[ad_1]

Howard Marks put it properly when he stated that, reasonably than worrying about share value volatility, ‘The risk of everlasting loss is the danger I fear about… and each sensible investor I do know worries about.’ When we take into consideration how dangerous an organization is, we all the time like to have a look at its use of debt, since debt overload can result in destroy. As with many different corporations Quisitive Technology Solutions, Inc. (CVE:QUIS) makes use of debt. But ought to shareholders be anxious about its use of debt?

When Is Debt A Problem?

Debt is a instrument to assist companies develop, but when a enterprise is incapable of paying off its lenders, then it exists at their mercy. If issues get actually dangerous, the lenders can take management of the enterprise. However, a extra widespread (however nonetheless painful) state of affairs is that it has to lift new fairness capital at a low value, thus completely diluting shareholders. Of course, loads of corporations use debt to fund development, with none adverse penalties. The very first thing to do when contemplating how a lot debt a enterprise makes use of is to have a look at its money and debt collectively.

View our latest analysis for Quisitive Technology Solutions

What Is Quisitive Technology Solutions’s Debt?

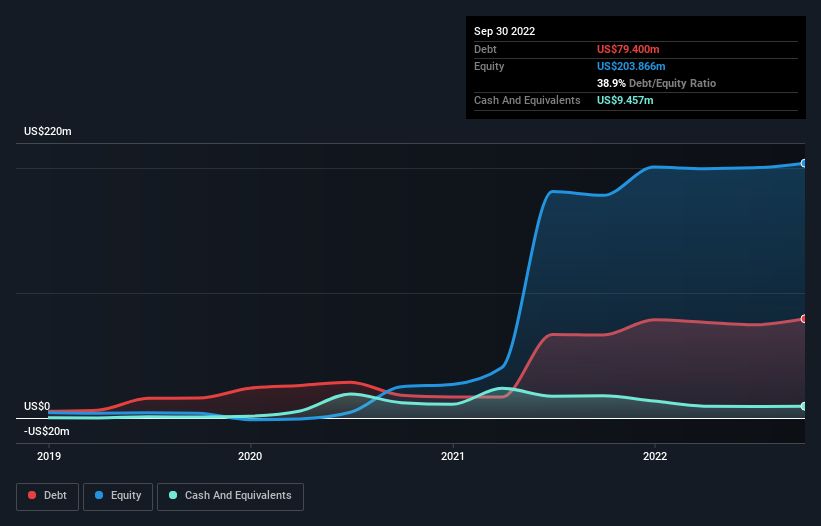

You can click on the graphic under for the historic numbers, however it exhibits that as of September 2022 Quisitive Technology Solutions had US$79.4m of debt, a rise on US$66.3m, over one yr. On the flip facet, it has US$9.46m in money resulting in internet debt of about US$69.9m.

A Look At Quisitive Technology Solutions’ Liabilities

We can see from the newest stability sheet that Quisitive Technology Solutions had liabilities of US$44.4m falling due inside a yr, and liabilities of US$83.9m due past that. On the opposite hand, it had money of US$9.46m and US$29.4m price of receivables due inside a yr. So its liabilities outweigh the sum of its money and (near-term) receivables by US$89.4m.

This deficit is not so dangerous as a result of Quisitive Technology Solutions is price US$203.4m, and thus might in all probability increase sufficient capital to shore up its stability sheet, if the necessity arose. But it is clear that we should always positively intently study whether or not it will probably handle its debt with out dilution.

We measure an organization’s debt load relative to its earnings energy by its internet debt divided by its earnings earlier than curiosity, tax, depreciation, and amortization (EBITDA) and by calculating how simply its earnings earlier than curiosity and tax (EBIT) cowl its curiosity expense (curiosity cowl). The benefit of this strategy is that we keep in mind each absolutely the quantum of debt (with internet debt to EBITDA) and the precise curiosity bills related to that debt (with its curiosity cowl ratio).

While Quisitive Technology Solutions’s debt to EBITDA ratio (4.2) means that it makes use of some debt, its curiosity cowl could be very weak, at 0.93, suggesting excessive leverage. It appears that the enterprise incurs giant depreciation and amortisation fees, so possibly its debt load is heavier than it might first seem, since EBITDA is arguably a beneficiant measure of earnings. So shareholders ought to in all probability remember that curiosity bills seem to have actually impacted the enterprise these days. However, it needs to be some consolation for shareholders to recall that Quisitive Technology Solutions truly grew its EBIT by a hefty 113%, during the last 12 months. If it will probably preserve strolling that path it is going to be ready to shed its debt with relative ease. The stability sheet is clearly the realm to concentrate on when you’re analysing debt. But in the end the longer term profitability of the enterprise will resolve if Quisitive Technology Solutions can strengthen its stability sheet over time. So if you wish to see what the professionals assume, you may discover this free report on analyst profit forecasts to be fascinating.

Finally, a enterprise wants free money stream to repay debt; accounting income simply do not minimize it. So we clearly want to have a look at whether or not that EBIT is resulting in corresponding free money stream. Over the final three years, Quisitive Technology Solutions truly produced extra free money stream than EBIT. There’s nothing higher than incoming money in relation to staying in your lenders’ good graces.

Our View

Happily, Quisitive Technology Solutions’s spectacular conversion of EBIT to free money stream implies it has the higher hand on its debt. But the stark reality is that we’re involved by its curiosity cowl. All this stuff thought-about, it seems that Quisitive Technology Solutions can comfortably deal with its present debt ranges. On the plus facet, this leverage can enhance shareholder returns, however the potential draw back is extra danger of loss, so it is price monitoring the stability sheet. The stability sheet is clearly the realm to concentrate on when you’re analysing debt. But in the end, each firm can comprise dangers that exist exterior of the stability sheet. Be conscious that Quisitive Technology Solutions is showing 2 warning signs in our investment analysis , it is best to learn about…

At the tip of the day, it is usually higher to concentrate on corporations which might be free from internet debt. You can entry our special list of such companies (all with a monitor report of revenue development). It’s free.

Valuation is complicated, however we’re serving to make it easy.

Find out whether or not Quisitive Technology Solutions is probably over or undervalued by trying out our complete evaluation, which incorporates honest worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to convey you long-term centered evaluation pushed by basic knowledge. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link