vaccine, developed with researchers from the University of Oxford, were suspended this week after an illness in a study subject in Britain, casting doubts on an early rollout. At 9:18 am, the Sensex was up 309 points at 39,163 while the Nifty 83 points at 11,547.

HCL Tech, Zee, Bharti Infratel, Tata Motors, and SBI were teh top gainers while BPCL, HUL, UltraTech cement, Nestle and JSW Steel led the losses. Broader markets rose after Sebi issued clarification on multi-cap allocation circular. Nifty Midcap index gained 1.5 percent while the Smallcap index was up 2.3 percent. All sectors were in the green at opening with Nifty IT rising the most, up 1.4 percent. Bifty Bank, Nifty Auto and Nifty Metal also added over 0.7 percent each.

Vodafone Idea becomes co-presenting sponsor of Dream11 IPL 2020

Telecom operator Vodafone Idea has become the co-presenting sponsor of the upcoming Dream11 IPL 2020, scheduled to commence from September 19, the company said on Saturday. Vodafone and Idea have had engagement with the IPL cricket tournament in the past but this is the first ever sponsorship deal that Vodafone Idea has signed since its inception in August 2018. The company, which now operates under ‘Vi’ brand name has acquired the co-sponsorship rights of the live broadcast of T-20 premier league which will be held in Abu Dhabi, the UAE, and telecast on the Star Sports network, Vodafone Idea (VIL) said in a statement.

New SEBI rules for multi cap funds may not spark the much hoped-for rally in small caps

On the face of it, the new asset allocation rules for multi cap equity schemes announced by SEBI on Friday should send fund managers rushing to load up on mid and small cap stocks, particularly the latter. But not everybody in the market is betting on it, and for good reason. Under the new rule, these funds will have to invest a minimum of 75 percent of their total assets in equity and equity-related instruments. Also, the funds will have to invest a minimum of 25 percent of their corpus in each of the three categories of stocks–large caps, mid caps and small caps.

This led many analysts to assume that in order to comply with the revised rules, fund managers will have to liquidate their large cap holdings down to 50 percent. This is because it is technically possible for fund houses to have 25 percent of their assets each in mid caps and small cap stocks and the remaining in large caps. So, if large cap holdings have to be brought down to a maximum of 50 percent, and exposure to mid and small cap stocks has to be raised to a minimum of 25 percent, money will flow from large caps to mid and small caps as fund managers rebalance their portfolios. More here

HCL Tech releases Q2 update, expects revenue & margin to be meaningfully better than top end of the guidance.

Lenders have voted to push bid submission deadline to October 17 from September 16: Sources on DHFL

Sources on DHFL tell us that lenders have voted to push bid submission deadline to October 17 from September 16. Only 5 serious bidders remain in fray to acquire DHFL out of the 22 shortlisted. Bidders Oaktree Capital, Welspun Group are among the potential suitors. Do note, DHFL is facing claims of Rs 99,888 cr from various creditors under NCLT. 22 suitors were invited to submit bids on the basis of their EoIs. Adani Properties, SC Lowy, Piramal Enterprises seen as serious bidders

Sebi issues clarification on multi-cap allocation circular

Market regulator, Sebi, on Sunday clarified that mutual funds have multiple options to comply with the changes in the framework for multi-cap mutual funds. Further, it said that the changes are targeted at ensuring that funds are true to their ‘label’. “Sebi would like to clarify that mutual funds have many options to meet with the requirements of the circular, based on the preference of their unitholders. Apart from rebalancing their portfolio in the multi-cap schemes, they could inter-alia facilitate a switch to other schemes by unitholders, merge their multi-cap scheme with their large-cap scheme or convert their multi-cap scheme to another scheme category, for instance, large cum mid-cap scheme,” said Sebi in the statement issued on Sunday

On Friday, Sebi tweaked asset allocation framework for multi-cap mutual funds, requiring such funds to have a minimum corpus of 75 percent invested in equities as against the present mandate of 65 percent. Further, such funds will have to make a minimum investment of 25 percent each in equity and related instruments of large-cap, midcap and smallcap companies, according to the circular. More here

AstraZeneca resumes UK trials of COVID-19 vaccine halted by patient illness

AstraZeneca has resumed British clinical trials of its COVID-19 vaccine, one of the most advanced in development, after getting the green light from safety watchdogs, the company said on Saturday. The late-stage trials of the experimental vaccine, developed with researchers from the University of Oxford, were suspended this week after an illness in a study subject in Britain, casting doubts on an early rollout. “On 6 September, the standard review process triggered a voluntary pause to vaccination across all global trials to allow review of safety data by independent committees, and international regulators,” AstraZeneca said. It added that safety reviewers had recommended to Britain’s Medicines Health Regulatory Authority (MHRA) that it was safe to resume the British trials.

FPIs turn net sellers in September, pull out Rs 2,038 crore so far

Foreign portfolio investors (FPI) turned net sellers in Indian markets by pulling out Rs 2,038 crore so far in September as participants turned cautious in view of rising Indo-China tensions and weak global cues. According to the depositories data, a net Rs 3,510 crore was withdrawn from equities, while Rs 1,472 crore was pumped into debts by FPIs between September 1-11. FPIs were net buyers for three consecutive months — June to August. They invested Rs 46,532 crore in August, Rs 3,301 crore in July and Rs 24,053 crore in June on a net basis. More here

First up, here is quick catchup of what happened in the markets on Friday

Indian benchmark indices ended a little higher on Friday led by gains in IT, banks and metal stocks. The benchmark Sensex ended 0.04 percent or 14.23 points higher at 38,854.55 while the Nifty ended at 11,464.45, up 15.20 points or 0.13 percent. Broader indices outperformed the benchmarks as Nifty Midcap100 and Nifty SmallCap100 gained 0.68 percent and 0.27 percent, respectively.

Welcome to CNBC-TV18’s Market Live Blog

Good morning, readers! I am Pranati Deva the market’s desk of CNBC-TV18. Welcome to our market blog, where we provide rolling live news coverage of the latest events in the stock market, business and economy. We will also get you instant reactions and guests from our stellar lineup of TV guests and in-house editors, researchers, and reporters. If you are an investor, here is wishing you a great trading day. Good luck!

[ad_2]

Source link