[ad_1]

Stock Market Live: Indian indices were trading higher on Tuesday led by IT stocks and financial stocks as they trimmed gains to turn positive. Index heavyweights RIL, Infosys, TCS, HDFC Bank, and ICICI Bank contributed the most to the indices.

Ashoka Buildcon surges 8% after Co emerges lowest bidder for NHAI projects

Shares of Ashoka Buildcon surged 8 percent on Tuesday after the company emerged as the lowest bidder for two National Highways Authority of India (NHAI) projects with an aggregate quoted value of Rs 1,390 crore in Bihar under Bharatmala Pariyojana. The company, which is engaged in the construction of roads and highway projects, said the first project comprises a proposal for the four laning of Arrah to Pararia section of NH-319(Old NH-30) from Km 0+000 to Km 54+530 (Design Chainage) in Bihar under Bharatmala Pariyojana phase -1 on EPC mode (Package-I).

Security clearances should not jeopardize BPCL deal, says Govt

In a bid to ensure that the divestment process of state-run Bharat Petroleum Corporation Ltd (BPCL) is completed in time with all protocols, the government is keen on security clearance for prospective bidders before the financial bids opened. According to highly placed sources, the Core Group of secretaries on BPCL disinvestment, headed by cabinet secretary Rajiv Gauba has recommended that ‘the Security clearances should be taken at early stages of bid process and bidders too have been asked to obtain security clearances simultaneous along with financial bids.’ The group has also observed that BPCL divestment is very crucial to meet the disinvestment target of Rs 2.10 lakh crore for the current fiscal, thus even for the winning bidder, if he decides to form a special purpose vehicle (SPV) “the security clearance of all entities involved will be needed,” sources added. More here

Future Enterprises Q4 net loss at Rs 394.77 crore

Future Enterprises Ltd on Monday reported a consolidated net loss of Rs 394.77 crore for the fourth quarter ended March 31, 2020. The company had posted a net profit of Rs 66.58 crore in the January-March quarter a year ago, Future Enterprises Ltd (FEL) said in a BSE filing. Recently, the board of FEL has approved amalgamation of the Future Group entities with the company to facilitate Rs 24,713 crore deal to sell the retail and wholesale business to Reliance Retail, owned by oil-to-chemical conglomerate Reliance Industries Ltd. Its revenue from operations was down 50.01 per cent to Rs 783.28 crore during the quarter under review, as against Rs 1,566.96 crore in the same period last fiscal.

7 -day window for states to inform Centre about compensation options ends Today. Centre believes opting for option 1 doesn’t mean states will have to forego remaining compensation; balance compensation to be paid after borrowing is fully repaid: Sources to @TimsyJaipuria pic.twitter.com/juyIp6McMj

— CNBC-TV18 (@CNBCTV18Live) September 8, 2020

Market Watch: Rahul Mohindar of viratechindia.com

“On the IT stocks, I pick on Tata Consultancy Services (TCS) with target of Rs 2,400-2,410. It is more of an intraday trade, keep a stop loss of Rs 2,320 when buying.

I will be selling Coal India for a target of Rs 129, keeping stop loss at Rs 133.

HDFC which has been in the range for the last two months, I think will once again test the lower end of the range around Rs 1,730-1,740. So, it is a sell on HDFC for a Rs 1,740 target, keeping a stop loss above Rs 1,805.”

Sebi sets March 31 as cut-off date for re-lodgement of share transfer requests

Capital markets regulator Sebi on Monday fixed March 31, 2021, as the cut-off date for re-lodgement of share transfer requests. Transfer of securities held in physical mode has been discontinued with effect from April 1, 2019, but investors have not been barred from holding shares in the physical form. Sebi, in March 2019, had clarified that transfer deeds lodged before the deadline of April 1, 2019, and rejected or returned due to deficiency in the documents may be re-lodged with requisite documents. Now, Securities and Exchange Board of India (Sebi), has “decided to fix March 31, 2021, as the cut-off date for re-lodgement of transfer deeds”, according to a circular. “Further, the shares that are re-lodged for transfer (including those requests that are pending with the listed company / RTA, as on date) shall henceforth be issued only in Demat mode,” it added.

