[ad_1]

Wang Tao is the head of Asia economics and chief China economist at UBS Investment Bank. This article is a two-part forecast on China’s upcoming 14th Five-Year Plan. Read the first part here.

As a key part of China’s “dual circulation” strategy, we are convinced that China will further push forward opening-up in the new five-year plan rather than seeking seclusion. China has accelerated opening-up in recent years, including rolling out a new foreign investment law to level the playing field for foreign investors with the “negative list” scheme, removing foreign ownership caps on financial institutions, abolishing quota restrictions of QFII and RQFII, and implementation of stock and bond connect schemes.

Looking ahead, we expect China to further open domestic markets for foreign investors in most sectors, reduce the coverage of the negative list significantly, and lower import tariffs and nontariff barriers in the coming five years. These measures, along with China’s large and rapidly growing market, and decent yield spreads, should help to attract foreign direct investment and portfolio investment flows in the coming years, following the significant increase recently.

Sustained infrastructure investment and rising consumer power

In the context of “domestic circulation,” investors may find opportunities in pushing for new urbanization, in particular in developing metropolitan areas and city clusters, and further relaxing “hukou” restrictions. For the former, China will likely continue to invest in infrastructure projects albeit at a much slower pace than the previous decade, especially transportation projects, urban public facilities and construction in underdeveloped regions. For the latter, “hukou” reform and people-oriented urbanization suggest new investment in public services and facilities, and more urban consumption.

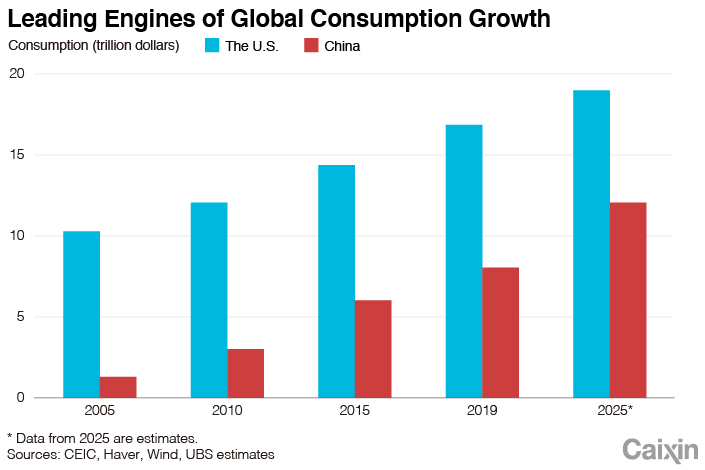

China will likely continue to be the leading engine of global consumption growth in the next five years with an expanding middle-class, as China’s total consumption is expected to reach $12 trillion in 2025, almost $4 trillion larger than in 2020. Meanwhile, China’s consumption upgrading will likely continue toward more services, better quality, more health-related spending, more experience and self-improvement, and more online shopping.

|

Technology and innovation to be a top priority

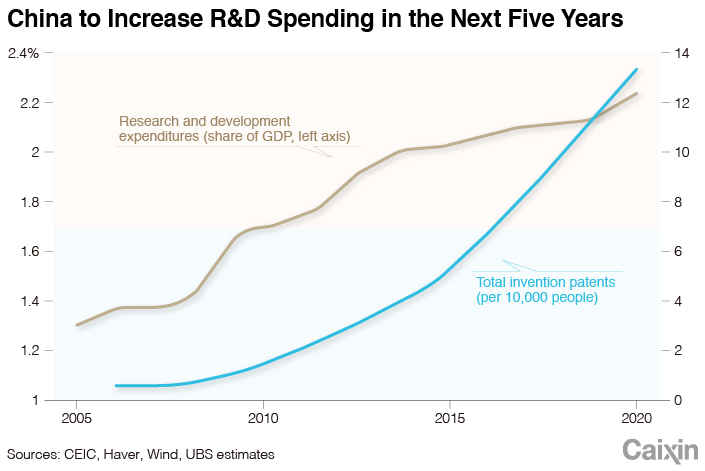

China is likely to target its research and development (R&D) share of GDP from 2.5% in 2020 to around 3% in 2025, and further increase spending in education and vocational training. In light of decoupling pressures and tech restrictions, China may allocate more resources to fundamental research, frontier research and technology bottleneck areas as well as better protect intellectual property rights and offer more market incentives to researchers.

|

In addition, China’s significant talent pool (around 8 million college graduates per year, of which more than 4 million with STEM majors), large market size and a relaxed regulatory environment should help underpin technology progress and accelerate the application of R&D outcomes.

Digitalization is a key area where China will likely try to maintain its leadership. We expect the government to further support digitalization and related implications in the next five-year plan. Covid-19 has accelerated digitalization. We expect China’s online sales penetration will continue to rise further from 21% in 2019 and 25% year to date in 2020, while online provision of other services including remote working, education, health care and financial services will also grow rapidly.

We expect the government to help facilitate Chinese corporations to transform their business model with more digital services such as smart retail and smart manufacturing, by increasing the provision of “new infrastructure,” including data centers, 5G networks, AI and the Internet of Things.

Although the annual investment of officially defined “new infrastructure” is still small for now (around 1 trillion yuan ($146 billion), equivalent to 5% of total infrastructure fixed-asset investment), we expect the 14th Five-year Plan to increase related investment more rapidly than the “old infrastructure” in the next five years.

Environmental protection and green economy to sustain momentum

China should be able to successfully achieve most of its commitments in the 13th Five-year Plan. With its persistent long-term ambition of developing the green economy, we expect China to set a higher standard of environmental protection and pollution emission in the new five-year plan, including 18% for non-fossil energy share in total energy consumption (versus 15.3% in 2019 and 15% target set for 2020), further reduction of energy use per unit of GDP, and carbon dioxide and sulphur dioxide emissions, higher share of days with good air quality, among others.

Demands for related equipment, services and investment are likely to continue growing at a faster pace. During the 2016-2019 period, China’s fixed-asset investment in the environmental protection sector enjoyed a much higher average annual growth of 36% than others. We expect sector fixed-asset investment to double the investment size from 2019 to over 1.5 trillion yuan by 2025.

Risk control stays crucial for sustainable and resilient development. Similar to previous five-year plans, China may not explicitly outline its plan to contain economic and financial risks in the 14th Five-year Plan. That said, we think the government is likely to put risk control into underlying consideration in the drawing-up of the five-year plan. In particular, deleveraging, containing the property bubble, and social stability are likely the top areas for risk control.

The views and opinions expressed in this opinion section are those of the authors and do not necessarily reflect the editorial positions of Caixin Media.

If you would like to write an opinion for Caixin Global, please send your ideas or finished opinions to our email: opinionen@caixin.com

Support quality journalism in China. Subscribe to Caixin Global starting at $0.99.

Register to read this article for free.

Register

[ad_2]

Source link