[ad_1]

Technology Solutions In The U.S. Healthcare Payer Market

Dublin, March 15, 2024 (GLOBE NEWSWIRE) — The “Technology Solutions In The U.S. Healthcare Payer Market Size, Share & Trends Analysis Report By Application, By Solution Type (Standalone, Integrated), By Payer Type (Government, Commercial), And Segment Forecasts, 2024 – 2030” report has been added to ResearchAndMarkets.com’s providing.

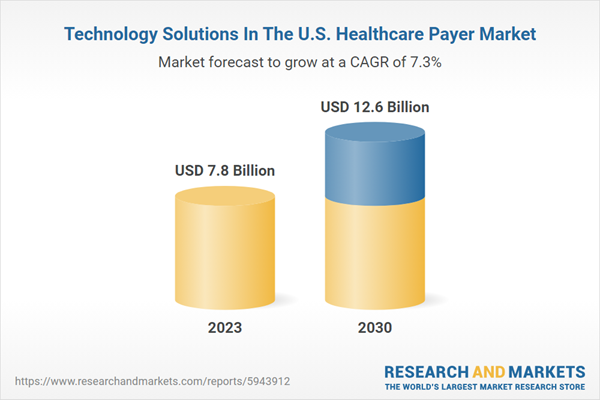

The know-how options within the U.S. healthcare payer market measurement is anticipated to achieve USD 12.6 billion by 2030. The market is predicted to broaden at a notable CAGR of seven.3% from 2024 to 2030. Major components driving the market progress embrace enrollment and billing modernization, rising acquisition by market leaders, rising curiosity of traders and enterprise capitalists, and revolutionizing healthcare utilizing modern applied sciences.

The curiosity of traders and enterprise capitalists within the healthcare payer sector is rising as know-how startups specializing in this business draw substantial consideration. This elevated consideration is pushed by a number of components, corresponding to digital transformation, value-based care, telehealth, information analytics, and consumer-centric care, highlighting the numerous potential for innovation and growth within the healthcare payer area. The healthcare business is present process speedy transformation, pushed by evolving affected person expectations, the shift towards value-based care, and the growing demand for extra accessible & personalised healthcare experiences. These adjustments have created a aggressive setting for startups to introduce modern applied sciences and options, with the potential to enhance and improve varied elements of the healthcare payer ecosystem.

The preliminary section of the pandemic required a robust emphasis on guaranteeing enterprise continuity, member communication, and help, and these priorities remained necessary for the long run. As the pandemic progressed from a distant concern to a worldwide disaster, marked by in depth closure of faculties and companies for social distancing, payers discovered participating with various stakeholders to handle the response measures collectively crucial. Healthcare payers adopted a number of response measures, corresponding to establishing collaborative boards with suppliers and authorities response groups, proactive identification of high-risk members, and preparation for provide and demand imbalances.

Moreover, key gamers out there are participating in strategic initiatives corresponding to partnerships, collaborations, new product launches, acquisitions, and expansions to strengthen their market place and broaden their buyer base. For occasion, in March 2023, Pegasystems Inc. introduced enhancements to the Pega Foundation for Healthcare. The platform will embrace clever AI-powered decision-making, personalised & responsive advantages, and expanded interoperability to assist payers, care suppliers, & clients.

Moreover, in April 2023, Cognizant and Microsoft introduced an growth of their long-standing healthcare collaboration to supply healthcare suppliers and payers with entry to streamlined claims administration, superior know-how options, and improved interoperability to supply higher affected person and member experiences and optimize enterprise operations. Microsoft and Cognizant are anticipated to work collaboratively to develop an integration roadmap between Cognizant’s TriZetto healthcare applied sciences and Microsoft Cloud for Healthcare.

Technology Solutions In The U.S. Healthcare Payer Market Report Highlights

-

Based on utility, the claims administration phase held the vast majority of the market share of 32.2% within the utility phase in 2023. As the inhabitants of insured people and the demand for healthcare companies proceed to extend, insurance coverage claims are additionally rising

-

Based on answer sort, the built-in phase held many of the market share of 64.4% within the solution-type phase in 2023 and is predicted to witness the quickest progress at a CAGR of seven.5% through the forecast interval. The rising emphasis on value-based care & inhabitants well being administration contributes to market progress

-

Based on payer sort, the business phase held the most important market share of 67.1 % in 2023 and is anticipated to witness the quickest progress at a CAGR of seven.5% over the forecast interval. The progress is attributed to the growing adoption of medical health insurance among the many inhabitants

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

149 |

|

Forecast Period |

2023 – 2030 |

|

Estimated Market Value (USD) in 2023 |

$7.8 Billion |

|

Forecasted Market Value (USD) by 2030 |

$12.6 Billion |

|

Compound Annual Growth Rate |

7.3% |

|

Regions Covered |

United States |

Key Topics Covered:

Chapter 1 Methodology And Scope

Chapter 2 Executive Summary

Chapter 3 Technology Solutions In The U.S. Healthcare Payers Market Variables, Trends & Scope

