[ad_1]

The most you possibly can lose on any inventory (assuming you do not use leverage) is 100% of your cash. But if you choose an organization that’s actually flourishing, you possibly can make greater than 100%. Take, for instance New Oriental Education & Technology Group Inc. (NYSE:EDU). Its share value is already up a powerful 130% within the final twelve months. On prime of that, the share value is up 16% in a couple of quarter. The firm reported its monetary outcomes just lately; you possibly can compensate for the most recent numbers by studying our company report. In distinction, the long run returns are damaging, for the reason that share value is 63% decrease than it was three years in the past.

Now it is value taking a look on the firm’s fundamentals too, as a result of that may assist us decide if the long run shareholder return has matched the efficiency of the underlying enterprise.

Check out our latest analysis for New Oriental Education & Technology Group

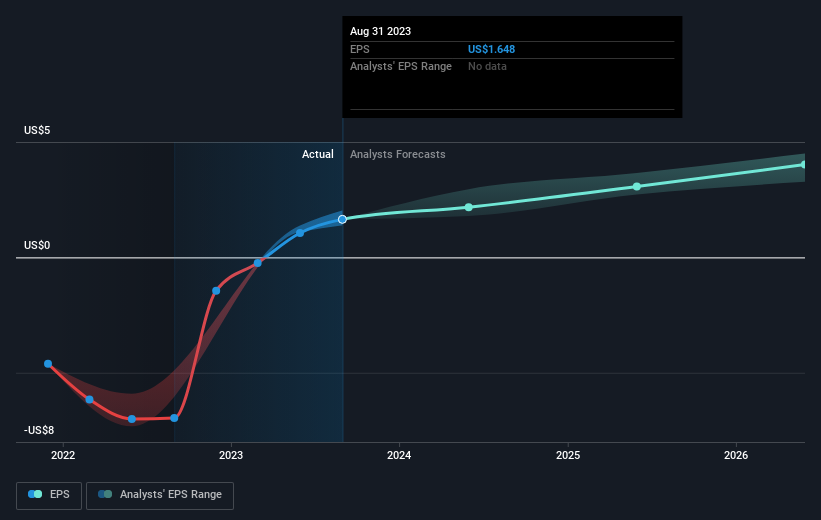

While markets are a strong pricing mechanism, share costs mirror investor sentiment, not simply underlying enterprise efficiency. One flawed however cheap option to assess how sentiment round an organization has modified is to check the earnings per share (EPS) with the share value.

New Oriental Education & Technology Group went from making a loss to reporting a revenue, within the final yr.

The consequence seems to be like a powerful enchancment to us, so we’re not stunned the market likes the expansion. Generally talking the profitability inflection level is a good time to analysis an organization carefully, lest you miss a possibility to revenue.

The graphic beneath depicts how EPS has modified over time (unveil the precise values by clicking on the picture).

We know that New Oriental Education & Technology Group has improved its backside line recently, however is it going to develop income? You may take a look at this free report showing analyst revenue forecasts.

A Different Perspective

It’s good to see that New Oriental Education & Technology Group has rewarded shareholders with a complete shareholder return of 130% within the final twelve months. That’s higher than the annualised return of three% over half a decade, implying that the corporate is doing higher just lately. In one of the best case situation, this may occasionally trace at some actual enterprise momentum, implying that now could possibly be a good time to delve deeper. Before deciding should you like the present share value, verify how New Oriental Education & Technology Group scores on these 3 valuation metrics.

Of course New Oriental Education & Technology Group is probably not one of the best inventory to purchase. So chances are you’ll want to see this free collection of growth stocks.

Please notice, the market returns quoted on this article mirror the market weighted common returns of shares that presently commerce on American exchanges.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to carry you long-term targeted evaluation pushed by basic knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link