[ad_1]

There’s little question that cash may be made by proudly owning shares of unprofitable companies. For instance, biotech and mining exploration corporations usually lose cash for years earlier than discovering success with a brand new remedy or mineral discovery. But whereas the successes are well-known, buyers shouldn’t ignore the very many unprofitable corporations that merely burn by all their money and collapse.

Given this danger, we thought we might check out whether or not Richmond Vanadium Technology (ASX:RVT) shareholders ought to be nervous about its money burn. For the needs of this text, money burn is the annual price at which an unprofitable firm spends money to fund its progress; its detrimental free money circulation. First, we’ll decide its money runway by evaluating its money burn with its money reserves.

See our latest analysis for Richmond Vanadium Technology

How Long Is Richmond Vanadium Technology’s Cash Runway?

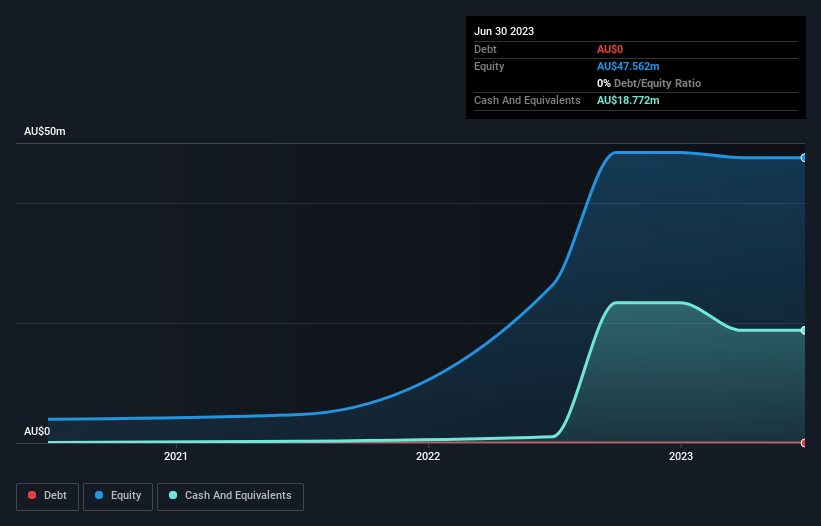

A money runway is outlined because the size of time it might take an organization to expire of cash if it saved spending at its present price of money burn. In June 2023, Richmond Vanadium Technology had AU$19m in money, and was debt-free. In the final 12 months, its money burn was AU$2.9m. So it had a money runway of about 6.5 years from June 2023. While this is just one measure of its money burn state of affairs, it actually offers us the impression that holders don’t have anything to fret about. The picture under reveals how its money stability has been altering over the previous few years.

How Is Richmond Vanadium Technology’s Cash Burn Changing Over Time?

Although Richmond Vanadium Technology reported income of AU$252k final 12 months, it did not even have any income from operations. That means we think about it a pre-revenue enterprise, and we’ll focus our progress evaluation on money burn, for now. In reality, it ramped its spending strongly over the past 12 months, growing money burn by 146%. That kind of ramp in expenditure is little question supposed to generate worthwhile long run returns. Richmond Vanadium Technology makes us just a little nervous as a consequence of its lack of considerable working income. We favor many of the shares on this list of stocks that analysts expect to grow.

How Easily Can Richmond Vanadium Technology Raise Cash?

Given its money burn trajectory, Richmond Vanadium Technology shareholders could want to think about how simply it may increase more money, regardless of its strong money runway. Generally talking, a listed enterprise can increase new money by issuing shares or taking up debt. Many corporations find yourself issuing new shares to fund future progress. By an organization’s money burn relative to its market capitalisation, we acquire perception on how a lot shareholders could be diluted if the corporate wanted to boost sufficient money to cowl one other 12 months’s money burn.

Since it has a market capitalisation of AU$67m, Richmond Vanadium Technology’s AU$2.9m in money burn equates to about 4.3% of its market worth. That’s a low proportion, so we determine the corporate would be capable to increase more money to fund progress, with just a little dilution, and even to easily borrow some cash.

How Risky Is Richmond Vanadium Technology’s Cash Burn Situation?

As you possibly can in all probability inform by now, we’re not too nervous about Richmond Vanadium Technology’s money burn. For instance, we predict its money runway means that the corporate is on a very good path. While we should concede that its growing money burn is a bit worrying, the opposite components talked about on this article present nice consolation on the subject of the money burn. Looking in any respect the measures on this article, collectively, we’re not nervous about its price of money burn; the corporate appears nicely on high of its medium-term spending wants. On one other observe, Richmond Vanadium Technology has 4 warning signs (and 3 which are a bit concerning) we predict it is best to learn about.

Of course, you may discover a unbelievable funding by trying elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We purpose to deliver you long-term targeted evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link