[ad_1]

Even when a enterprise is dropping cash, it is doable for shareholders to generate income in the event that they purchase a very good enterprise on the proper worth. For instance, biotech and mining exploration firms usually lose cash for years earlier than discovering success with a brand new remedy or mineral discovery. But whereas historical past lauds these uncommon successes, people who fail are sometimes forgotten; who remembers Pets.com?

So, the pure query for Resonance Health (ASX:RHT) shareholders is whether or not they need to be involved by its price of money burn. In this text, we outline money burn as its annual (adverse) free money circulate, which is the sum of money an organization spends annually to fund its development. Let’s begin with an examination of the enterprise’ money, relative to its money burn.

Check out our latest analysis for Resonance Health

How Long Is Resonance Health’s Cash Runway?

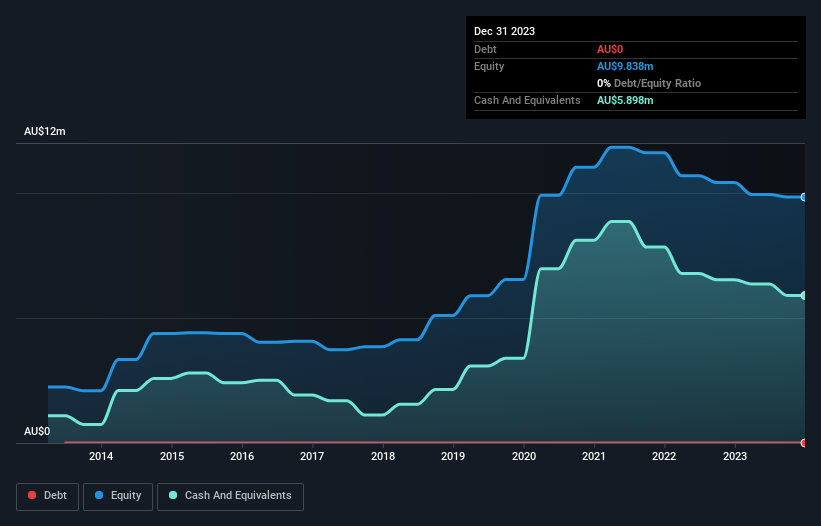

A money runway is outlined because the size of time it could take an organization to expire of cash if it stored spending at its present price of money burn. When Resonance Health final reported its December 2023 steadiness sheet in February 2024, it had zero debt and money price AU$5.9m. Looking on the final 12 months, the corporate burnt by means of AU$687k. So it had a money runway of about 8.6 years from December 2023. Even although that is however one measure of the corporate’s money burn, the considered such an extended money runway warms our bellies in a comforting means. You can see how its money steadiness has modified over time within the picture under.

How Well Is Resonance Health Growing?

It was pretty optimistic to see that Resonance Health diminished its money burn by 54% over the last 12 months. On prime of that, working income was up 38%, making for a heartening mixture It appears to be rising properly. Of course, we have solely taken a fast have a look at the inventory’s development metrics, right here. This graph of historic revenue growth exhibits how Resonance Health is constructing its enterprise over time.

How Easily Can Resonance Health Raise Cash?

While Resonance Health appears to be in an honest place, we reckon it’s nonetheless price excited about how simply it might elevate additional cash, if that proved fascinating. Generally talking, a listed enterprise can elevate new money by means of issuing shares or taking over debt. One of the principle benefits held by publicly listed firms is that they’ll promote shares to traders to boost money and fund development. By evaluating an organization’s annual money burn to its complete market capitalisation, we are able to estimate roughly what number of shares it must subject with the intention to run the corporate for an additional 12 months (on the identical burn price).

Resonance Health has a market capitalisation of AU$30m and burnt by means of AU$687k final 12 months, which is 2.3% of the corporate’s market worth. That means it might simply subject a number of shares to fund extra development, and would possibly nicely be able to borrow cheaply.

So, Should We Worry About Resonance Health’s Cash Burn?

It might already be obvious to you that we’re comparatively snug with the way in which Resonance Health is burning by means of its money. In specific, we expect its money runway stands out as proof that the corporate is nicely on prime of its spending. And even its money burn discount was very encouraging. Looking in any respect the measures on this article, collectively, we’re not nervous about its price of money burn; the corporate appears nicely on prime of its medium-term spending wants. On one other observe, we performed an in-depth investigation of the corporate, and recognized 3 warning signs for Resonance Health (1 is probably critical!) that you have to be conscious of earlier than investing right here.

Of course Resonance Health might not be the very best inventory to purchase. So you could want to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We goal to carry you long-term targeted evaluation pushed by elementary information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link