[ad_1]

(Pexels)

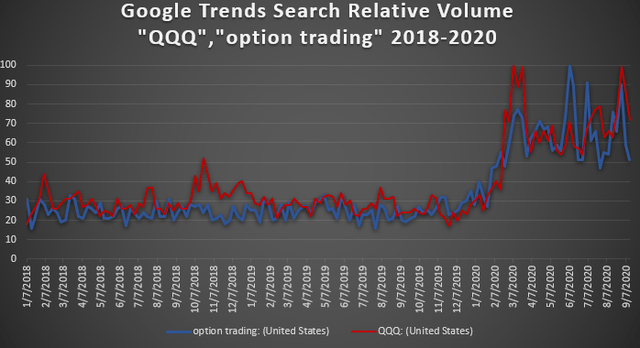

Technology stocks have been all the rage most of this year with the Nasdaq 100 up nearly 25% since the year began and names like Apple (NASDAQ:AAPL) and AMD (NASDAQ:AMD) being 40-50% higher. There has also been a growing interest in speculation among many investors which may be partially driving technology companies. This is demonstrated through the rise in Google Trends relative search volume for the terms “QQQ” (the main vehicle used to trade Nasdaq) and “options trading”.

See below:

As you can see, the search volumes for both terms are closely correlated. This gives weight to the theory that the bulk of option speculation is in fact in technology and growth stocks. Search volumes for both terms saw a large spike during the March crash and have stayed at a high level since. There has been a notable decline in search volumes for both terms in recent weeks corresponding to the sell-off in the Nasdaq 100.

Since September 2nd, the Nasdaq 100 has declined around 12% from its all-time high and recently broke below its support level of 11,000. Importantly, the weighted-average breakeven price of all call options on QQQ is currently at this level, meaning many of these options may expire worthless. This may mean an end to the growing speculation around technology stocks.

The Top 10 Technology Losers

Regardless of whether or not we’ve seen the “big top” in technology, many once-expensive technology giants are trading at much lower prices than they were two weeks ago. I’ve found the top 10 worst performers among large-cap technology stocks from the popular tech ETF (XLK).

Without further ado, here are the ten biggest losers:

| Ticker | Name | Performance Since 9/1/2020 | Subindustry |

| (AAPL) | Apple Inc. | -20.26% | Consumer Technology |

| (AMD) | Advanced Micro Devices, Inc. | -19.05% | Semiconductor |

| (PYPL) | PayPal Holdings, Inc. | -17.50% | Payment Processing |

| (CRM) | Salesforce.com, Inc. | -14.52% | Software |

| (KLAC) | KLA Corp. | -14.26% | Semiconductor |

| (INTU) | Intuit Inc. | -14.08% | Software |

| (ADBE) | Adobe Inc. | -13.76% | Software |

| (NLOK) | NortonLifeLock, Inc. | -13.06% | Software – Security |

| (MSFT) | Microsoft Corporation | -12.83% | Consumer Technology |

| (SNPS) | Synopsys, Inc. | -12.83% | Software – Security |

Overall, it is the subindustries that have seen the best performance this year such as software and semiconductors that are seeing the greatest losses. The software ETF (IGV) has had a great year with a 29% return YTD as well as the semiconductor ETF (SMH) at 21%.

Of course, with both software and semiconductors, it is those tied to new technologies such as 5G, cloud computing, and internet of things that are seeing the “best of the best” performance. This includes most of the companies above. Particularly, Apple, Advanced Micro Devices, and Synopsys.

Most of these stocks are considerably cheaper than they were two weeks ago, but that does not make them cheap. As you can see below, all but two have forward “P/E” ratios below 20X with some ranging above 50X:

| Ticker | Forward EPS | Price |

Forward Price-to-Earnings |

| AAPL | $3.25 | $107.81 | 33.2 |

| AMD | $1.10 | $75.08 | 68.3 |

| PYPL | $3.72 | $174.65 | 46.9 |

| CRM | $3.73 | $241.89 | 64.8 |

| KLAC | $11.35 | $179.07 | 15.8 |

| INTU | $8.44 | $298.08 | 35.3 |

| ADBE | $9.93 | $463.59 | 46.7 |

| NLOK | $1.35 | $20.80 | 15.4 |

| MSFT | $6.45 | $199.66 | 31.0 |

| SNPS | $5.55 | $196.96 | 35.5 |

| Average (Harmonic) | 31.25 |

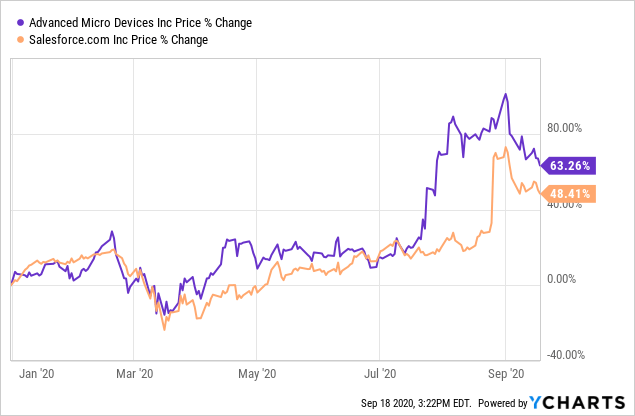

The average forward “P/E” in the fund is a high 31X. This is 50% higher than the forward “P/E” ratio of the S&P 500 as a whole. The most extreme are Salesforce and AMD which both have sky-high valuations, above 60X. Indeed, these companies have strong historical growth and are major players in ongoing technological innovation, but even Apple never had a forward “P/E” ratio that high.

As you can see below, both of those two companies saw large spikes over summer and are now slipping back down:

Data by YCharts

Data by YCharts

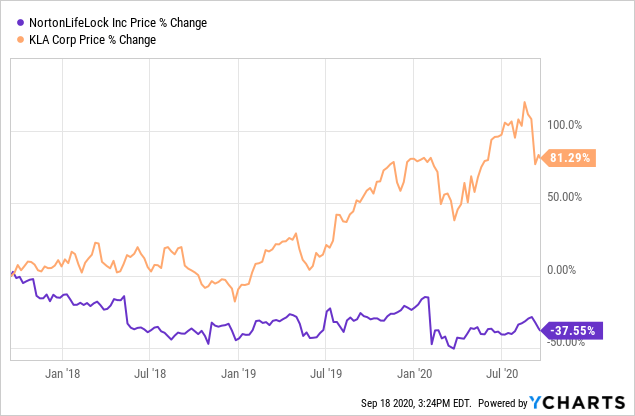

On the cheaper side, we have the semiconductor manufacturer KLA Corporation and the security software company NortonLifeLock. As you can see below, KLA corporation has had strong performance while Norton’s has been very weak:

Data by YCharts

Data by YCharts

Norton is at a “cheap” valuation today, but the company has been struggling with growth for years, and it may be the case that its days as a security software leader are simply behind it. On the other hand, there may be a strong value opportunity in KLA Corporation which has both strong performance and a low valuation.

Looking Forward

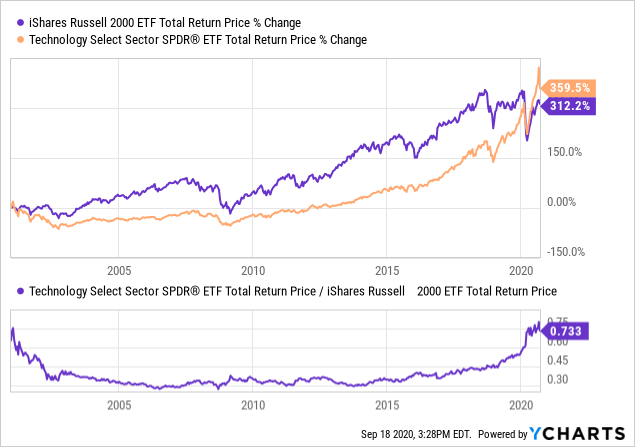

The major question technology investors ought to ask is whether or not the years of outperformance are ending. Indeed, if the technology is removed from major indices, performance is considerably worse as seen in the Russell 2000 ETF (IWM), which holds much less of that sector than the major indices. Indeed, the price ratio of the technology large-cap ETF XLK and IWM signals that we are back in the 2000 tech bubble territory:

Data by YCharts

Data by YCharts

Looking closer, we can see that technology’s outperformance record over the Russell 2000 has been awfully low over the past three months than in years prior. Indeed, the March crash in stocks may have been the peak period of technology’s outperformance.

Sifting through the top 10 most beaten-down large technology stocks, we can see a few potential short-term pullback opportunities. Most notably in KLA Corporation and perhaps Microsoft. Still, my overall long-term view on technology is bearish. This is not because I don’t love the new products, but because too many people love them and have pushed their stock prices to unreasonably high levels.

Overall, I firmly believe this is a good time for investors to be defensive and avoid technology companies with rampant speculative interest. They could continue higher, but as we’ve begun to see over the past two weeks, they also have tremendous downside potential.

Interested In More Alternative Insights?

If you’re looking for (much) more research, I run the Conviction Dossier here on Seeking Alpha. The marketplace service provides an array of in-depth portfolios as well as weekly commodity and economic research reports. Additionally, we provide actionable investment and trade ideas designed to give you an edge on the crowd.

As an added benefit, we’re allowing each new member one exclusive pick where they can have us provide in-depth research on any company or ETF they’d like. You can learn about what we can do for you here.

Disclosure: I am/we are short AAPL, AMD, CRM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link