/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KEGKFRO24VF67PWV7V2ADNG37U.png)

[ad_1]

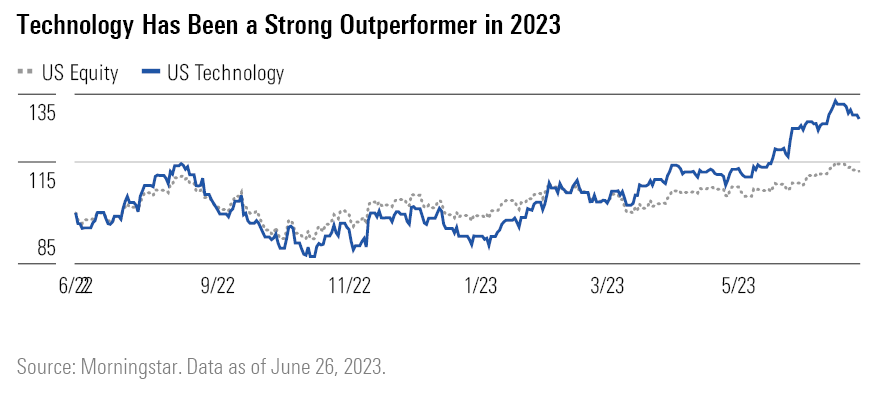

The 12 months 2022 was a tough one for the expertise sector, however we noticed a restoration in tech within the first quarter of 2023 and an excellent sharper rally within the second quarter, boosted at the very least partly by the large hype and demand for all issues related to synthetic intelligence. The sector is now an outperformer to the broader market over the previous 12 months.

Mega cap tech shares (Apple, Microsoft) are nonetheless faring higher than the general group, and Nvidia emerged as one other (transient) member of the $1 trillion membership, however different tech shares additionally recovered. We stay assured in secular tailwinds in expertise, resembling cloud computing, synthetic intelligence, and rising semiconductor demand in quite a lot of finish markets. We nonetheless see some choose shopping for alternatives in semis and software program, even with some macroeconomic issues on the horizon.

Across the tech panorama, Nvidia’s spectacular outlook for 2023 signifies that main cloud and Internet firms are racing to coach and broaden their AI fashions. We suppose AI has the potential to revolutionize industries and the way individuals work together with the world. Meanwhile, the dreadful demand surroundings for PCs and smartphones appears to have bottomed, though we solely anticipate a gradual restoration. Automotive semis was the final sector to see headwinds, however provide/demand appears to be normalizing.

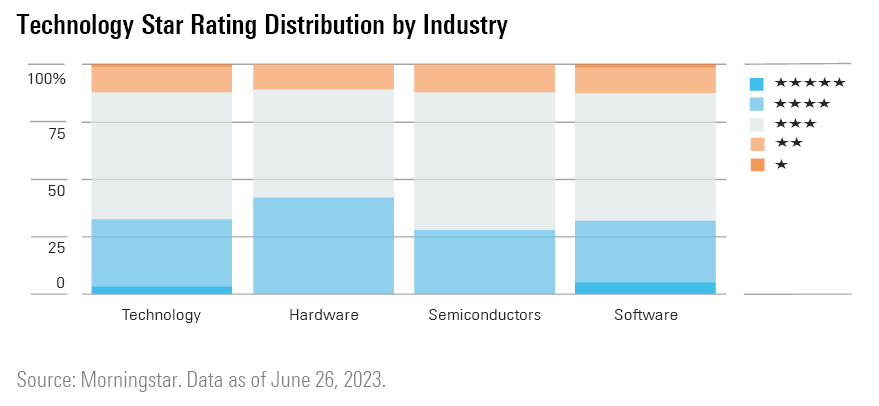

The Morningstar US Technology Index is up practically 28% on a trailing 12-month foundation, in contrast with the U.S. fairness market up solely 12%. Over the previous quarter, tech rose 12% whereas the U.S. fairness market rose solely 5%. The median U.S. expertise inventory is 6% undervalued, and we see much less of a margin of security than when these shares have been 20%-25% undervalued 9 months in the past. The median {hardware}, software program and semis inventory are undervalued within the 5%-7% vary.

