[ad_1]

Key Insights

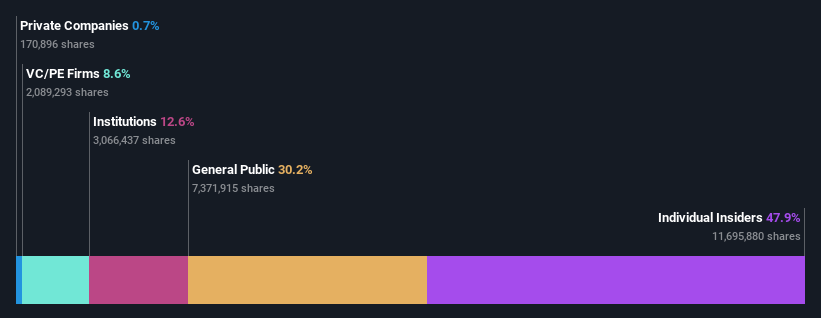

A have a look at the shareholders of Macquarie Technology Group Limited (ASX:MAQ) can inform us which group is strongest. With 48% stake, particular person insiders possess the utmost shares within the firm. Put one other method, the group faces the utmost upside potential (or draw back danger).

So it follows, each choice made by insiders of Macquarie Technology Group concerning the corporate’s future could be essential to them.

Let’s delve deeper into every kind of proprietor of Macquarie Technology Group, starting with the chart beneath.

Check out our latest analysis for Macquarie Technology Group

What Does The Institutional Ownership Tell Us About Macquarie Technology Group?

Institutions sometimes measure themselves in opposition to a benchmark when reporting to their very own traders, in order that they usually change into extra enthusiastic a couple of inventory as soon as it is included in a serious index. We would anticipate most firms to have some establishments on the register, particularly if they’re rising.

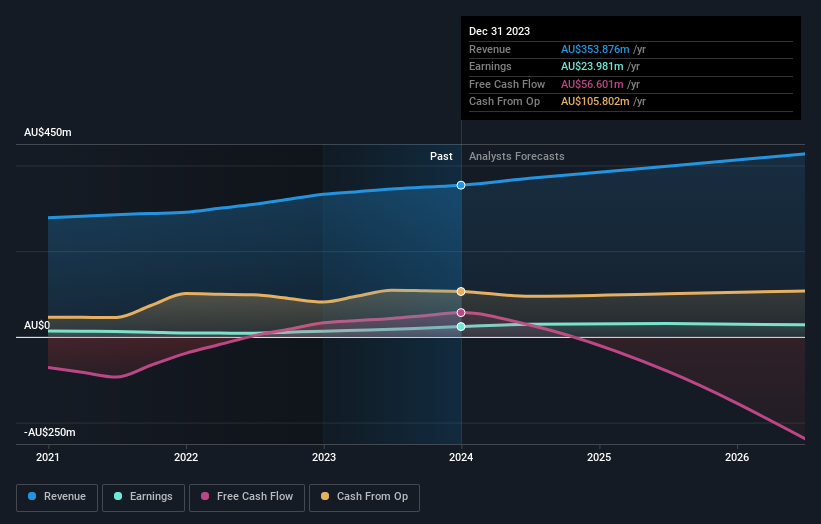

We can see that Macquarie Technology Group does have institutional traders; and so they maintain a superb portion of the corporate’s inventory. This implies the analysts working for these establishments have seemed on the inventory and so they prefer it. But identical to anybody else, they may very well be unsuitable. It shouldn’t be unusual to see a giant share worth drop if two giant institutional traders attempt to promote out of a inventory on the identical time. So it’s value checking the previous earnings trajectory of Macquarie Technology Group, (beneath). Of course, remember the fact that there are different components to think about, too.

Macquarie Technology Group shouldn’t be owned by hedge funds. The firm’s CEO David Tudehope is the most important shareholder with 46% of shares excellent. In comparability, the second and third largest shareholders maintain about 8.6% and 4.7% of the inventory.

To make our research extra fascinating, we discovered that the highest 2 shareholders have a majority possession within the firm, which means that they’re highly effective sufficient to affect the choices of the corporate.

While learning institutional possession for an organization can add worth to your analysis, it’s also a superb follow to analysis analyst suggestions to get a deeper perceive of a inventory’s anticipated efficiency. Quite just a few analysts cowl the inventory, so you possibly can look into forecast progress fairly simply.

Insider Ownership Of Macquarie Technology Group

The definition of firm insiders may be subjective and does differ between jurisdictions. Our knowledge displays particular person insiders, capturing board members on the very least. The firm administration reply to the board and the latter ought to signify the pursuits of shareholders. Notably, typically top-level managers are on the board themselves.

I usually think about insider possession to be a superb factor. However, on some events it makes it harder for different shareholders to carry the board accountable for choices.

Our most up-to-date knowledge signifies that insiders personal an inexpensive proportion of Macquarie Technology Group Limited. Insiders personal AU$931m value of shares within the AU$1.9b firm. That’s fairly significant. Most would say this exhibits a superb diploma of alignment with shareholders, particularly in an organization of this dimension. You can click here to see if those insiders have been buying or selling.

General Public Ownership

With a 30% possession, most of the people, largely comprising of particular person traders, have a point of sway over Macquarie Technology Group. This dimension of possession, whereas appreciable, might not be sufficient to vary firm coverage if the choice shouldn’t be in sync with different giant shareholders.

Private Equity Ownership

With a stake of 8.6%, non-public fairness corporations may affect the Macquarie Technology Group board. Sometimes we see non-public fairness stick round for the long run, however usually talking they’ve a shorter funding horizon and — because the title suggests — do not put money into public firms a lot. After a while they could look to promote and redeploy capital elsewhere.

Next Steps:

It’s all the time value occupied with the totally different teams who personal shares in an organization. But to grasp Macquarie Technology Group higher, we have to think about many different components. Consider dangers, as an example. Every firm has them, and we have noticed 1 warning sign for Macquarie Technology Group you must learn about.

But finally it’s the future, not the previous, that may decide how nicely the homeowners of this enterprise will do. Therefore we predict it advisable to check out this free report showing whether analysts are predicting a brighter future.

NB: Figures on this article are calculated utilizing knowledge from the final twelve months, which consult with the 12-month interval ending on the final date of the month the monetary assertion is dated. This might not be according to full 12 months annual report figures.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles are usually not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary state of affairs. We intention to carry you long-term centered evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link