Technical View | The Nifty is trading above 11,300 which continues to remain a bullish sign. However, if we disrespect the levels of 11,200, we could slide further to break 11,000. On the upside, an impulsive bull rally will only be seen post 11,600. Until then we would be in a 300-400 point range between 11,200 – 11,600, says Manish Hathiramani, Index Trader and Technical Analyst, Deen Dayal Investments.

Buzzing | Info Edge shares gain over 3% post Q1 earnings

Shares of Info Edge (India) gained over 3 percent in early trade on Tuesday after the company posted net profit in the June quarter along with better operating performance.The company reported a consolidated net profit of Rs 93.66 crore in the first quarter of fiscal 2021 as compared to a loss of Rs 190.91 crore.Consolidated net revenue in Q1FY21 fell 10.85 percent to Rs 285 crore from Rs 319.7 crore, YoY.On the operating front, earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) jumped 16.62 percent to Rs 104 crore from Rs 89.18 crore. EBITDA margin in Q1FY21 was at 36.49 percent, up by 8.6 percent, YoY.

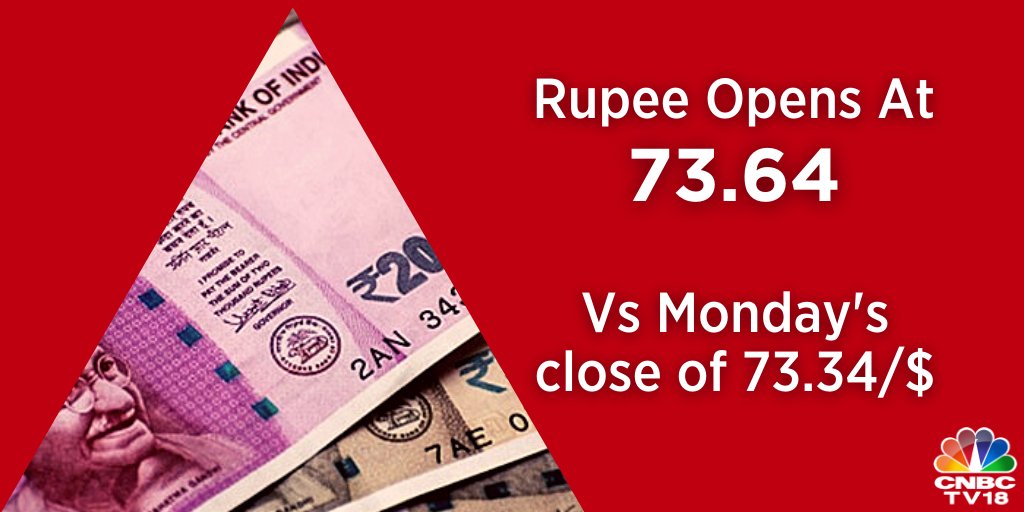

Rupee Opens | The Indian rupee opened at 1-week low against the US dollar, falls 30 paise versus yesterday’s close.

IPO market picks up: Two in one week and more in the pipeline

After witnessing a lackluster year so far amid the COVID-19 pandemic, the Initial Public Offer (IPO) market is likely to pick up again with two IPOs hitting the street this week itself. The IPO of Happiest Minds Technologies, an IT services firm promoted by the founder of Mindtree, went live on exchanges on Monday and sailed through on the day 1 of subscription helped by strong demand for retail investors. The Rs 702 crore public issue of the Bengaluru-based firm has seen a 2.86 times subscription so far.

The second IPO lined up this week is of Route Mobile, a cloud communications service provider. The 600 crore IPO will be open for public subscription on September 9. The company has fixed price band of Rs 345-350 a share. The public offer comprises a fresh issue worth Rs 240 crore and an offer for sale (OFS) of Rs 360 crore by promoters — Y Sandipkumar Gupta and Rajdipkumar Gupta. The initial public offer (IPO) will conclude on September 11 and the investment by anchor investors will be finalised by September 8.

