[ad_1]

When considering of worldwide nations to look at concerning commodity demand, focus usually shifts to China, and rightfully so. Over the previous decade, China’s rising economic system has allowed their middle-class inhabitants to develop financially. With extra money of their pocket to spend on meals, Chinese demand for commodities, particularly agricultural commodities and proteins, grew considerably.

And whereas China continues to be an important piece of the worldwide commodity demand puzzle, India should not be ignored.

What’s occurred

Surpassing China because the primary nation by way of inhabitants, India is now the world’s largest with over 1.4 billion folks. India can also be gaining momentum as a world financial powerhouse.

India is the fifth largest economic system on the earth, behind the United States, China, Japan, and Germany. They have emerged from a post-Covid restoration with astonishing energy. According to a current Reuters article, “The Indian economy expanded 7.6% in the July – September quarter, better than expectations from Reserve Bank of India’s estimate of 6.5%.”

Because of this, India is the nation to observe within the coming years by way of agricultural commodity demand.

From a advertising perspective

Demand for agricultural commodities in India are prone to develop within the coming years because the inhabitants grows together with the economic system. A easy web search means that throughout the nation of India, meals staples reminiscent of rice, wheat flour, lentils, hen, mutton, and fish are main meals consumed by the final inhabitants. Oils reminiscent of sunflower, cottonseed, and soybean oils are well-liked for cooking.

I’m fairly curious as to the potential change in meals and protein demand that India will encounter within the coming decade as their middle-class customers acquire financial stature. Will their diets change, comparable in style to how Chinese diets have modified over the previous decade?

Here are 4 agricultural commodities to look at in India.

Cotton

Cotton for cottonseed oil and cotton use for the textile business is a vital commodity to observe by way of each manufacturing and demand.

India is the world’s second largest producer of cotton on the earth, following China. According to the USDA, for the 2023/24 crop 12 months, India is anticipated to develop 25 million bales (480-pounds every) of cotton, with home use of 24 million bales.

Most noticeable is that India makes use of almost all of the cotton it grows. Little is left to probably export to the world.

Wheat

India is the third largest grower of wheat on the earth, following China and the European Union.

According to the latest USDA report, India is anticipated to develop 110.55 million metric tons of wheat for the 2023/24 crop 12 months, with home use of 108.65 mmt, which means that they use every part they develop.

This is the crop I’m watching essentially the most, as the worldwide demand for wheat continues to stay sturdy, with world ending shares of wheat trending decrease. India has no room for a wheat crop failure.

Rice

India is the second largest rice grower on the earth, following China. The most up-to-date USDA report has Indian rice manufacturing for 2023/24 at 132 mmt, with home use at 118 mmt. Interestingly sufficient, India does export almost 16.5 mmt of rice to the world.

This signifies that what they develop, they dissipate totally each domestically and for export, counting on a adequate “beginning stock” pile of 35 mmt. However, ending shares for 2023/24 are trending decrease, now pegged at 32.5 mmt.

Soybean merchandise

Soybean and soybean product demand can also be rising in India as a serious staple for India’s sustainable protein wants. Soymeal demand for feed for hen edges larger with demand close to 7 mmt yearly, in response to the USDA.

Soyoil demand in India is close to 5.1 mmt, with imports of three.3 mmt, and prone to develop.

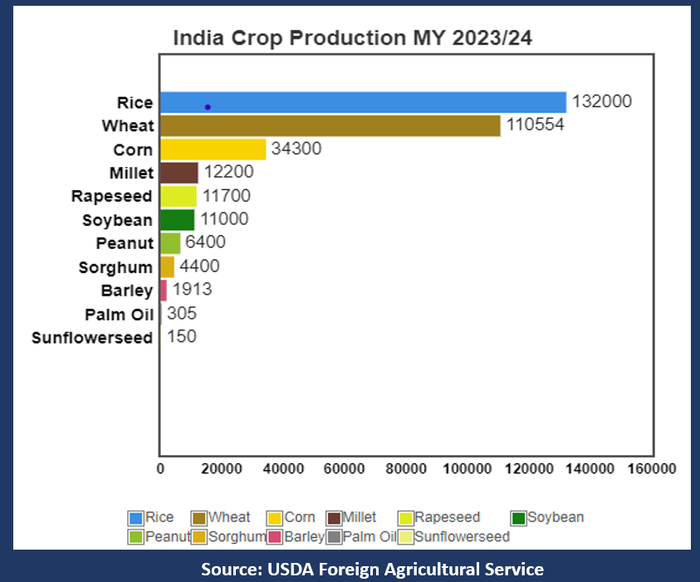

Here is a take a look at extra agricultural crop manufacturing in India. Rice and wheat are by far their largest crops.

Prepare your self

As a rising financial powerhouse, India’s demand for commodities is prone to proceed to develop each because of inhabitants progress and an rising center class.

Also, as a result of India consumes a majority of its manufacturing throughout a number of commodities, any extreme climate gyration within the nation could drastically decrease manufacturing and shift India to a reliance on imports.

This is a world market that U.S. farmers need to be monitoring as a future essential rising commerce accomplice.

Reach Naomi Blohm at 800-334-9779, on X (beforehand Twitter): @naomiblohm, and at [email protected].

Disclaimer: The information contained herein is believed to be drawn from dependable sources however can’t be assured. Individuals appearing on this info are chargeable for their very own actions. Commodity buying and selling will not be appropriate for all recipients of this report. Futures and choices buying and selling contain important danger of loss and will not be appropriate for everybody. Therefore, rigorously think about whether or not such buying and selling is appropriate for you in gentle of your monetary situation. Examples of seasonal worth strikes or excessive market situations will not be meant to suggest that such strikes or situations are widespread occurrences or prone to happen. Futures costs have already factored within the seasonal facets of provide and demand. No illustration is being made that situation planning, technique or self-discipline will assure success or earnings. Any selections you might make to purchase, promote or maintain a futures or choices place on such analysis are solely your individual and never in any method deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM discuss with Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing dealer and is a member of National Futures Association. SP Risk Services, LLC is an insurance coverage company and an equal alternative supplier. Stewart-Peterson Inc. is a publishing firm. A buyer could have relationships with all three firms. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. except in any other case famous, companies referenced are companies of Stewart-Peterson Group Inc. Presented for solicitation.

[adinserter block=”4″]

[ad_2]

Source link