Technology Is on the Start of a Boom Cycle in AI Investments

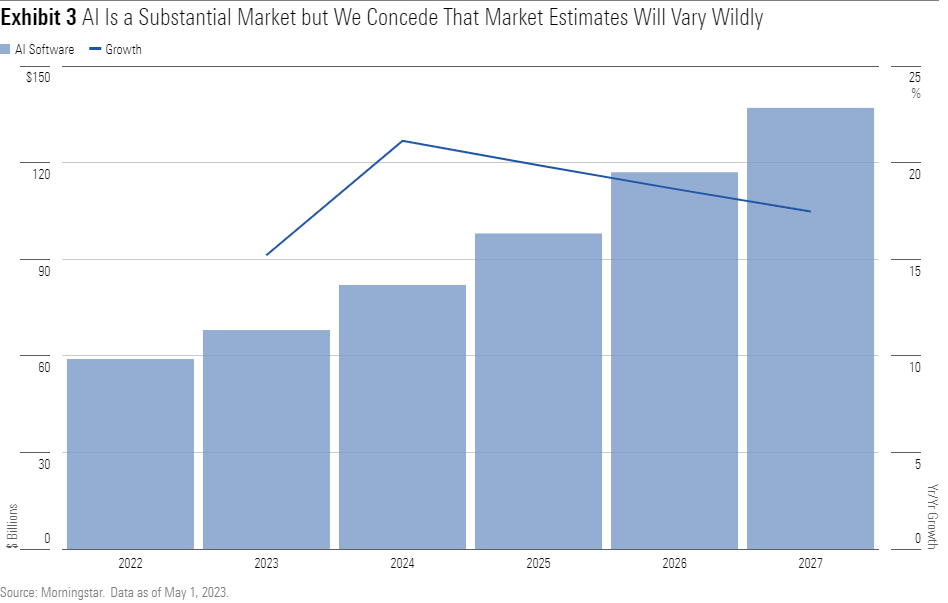

Consumers and companies alike are serious about synthetic intelligence, though there’s no clear and clear solution to measurement this market. We anticipate that AI growth shall be huge, however monetization could also be scattered. Some corporations might weave AI into present merchandise, whereas some might earn direct charges from AI fashions. We take our greatest try and measurement the market (see subsequent chart), primarily based on a mix of business estimates, however we nonetheless suppose that the impression of AI might go far past the impression of upper software program costs.

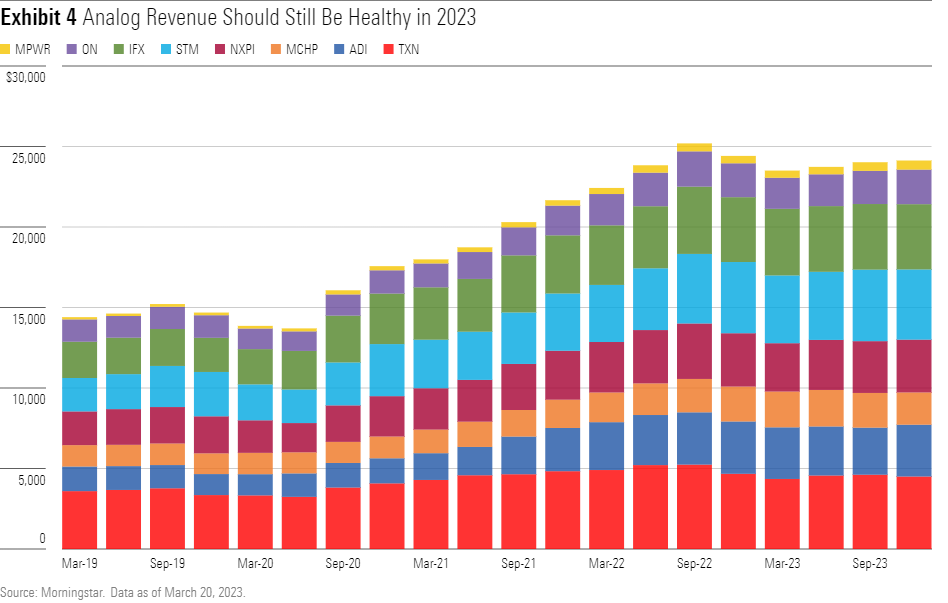

Elsewhere in tech, analog and combined sign semiconductor income progress has been stellar in current quarters, because of the worldwide chip scarcity and excessive demand for content material in automotive.

We’re seeing indicators of a slowdown in 2023 as corporations will doubtless face robust comps, however general gross sales ranges ought to stay wholesome and are supported by massive order backlogs.

Top Technology Sector Stock Picks

Salesforce CRM

- Fair Value Estimate: $245.00

- Star Rating: 3 Stars

- Uncertainty Rating: High

- Economic Moat Rating: Wide

We consider Salesforce.com represents among the best long-term progress tales in large-cap software program attributable to its ever-expanding portfolio of complementary options that permit customers to fully embrace their prospects, thereby constructing relationships, strengthening retention, and driving income. In our view, Salesforce will profit farther from pure cross-selling amongst its clouds, upselling extra sturdy options inside product strains, pricing actions, worldwide progress, and continued acquisitions such because the current offers for Slack and Tableau.

Cognizant Technology Solutions CTSH

- Fair Value Estimate: $91.00

- Star Rating: 5 Stars

- Uncertainty Rating: Medium

- Economic Moat Rating: Narrow

We suppose Cognizant is well-positioned to push its fame previous being a back-office outsourcer to larger worth technical choices—like digital engineering and AI options—in addition to digital transformation consulting. In our view, losers of digital transformation shall be a lot smaller IT providers gamers that lose out due to consolidation of accounts with bigger distributors, like Cognizant. We bake in a five-year income compound annual progress fee of 8% for Cognizant, an acceleration of 5% during the last 5 years.

Teradyne TER

- Fair Value Estimate: $157.00

- Star Rating: 4 Stars

- Uncertainty Rating: High

- Economic Moat Rating: Wide

Teradyne is a chip-testing behemoth that makes use of a big analysis and growth price range to provide top-tier automated check gear and attain a number one market share, all whereas posting higher profitability than its friends. Teradyne boasts particularly robust relationships with Apple and TSMC, however we predict the breadth and depth of its capabilities throughout many chip varieties and finish purposes signify spectacular intangible belongings that inform our vast financial moat ranking.

[adinserter block=”4″]

[ad_2]

Source link