ED arrests Deepak Kochhar in ICICI Bank-Videocon case

Deepak Kochhar the husband of former MD and CEO of ICICI Bank Chanda Kochhar has been arrested by the Enforcement Directorate (ED) in Mumbai. Source confirmed with CNBC-TV18 that Deepak was arrested on September 7 in connection with investigations into allegedly financial irregularities between ICICI Bank and Videocon. PTI reported, officials said that Deepak was arrested by the agency in Mumbai under sections of the Prevention of Money Laundering Act (PMLA). The couple were questioned by the central probe agency in a case of alleged irregularities and money laundering in giving bank loans to the Videocon group. The ED, early this year, also attached assets worth Rs 78 crore “in possession of” Chanda Kochhar, Deepak Kochhar and the companies owned and controlled by him. More here

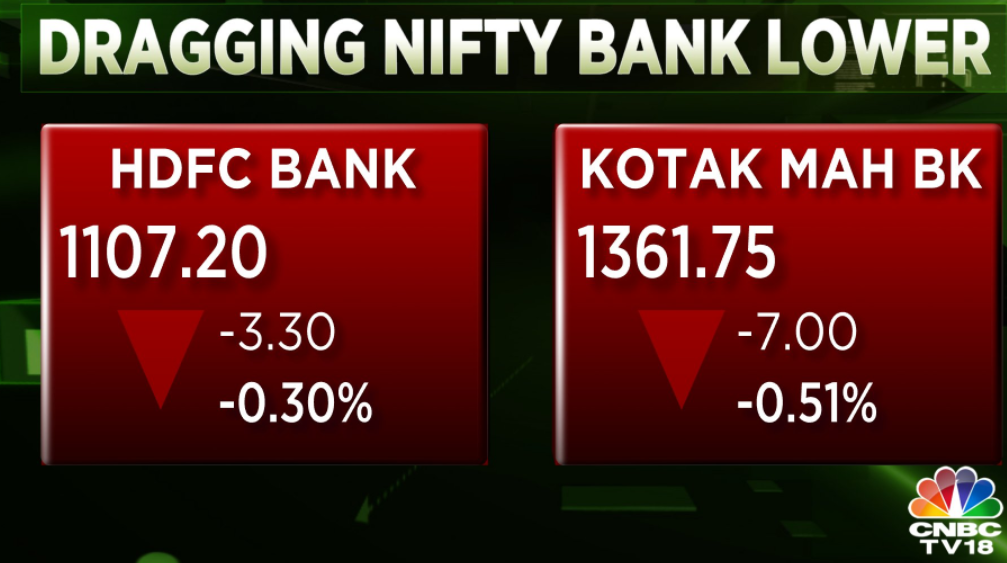

HDFC Bank & Kotak Mahindra contributing more than 40% to Nifty Bank’s losses currently

Opening Bell: Sensex, Nifty open on a muted note; financials drag

Indian indices opened on a muted note Tuesday as decline in financial stocks were capped by gains in heavyweights like RIL, Infosys anf ITC. At 9:18 am, the Sensex was trading 54 points lower at 38,363 while the Nifty was down 17 points at 11,338. Broader markets were also flat, in line with the benchmarks. Among sectors, the banking and fin services indices fell around 0.4 percent in the early deals while IT, pharma and realty sectors were in the green at opening. On the Nifty50 index, RIL, ITC, L&T, HDFC Life and Axis Bank were the top gainers while Bharti Infratel, Powergrid, Nestle, HDFC and ONGC led the losses.

Oil mixed after dropping on demand concerns post-US holiday

Oil prices were mixed in early trade on Tuesday on looming demand worries about a possible rise in COVID-19 cases following the US Labor Day long weekend, which also marks the end of the peak US driving season. Coronavirus cases rose in 22 of the 50 US states, a Reuters analysis showed, on the holiday weekend traditionally filled with gatherings to mark the end of summer. At the same time, cases are flaring up in India and Britain. US West Texas Intermediate (WTI) crude futures fell 64 cents, or 1.6 percent, to USD 39.13 per barrel at 0221 GMT, playing catch-up with a drop in Brent prices overnight. Brent crude futures inched up 6 cents, or 0.1 percent, to USD 42.07 a barrel, after falling 1.5 percent on Monday.