3.1 Market Lineage Outlook

3.2 Healthcare It Trends/dynamics In U.S. Healthcare Payers Market

3.2.1 Market Driver Analysis

3.2.1.1 Market Leaders

3.2.1.1.1 Modernization Of Enrollment And Billing Processes

3.2.1.1.2 Growing Acquisitions By Market Leaders

3.2.1.2 Emerging Players/startups

3.2.1.2.1 Growing Interest Of Investors And Venture Capitalists

3.2.1.2.2 Revolutionization Of Healthcare Using Innovative Technologies

3.2.2 Market Restraint Analysis

3.2.2.1 Market Leaders

3.2.2.1.1 Demand-supply Gap Of Tech Experts

3.2.2.2 Emerging Players/startups

3.2.2.2.1 Growing Instances Of Data Breaches

3.2.3 Market Challenges Analysis

3.2.3.1 Market Leaders

3.2.3.1.1 Inflation And Rising Cost Of Care

3.2.3.2 Emerging Players/startups

3.2.3.2.1 Increased Competition

3.2.4 Market Opportunity Analysis

3.2.4.1 Market Leaders

3.2.4.1.1 Growing Demand For Innovative Technologies

3.2.4.2 Emerging Players/startups

3.2.4.2.1 Enhanced Communication And Engagement

3.3 Industry Analysis Tools: Porter’s Analysis

3.4 Industry Analysis – Pest

3.5 U.S. Healthcare Payers Market Technology Timeline

3.5.1 Secondary Survey Insights Related To Changes In Technology Investments By Healthcare Payers

3.5.2 Emerging Trends

3.5.2.1 Digital Technology Analysis

3.5.2.2 Modernization

3.5.2.2.1 Cloud-based Solutions Analysis

3.5.2.3 Ai-enabled Technology Analysis

3.6 Impact Of Covid-19 Pandemic

Chapter 4 U.S. Healthcare Payer Market

Chapter 5 Technology Solutions In The U.S. Healthcare Payers Market: Application Estimates & Trend Analysis

5.1 Segment Dashboard

5.2 Application Movement Analysis, USD Million, 2023 & 2030

5.2.1 Enrollment And Member Management

5.2.2 Provider Management

5.2.3 Claims Management

5.2.4 Value-based Payments

5.2.5 Revenue Management And Billing

5.2.6 Analytics

5.2.7 Personalize /CRM

5.2.8 Clinical Decision Support

5.2.9 Data Management And Authorization

5.2.10 Others

Chapter 6 Technology Solutions In The U.S. Healthcare Payers Market: Solution Type Estimates & Trend Analysis

6.1 Segment Dashboard

6.2 Technology Solutions In The U.S. Healthcare Payers Market: Solution Type Movement Analysis, USD Million, 2023 & 2030

6.2.1 Standalone

6.2.2 Integrated

Chapter 7 Country Estimates, Technology Solutions In The U.S. Healthcare Payers Market, By Application And Solution Type

Chapter 8 Market Player Analysis

8.1 Recent Developments & Impact Analysis By Key Market Participants

8.1.1 Cognizant (Trizetto Business Line)

8.1.2 Zeomega

8.1.3 Pegasystems, Inc.

8.1.4 Hyland Software, Inc.

8.1.5 Medecision

8.1.6 Medhok, Inc. (Mhk)

8.2 Company/competitors Categorization (Key Innovators, Market Leaders, Emerging Players)

8.3 Estimated Dominant Company Market Position Analysis, 2023

8.4 Top Technology Solution Providers For Healthcare Payers

8.5 Competitive Factors And Strategies Implementation

8.6 Healthcare Payer’s Digital Transformation Initiatives

8.6.1 Key Focus Areas For Healthcare Payers

8.6.2 Digital Healthcare Payer’s Transformation Use Cases

8.6.2.1 Accelerating Claims Processing

8.6.2.1.1 Gleematic A.i: Cognitive Automation For Claims Processing

8.6.2.2 Enhancing Customer Care

8.6.2.2.1 Virtusa Corp.: 98% Boost In Customer Satisfaction Realized By Top Payer

8.6.2.3 Accelerating New Member Enrollment

8.6.2.3.1 Innova Solutions: Enrollment Management Solution For Leading U.S. Health Insurance Company

8.6.2.4 Enabling Remote Workforce

8.6.2.4.1 Productive Edge: Revolutionizing Primary Care: A Regional Payer’s Innovative Virtual Solution For Patient Needs

8.6.2.5 Enhancing Interoperability

8.6.2.5.1 Hyland Software, Inc.: A Complex Regional Health System And Plan Provider Achieves Interoperability And Significant Roi

8.6.2.6 Other Applications

8.6.2.6.1 Hyland Software, Inc.: New York Health Plan Enhances Efficiency And Security By Automating Appeals And Grievances Processes

8.7 Analyst Recommendations For Healthcare Payers Regarding Technology Solutions

Chapter 9 Technology Solutions In The U.S. Healthcare Payers Market: Competitive Analysis

9.1 Strategic Initiatives

9.2 Top 5 Consulting Service Lines

-

EV

-

Deloitte

-

KPMG

-

Pricewaterhousecoopers

-

NTT Data

9.3 Top 5 Indian Advisory Companies

-

Infosys

-

TCS

-

Wipro

-

Cognizant

-

Optum

Chapter 10 Technology Solutions within the U.S. Healthcare Payers Market: Market Player Landscape

10.1 Major Market Player Landscape

-

HEALTHEDGE

-

ORACLE

-

ORACLE EBS

-

COGNIZANT

10.2 Company Profiles

-

COGNIZANT

-

ZEOMEGA

-

Oracle

-

HealthEdge Software Inc.

-

Pegasystems Inc.

-

Hyland Software Inc.

-

Zyter (Zyter| TrueCare)

-

Medecision

-

OSP

-

Open Text Corporation

-

MedHOK, Inc. (MHK)

For extra details about this report go to https://www.researchandmarkets.com/r/8eqjar

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s main supply for worldwide market analysis experiences and market information. We give you the most recent information on worldwide and regional markets, key industries, the highest corporations, new merchandise and the most recent developments.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[adinserter block=”4″]

[ad_2]

Source link