[ad_1]

JF Technology Berhad’s (KLSE:JFTECH) inventory is up by a substantial 14% over the previous three months. Given that inventory costs are often aligned with an organization’s monetary efficiency within the long-term, we determined to review its monetary indicators extra carefully to see if that they had a hand to play within the current worth transfer. Specifically, we determined to review JF Technology Berhad’s ROE on this article.

Return on Equity or ROE is a take a look at of how successfully an organization is rising its worth and managing traders’ cash. In easier phrases, it measures the profitability of an organization in relation to shareholder’s fairness.

See our latest analysis for JF Technology Berhad

How Is ROE Calculated?

ROE will be calculated by utilizing the method:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, based mostly on the above method, the ROE for JF Technology Berhad is:

8.8% = RM12m ÷ RM133m (Based on the trailing twelve months to June 2023).

The ‘return’ is the quantity earned after tax over the past twelve months. One solution to conceptualize that is that for every MYR1 of shareholders’ capital it has, the corporate made MYR0.09 in revenue.

What Is The Relationship Between ROE And Earnings Growth?

So far, we have discovered that ROE is a measure of an organization’s profitability. Depending on how a lot of those income the corporate reinvests or “retains”, and the way successfully it does so, we’re then capable of assess an organization’s earnings development potential. Generally talking, different issues being equal, companies with a excessive return on fairness and revenue retention, have a better development fee than companies that don’t share these attributes.

JF Technology Berhad’s Earnings Growth And 8.8% ROE

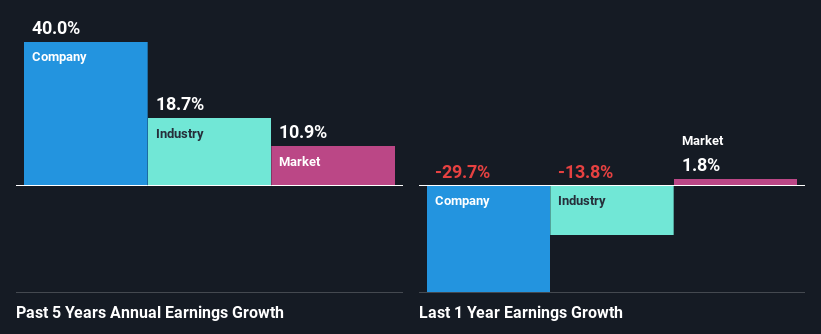

At first look, JF Technology Berhad’s ROE does not look very promising. We then in contrast the corporate’s ROE to the broader business and had been dissatisfied to see that the ROE is decrease than the business common of 11%. In spite of this, JF Technology Berhad was capable of develop its web earnings significantly, at a fee of 40% within the final 5 years. So, there is perhaps different facets which might be positively influencing the corporate’s earnings development. For occasion, the corporate has a low payout ratio or is being managed effectively.

We then in contrast JF Technology Berhad’s web earnings development with the business and we’re happy to see that the corporate’s development determine is greater compared with the business which has a development fee of 19% in the identical 5-year interval.

Earnings development is a large think about inventory valuation. What traders want to find out subsequent is that if the anticipated earnings development, or the dearth of it, is already constructed into the share worth. This then helps them decide if the inventory is positioned for a vibrant or bleak future. One good indicator of anticipated earnings development is the P/E ratio which determines the worth the market is keen to pay for a inventory based mostly on its earnings prospects. So, you could need to check if JF Technology Berhad is trading on a high P/E or a low P/E, relative to its business.

Is JF Technology Berhad Using Its Retained Earnings Effectively?

JF Technology Berhad’s important three-year median payout ratio of 57% (the place it’s retaining solely 43% of its earnings) means that the corporate has been capable of obtain a excessive development in earnings regardless of returning most of its earnings to shareholders.

Moreover, JF Technology Berhad is set to maintain sharing its income with shareholders which we infer from its lengthy historical past of 9 years of paying a dividend.

Conclusion

On the entire, we do really feel that JF Technology Berhad has some constructive attributes. That is, fairly a powerful development in earnings. However, the low revenue retention implies that the corporate’s earnings development may have been greater, had it been reinvesting a better portion of its income. Up until now, we have solely made a brief examine of the corporate’s development information. You can do your personal analysis on JF Technology Berhad and see the way it has carried out previously by taking a look at this FREE detailed graph of past earnings, revenue and cash flows.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us immediately. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We purpose to deliver you long-term targeted evaluation pushed by basic information. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

[adinserter block=”4″]

[ad_2]

Source link