[ad_1]

Justin Sullivan

While we like Seagate Technology Holdings plc’s (NASDAQ:STX) place throughout the storage business, we proceed to be hold-rated on the inventory. We count on demand for STX’s major income, Hard Disk Drives (“HDDs”), to proceed to weaken as a result of normalizing PC demand post-pandemic and moderating cloud and enterprise storage spending. The inventory has dropped almost 30% since our downgrade in mid-June. We count on extra draw back forward and advocate traders wait on the sidelines till HDD demand recovers.

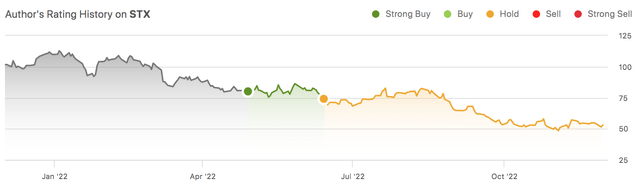

The following graph outlines our ranking historical past of STX inventory.

More HDD weak point to be priced in

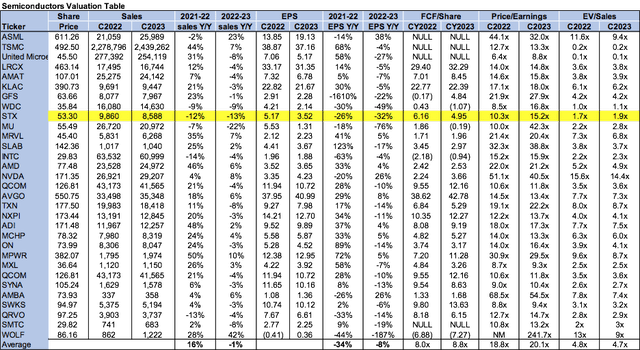

STX derives the majority of its income from its HDD product line, accounting for 87% of complete income in 1Q23. Our bearish sentiment on the inventory is predicated on our perception that HDD demand will proceed to be weak towards 1H23. STX’s 1Q23 earnings report confirmed HDD income decline by 26% sequentially and 38% Y/Y to $1,722M. We consider STX’s crashing HDD income outcomes from near-term demand weak point and buyer stock correction.

The following desk outlines STX’s income by product line for 1Q23.

STX Q1FY23 earnings presentation

We don’t consider the weak point is over but. We count on the STX will proceed to underperform because of two elements:

1. Normalizing PC market demand

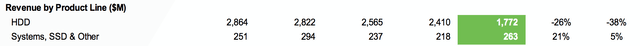

HDDs have been historically utilized for PCs and smartphones, however extra just lately, these two markets are changing HDDs with quicker and extra immediate Solid State Drive (SSDs) storage. HDDs are nonetheless broadly utilized in PCs, and therefore we attribute a part of STX’s declining HDD income to weaker demand from its PC markets or legacy market. STX’s legacy market capability shipped has declined 11% sequentially and 47% Y/Y in 1Q23. We consider the corporate is feeling strain from the normalizing PC demand within the post-pandemic atmosphere. Gartner reported worldwide PC shipments declined by 19.5% Y/Y within the 3Q22. We don’t count on STX to take pleasure in the identical demand in its legacy markets because it did in the course of the pandemic. We additionally consider SSDs are more and more canalizing HDDs within the PC area. We count on continued weak demand to gate preserve STX’s near-term income progress.

2. Moderating cloud and enterprise storage spending

Cloud and enterprise storage spending have been taking the highlight as STX’s quickest rising end-markets, however HDD gross sales on this enviornment are additionally on-decline. STX’s mass capability income is down 25% sequentially and 21% Y/Y in 1Q23. We attribute the normalized demand on cloud and enterprise storage spending fronts to the tough macroeconomic atmosphere. We consider fewer clients are opting to spend money on cloud and storage spending as inflationary pressures and rates of interest peak. Mass capability shipments made up 88% of STX’s complete capability shipped in 1Q23. Our bearish sentiment on the inventory is predicated on our perception that STX will proceed to see weak HDD demand from its mass capability markets towards 1H23.

The following graphs define STX’s mass capability income tendencies between 1Q22-1Q23.

STX’s Q1FY2023 earnings presentation

Not alone within the negatives

STX is feeling the grunt of weakening storage demand alongside the broader semiconductor peer group. In August, StorageNewsletter reported that HDD shipments declined 15% last quarter. While STX suffered double-digit declines as a result of weaker HDD demand, so did its competitors. Toshiba (TOSBF, TOSYY) is dealing with related declines plunging 15% sequentially in shipped capability. Western Digital Corp (WDC) additionally noticed softer demand for HDDs, with HDD income dropping from 2,128M in 4Q22 to 2,014M in 1Q23. We count on the worldwide storage demand to stay weak till macroeconomic headwinds ease.

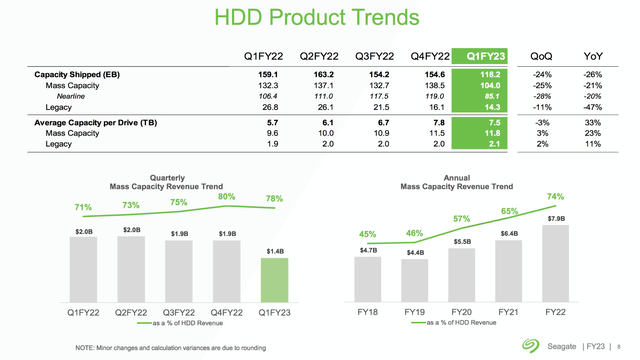

Valuation

STX is comparatively low cost, however we count on extra draw back to be factored into the inventory. On a P/E foundation, the inventory is buying and selling at 15.2x C2023 EPS $3.52 in comparison with the peer group common at 20.1x. The inventory is buying and selling at 1.9x EV/C2023 Sales versus the peer group common of 4.7x. While the inventory is buying and selling effectively under the peer group, we don’t advocate traders purchase the inventory on weak point simply but. We consider weak HDD demand will proceed and advocate traders wait on the sidelines till the draw back dangers have been factored in.

The following desk outlines STX’s valuation in comparison with the peer group common.

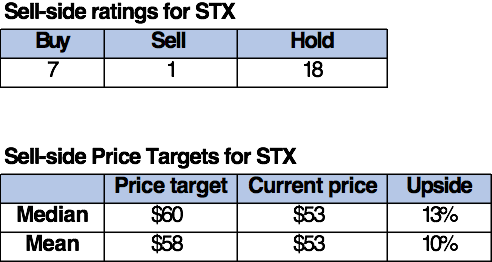

Word on Wall Street

Wall Street shares our bearish thesis on the inventory. Of the 26 analysts protecting the inventory, seven are buy-rated, 18 are hold-rated, and the remaining are sell-rated. The inventory is presently priced at $53 per share. The median sell-side worth goal is $60, whereas the imply is $58, with a possible 10-13% upside.

The following tables define STX’s sell-side scores and worth targets.

TechStockPros

What to do with the inventory

STX inventory has declined almost 53% YTD and 30% since our downgrade of the inventory. We consider STX is dealing with moderating demand as a result of weaker PC markets within the post-pandemic atmosphere and sluggish cloud and enterprise storage spending as a result of macroeconomic headwinds. We don’t see HDD demand recovering within the close to time period and advocate traders look forward to a greater entry level on Seagate Technology Holdings plc.

Editor’s Note: This article discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.

[adinserter block=”4″]

[ad_2]

Source link