[ad_1]

Key Insights

The outcomes at Thunderbird Entertainment Group Inc. (CVE:TBRD) have been fairly disappointing just lately and CEO Jenn McCarron bears some duty for this. Shareholders can take the prospect to carry the board and administration accountable for the unsatisfactory efficiency on the subsequent AGM on 14th of December. This will probably be even be an opportunity the place they will problem the board on firm course and vote on resolutions equivalent to govt remuneration. From our evaluation, we expect CEO compensation may have a evaluate in gentle of the latest efficiency.

Check out our latest analysis for Thunderbird Entertainment Group

How Does Total Compensation For Jenn McCarron Compare With Other Companies In The Industry?

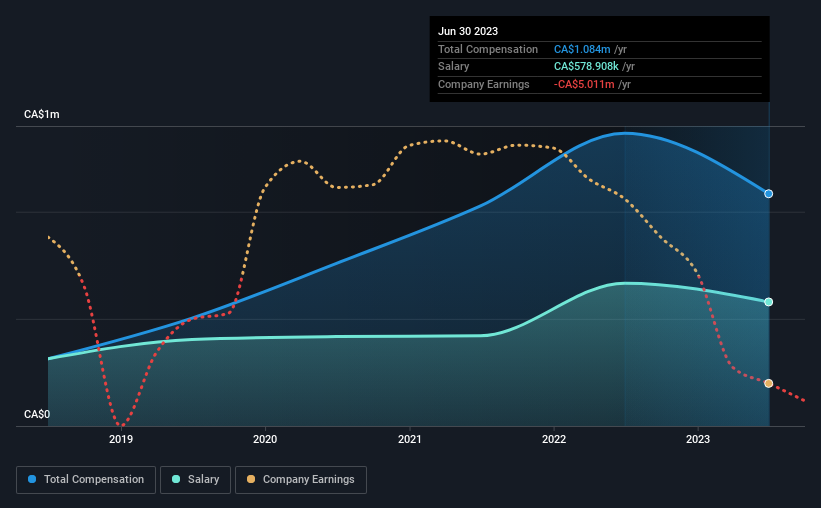

Our knowledge signifies that Thunderbird Entertainment Group Inc. has a market capitalization of CA$113m, and complete annual CEO compensation was reported as CA$1.1m for the yr to June 2023. Notably, that is a lower of 21% over the yr earlier than. In explicit, the wage of CA$578.9k, makes up a pretty big portion of the whole compensation being paid to the CEO.

On evaluating similar-sized corporations within the Canadian Entertainment industry with market capitalizations beneath CA$272m, we discovered that the median complete CEO compensation was CA$305k. Hence, we are able to conclude that Jenn McCarron is remunerated larger than the trade median.

|

Component |

2023 |

2022 |

Proportion (2023) |

|

Salary |

CA$579k |

CA$666k |

53% |

|

Other |

CA$505k |

CA$700k |

47% |

|

Total Compensation |

CA$1.1m |

CA$1.4m |

100% |

Talking by way of the trade, wage represented roughly 75% of complete compensation out of all the businesses we analyzed, whereas different remuneration made up 25% of the pie. In Thunderbird Entertainment Group’s case, non-salary compensation represents a larger slice of complete remuneration, compared to the broader trade. If wage dominates complete compensation, it means that CEO compensation is leaning much less in the direction of the variable element, which is often linked with efficiency.

Thunderbird Entertainment Group Inc.’s Growth

Over the final three years, Thunderbird Entertainment Group Inc. has shrunk its earnings per share by 90% per yr. Revenue was fairly flat on final yr.

The decline in EPS is a bit regarding. And the flat income is significantly uninspiring. These components recommend that the enterprise efficiency would not actually justify a excessive pay packet for the CEO. Moving away from present kind for a second, it might be necessary to test this free visual depiction of what analysts expect for the future.

Has Thunderbird Entertainment Group Inc. Been A Good Investment?

Given the whole shareholder lack of 30% over three years, many shareholders in Thunderbird Entertainment Group Inc. are in all probability quite dissatisfied, to say the least. This suggests it might be unwise for the corporate to pay the CEO too generously.

In Summary…

Along with the enterprise performing poorly, shareholders have suffered with poor share worth returns on their investments, suggesting that there is little to no likelihood of them being in favor of a CEO pay increase. At the upcoming AGM, administration will get an opportunity to clarify how they plan to get the enterprise again on observe and handle the issues from buyers.

While CEO pay is a vital issue to pay attention to, there are different areas that buyers needs to be aware of as properly. We did our analysis and noticed 1 warning sign for Thunderbird Entertainment Group that buyers ought to look into transferring ahead.

Important be aware: Thunderbird Entertainment Group is an thrilling inventory, however we perceive buyers could also be on the lookout for an unencumbered stability sheet and blockbuster returns. You would possibly discover one thing higher in this list of interesting companies with high ROE and low debt.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to carry you long-term targeted evaluation pushed by basic knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link