[ad_1]

, Nushaiba Iqbal

, Edited by Explained Desk | New Delhi |

Updated: September 1, 2020 5:17:05 am

As it turns out, the GDP contracted by 24% per cent in Q1.

As it turns out, the GDP contracted by 24% per cent in Q1.

ALthough MOST people expected India’s GDP to show substantial contraction when the Ministry of Statistics and Programme Implementation (MoSPI) released the data for the first quarter (April, May, June) of the current financial year on Monday, the broad consensus was that the decline would not exceed 20%. As it turns out, the GDP contracted by 24% per cent in Q1.

In other words, the total value of goods and services produced in India in April, May and June this year is 24% less than the total value of goods and services produced in India in the same three months last year.

Read | LAC chill, GDP fall, Covid surge: storm hits heated markets

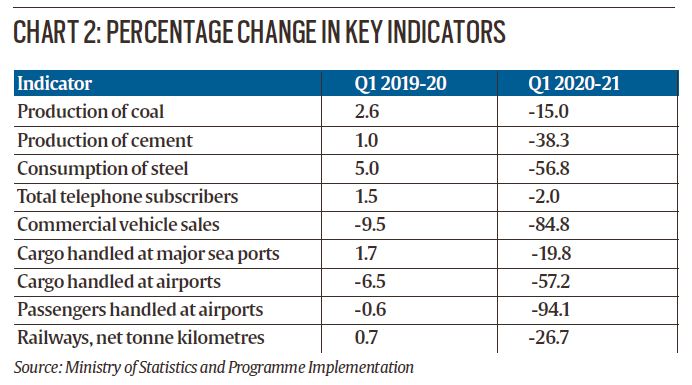

As Chart 2 bears out, almost all the major indicators of growth in the economy — be it production of cement or consumption of steel — show deep contraction. Even total telephone subscribers saw a contraction in this quarter.

What is worse is that, because of the widespread lockdowns, the data quality is sub-optimal and most observers expect this number to worsen when it is revised in due course.

What is biggest implication?

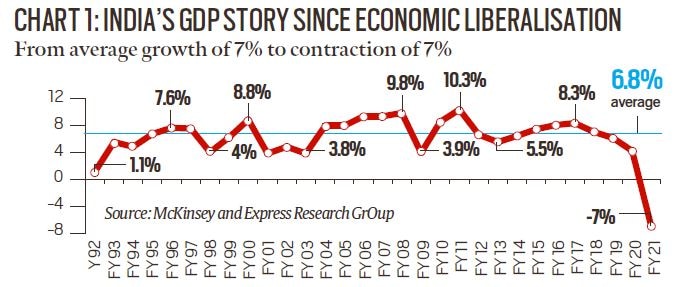

With GDP contracting by more than what most observers expected, it is now believed that the full-year GDP could also worsen. A fairly conservative estimate would be a contraction of 7% for the full financial year.

Chart 1 puts this in perspective. Since economic liberalisation in the early 1990s, Indian economy has clocked an average of 7% GDP growth each year. This year, it is likely to turn turtle and contract by 7%.

Read | Extent of damage clearer, stage set for second stimulus

In terms of the gross value added (a proxy for production and incomes) by different sectors of the economy, data show that barring agriculture, where GVA grew by 3.4%, all other sectors of the economy saw their incomes fall.

The worst affected were construction (–50%), trade, hotels and other services (–47%), manufacturing (–39%), and mining (–23%). It is important to note that these are the sectors that create the maximum new jobs in the country. In a scenario where each of these sectors is contracting so sharply — that is, their output and incomes are falling — it would lead to more and more people either losing jobs (decline in employment) or failing to get one (rise in unemployment).

What causes GDP contraction? Why hasn’t the government been able to curb it?

What causes GDP contraction? Why hasn’t the government been able to curb it?

In any economy, the total demand for goods and services — that is the GDP — is generated from one of the four engines of growth.

The biggest engine is consumption demand from private individuals like you. Let’s call it C, and in the Indian economy, this accounted for 56.4% of all GDP before this quarter.

Read | Chidambaram on GDP data: ‘Economic tragedy foretold, matter of shame for Modi govt’

The second biggest engine is the demand generated by private sector businesses. Let’s call it I, and this accounted for 32% of all GDP in India.

The third engine is the demand for goods and services generated by the government. Let’s call it G, and it accounted for 11% of India’s GDP.

The last engine is the net demand on GDP after we subtract imports from India’s exports. Let’s call it NX. In India’s case, it is the smallest engine and, since India typically imports more than it exports, its effect is negative on the GDP.