Global Markets: Shares stabilise, try to shrug off US tech rout scare

Asian shares and US stock futures regained some footing on Tuesday following a small bounce in European markets as investors looked to whether high-flying US tech shares could recover from their recent rout. Japan’s Nikkei advanced 0.4 percent as revised data confirmed the nation had slumped into its worst postwar contraction, with business spending taking a bigger hit from the coronavirus than initially estimated. China’s blue-chip index tacked on 0.2 percent while Hong Kong’s Hang Seng gained 0.6 percent, even as President Donald Trump on Monday ramped up his anti-Chinese rhetoric by again raising the idea of de-coupling the US and Chinese economies. More here

Fresh fire hits stricken oil supertanker off Sri Lanka

Firefighters are again battling flames aboard a fully loaded oil supertanker off Sri Lanka, the island’s nation’s navy said on Monday, four days after fire first broke out on the New Diamond. “Fresh flames have risen in the funnel section of the MT New Diamond Supertanker and firefighters are battling the fire using foam to contain the blaze,” said the Navy spokesman Captain Indika de Silva, adding that the fire had not reached the oil cargo of around 2 million barrels. A fire first broke out last Thursday in the engine room and spread to the bridge of the very large crude carrier, chartered by Indian Oil Corp for importing oil from Kuwait. That blaze was doused on Sunday. Tugs had been spraying water onto the ship on Monday to keep the metal cool, but high winds ignited the flames once again, de Silva said. More here

Some global cues this morning

CNBC-TV18’s top stocks to watch out for on September 8

SBI | The bank plans to recruit more than 14,000 people this year.

Dr Reddy’s Laboratories | The company has launched Fulvestrant injection in the US market.

Future Enterprises | The company reported a consolidated net loss of Rs 394.77 crore in Q4FY20 as against a net profit of Rs 66.58 crore, YoY.

Happiest Minds IPO subscribed 2.87 times on day 1

The initial public offer of IT services firm Happiest Minds Technologies was subscribed 2.87 times on the first day of bidding on Monday. The IPO received bids for 6,67,09,800 shares against total issue size of 2,32,59,550 shares, according to data available with the NSE. Qualified institutional buyers (QIBs) category was subscribed 8 per cent, non-institutional investors 62 per cent and retail individual investors 14.61 times. Happiest Minds Technologies has raised Rs 316 crore from anchor investors. The IPO will close on Wednesday (September 9). The price band of the offer has been fixed at Rs 165 to Rs 166 per equity share.

Fitch revises India’s FY21 fiscal deficit forecast to 8.2% of GDP from 7.2%

Global credit rating agency Fitch has revised India’s FY21 central government fiscal deficit forecast to 8.2 percent of GDP from 7.2 percent due to higher than anticipated willingness of govt to spend amid weak revenue collection. The rating agency also forecasts total government deficit including the state deficit for FY21 at 11.8 percent of GDP. This is due to a quicker than previously anticipated divergence in expenditures and non-debt receipts, which saw the deficit exceed the full year target in only four months, Fitch said. More here

First up, here is quick catchup of what happened in the markets on Monday

Indian indices ended marginally higher after a volatile session on Monday led by IT, FMCG stocks and heavyweights HDFC and RIL. Investors shrugged off caution as the country became the second-most hit with coronavirus and selloff in Wall Street. The Sensex ended 60 points higher at 38,417 while the Nifty rose 40 points to 11,374. Broader markets were mixed with Nifty Midcap down 0.7 percent and Nifty Smallcap up 0.2 percent. Most sectors turned positive in the last leg of the trade. Nifty FMCG and Nifty IT rose over half a percent each. Meanwhile Nifty Realty and Nifty Auto lost 0.8 percent and 0.27 percent. The banking and fin services indices were flat for the day.

Welcome to CNBC-TV18’s Market Live Blog

Good morning, readers! I am Pranati Deva the market’s desk of CNBC-TV18. Welcome to our market blog, where we provide rolling live news coverage of the latest events in the stock market, business and economy. We will also get you instant reactions and guests from our stellar lineup of TV guests and in-house editors, researchers, and reporters. If you are an investor, here is wishing you a great trading day. Good luck!

[ad_2]

Source link