So total GDP = C + I + G + NX

📣 Express Explained is now on Telegram. Click here to join our channel (@ieexplained) and stay updated with the latest

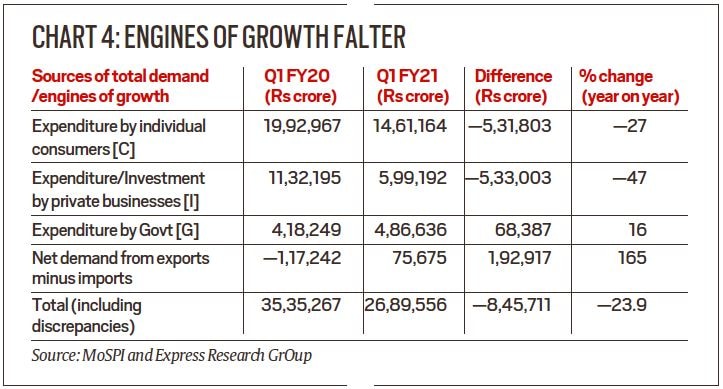

Now look at Chart 4. It shows what has happened to each of the engines in Q1.

Private consumption — the biggest engine driving the Indian economy — has fallen by 27%. In money terms, the fall is of Rs 5,31,803 crore over the same quarter last year.

The second biggest engine — investments by businesses — has fallen even harder — it is half of what it was last year same quarter. In money terms, the contraction is Rs 5,33,003 crore.

Read | Only farm sector output sees growth, outpaces overall GDP for 3rd straight qtr

So the two biggest engines, which accounted for over 88% of Indian total GDP, Q1 saw a massive contraction.

The NX or the net export demand has turned positive in this Q1 because India’s imports have crashed more than its exports. While on paper, this provides a boost to overall GDP, it also points to an economy where economic activity has plummeted.

That brings us to the last engine of growth — the government. As the data shows, government’s expenditure went up by 16% but this was nowhere near enough to compensate for the loss of demand (power) in other sectors (engines) of the economy.

Looking at the absolute numbers gives a clearer picture. When the demand from C and I fell by Rs 10,64,803 crore, the government’s spending increased by just Rs 68,387 crore. In other words, government’s spending increased but it was so meagre that it could cover just 6% of the total fall in demand being experienced by people and businesses.

The net result is that while, on paper, government expenditure’s share in the GDP has gone up from 11% to 18% yet the reality is that the overall GDP has declined by 24%. It is the lower level of absolute GDP that is making the government look like a bigger engine of growth than what it is.

What is the way out?

When incomes fall sharply, private individuals cut back consumption. When private consumption falls sharply, businesses stop investing. Since both of these are voluntary decisions, there is no way to force people to spend more and/or coerce businesses to invest more in the current scenario.

The same logic holds for exports and imports as well.

Under the circumstances, there is only one engine that can boost GDP and that is the government (G). Only when government spend more — either by building roads and bridges and paying salaries or by directly handing out money — can the economy revive in the short to medium term. If the government does not spend adequately enough then the economy will take a long time to recover.

What is holding back the government from spending more?

Even before the Covid crisis, government finances were overextended. In other words, it was not only borrowing but borrowing more than what it should have. As a result, today it doesn’t have as much money.

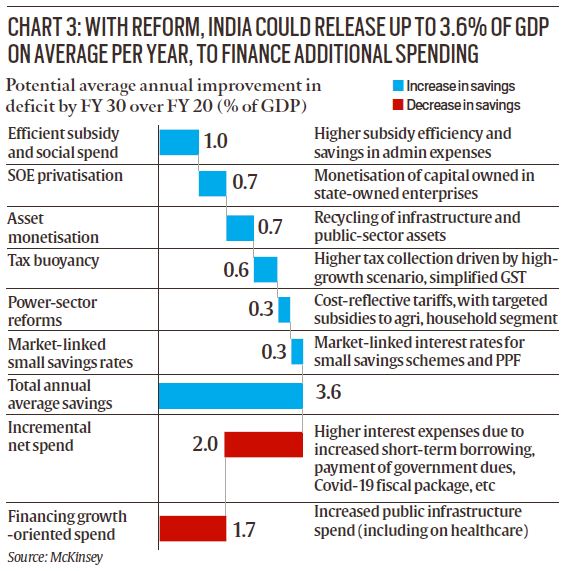

It will have to think of some innovative solutions to generate resources. Chart 4 by McKinsey Global Institute provides ways in which an additional 3.5 per cent of the GDP can be raised by the government.

📣 The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines

For all the latest Explained News, download Indian Express App.

© The Indian Express (P) Ltd

[ad_2]

Source link